- The Brexit rumors of financial services deal being done this week pushed Sterling back above 1.3000

- The UK services PMI fell to 52.2, missing the market expectations of a slide to 53.3 in October from 53.9 in the previous month.

- The UK Finance Ministry Official John Glen, as he says that he is extremely confident on reaching a Brexit deal on financial services imminently.

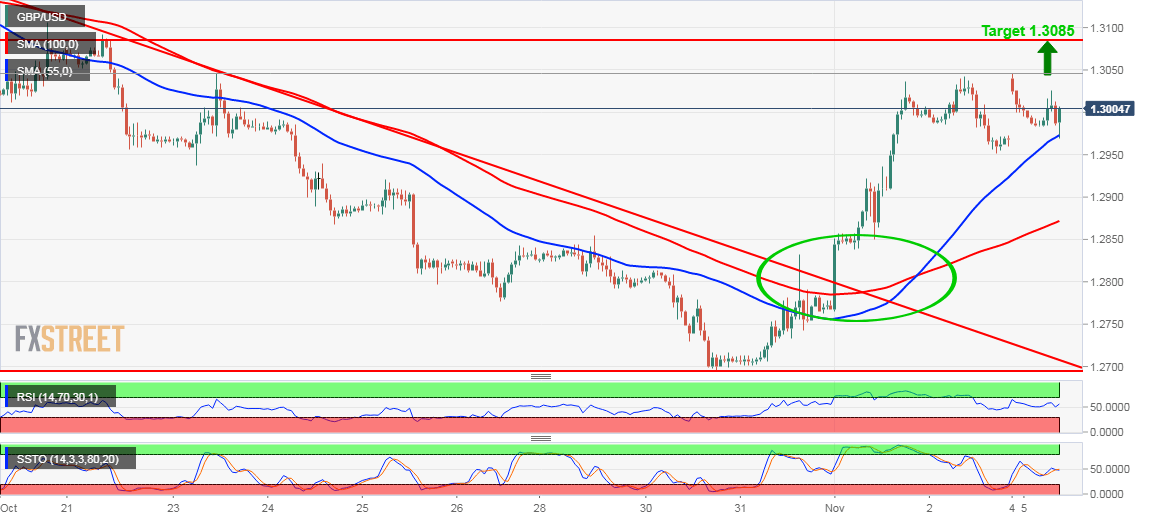

- Even with Sterling sliding back below 1.3000, 1.3085 remains the immediate target.

The GBP/USD opened with the gap on the upside rising to a fresh 2-week high of 1.3045 on Brexit optimistic weekend headlines suggesting the UK will finalize the financial services deal this week. The news slowly receded with the UK fundamentals playing in and the GBP/USD fell back below 1.3000. After the GBP/USD closes the gap falling to 1.2960, positive Brexit headlines are set to target 1.3085 next on the upside.

The UK Finance Ministry Official responsible for the financial services industry John Glen said that he is extremely confident in reaching a Brexit deal on financial services imminently.

Meanwhile, the IHS/Markit reported the UK services PMI fell to 52.2 in October missing big time on expectations of 53.3 and falling from 53.9 in the previous month.

The GBP/USD broke away from the downward sloping trend in a 1-hour chart and appreciated strongly to 1.3040 level. Given the speed of Sterling’s current appreciation and the fact that Sterling opened with the gap on the upside the immediate directional movement on Sterling should be on the downside with retracement towards 1.2960. This scenario is supported by the bearish crossover of Slow Stochastics downwards. Although correction might see GBP/USD retreating to 1.2960 near term, the ultimate target in a corrective move lays at 1.3085 representing 23.6% Fibonacci retracement of Sterling falling from 2018 high of 1.4377 to 2018 low of 1.2662.

GBPUSD 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.