GBP/USD Forecast: Modest recovery falling short of changing the bearish path

GBP/USD Current price: 1.2745

- UK Finance Minister Rishi Sunak unveiled an emergency jobs scheme.

- Realized sales in the UK unexpectedly surged in September, according to CBI.

- GBP/USD posted a modest intraday advance, the risk is still skewed to the downside.

The GBP/USD pair posted a modest intraday advance, reaching a daily high of 1.2780. UK Finance Minister Rishi Sunak unveiled an emergency jobs scheme, which will result in the government and firms top up wages of workers whose jobs were affected by the pandemic. The new Job Support Scheme will cover three-quarters of normal salaries for six months starting next November. The announcement is part of a wider plan to protect the economy over winter, according to Sunak.

The Sterling was also supported by the September CBI Distributive Trades Survey on realized sales, which unexpectedly jumped to 11% from -6% and against the -10% expected. This Friday, the BOE will publish the Q3 Quarterly Bulletin.

GBP/USD short-term technical outlook

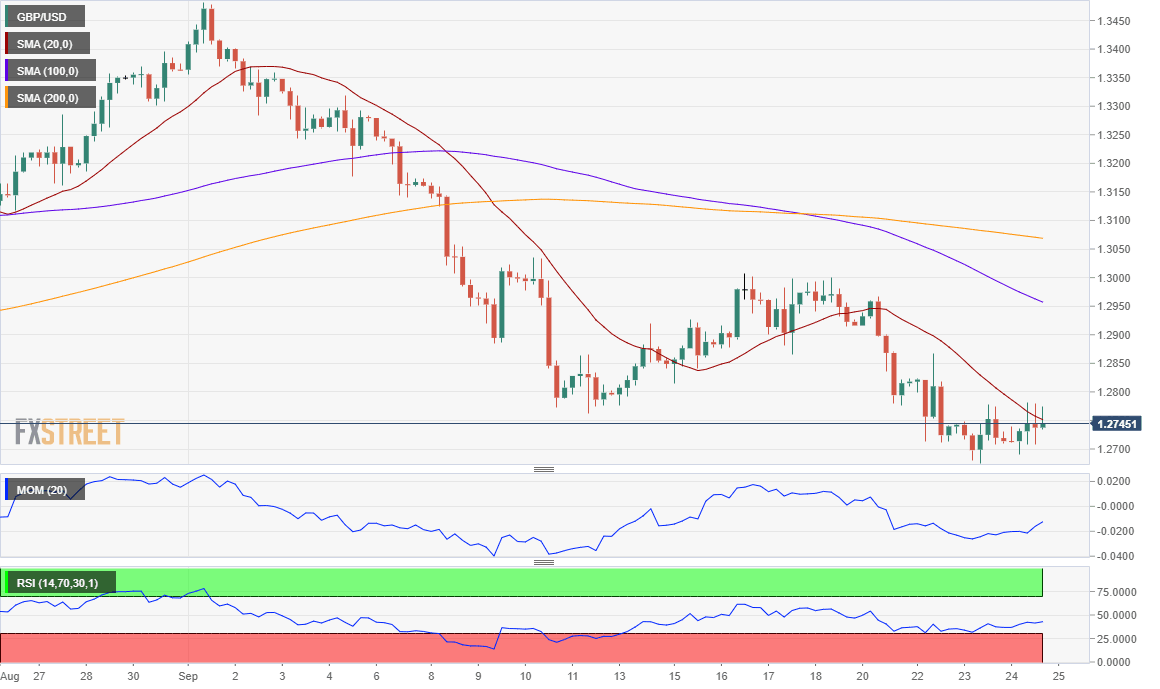

Demand for the greenback receded in the American afternoon, which helped the pair to retain its modest intraday gains. From a technical point of view, however, the bullish potential remains limited. The 4-hour chart shows that the pair is struggling with a bearish 20 SMA, while technical indicators advance modestly, yet within negative levels. The pair could have better chances of turning bullish on a clear break above the 1.2830 resistance level.

Support levels: 1.2700 1.2665 1.2620

Resistance levels: 1.2780 1.2830 1.2870

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.