GBP/USD forecast: Bulls trying to regain control amid hopes of a Brexit deal, UK jobs report eyed

- Renewed Brexit uncertainties exerted some intraday pressure on Monday.

- Reports that negotiators turn optimistic helped regain traction on Tuesday.

- Investors will further take cues from Tuesday's release of UK jobs report.

The GBP/USD pair had some good two-way price moves on the first day of a new trading week and remains at the mercy of Brexit news/developments. Having faced rejection near the very important 200-day SMA, the pair witnessed some intraday selling in reaction to Irish Foreign Minister Simon Coveney's comments, saying that a deal is possible but we are still not there yet. Coveney's remarks suggested prevailing differences between the two sides on the issue related to the Northern Irish border and turned investors sceptical about the chances of reaching a deal by Thursday's EU Summit.

Brexit headlines acting as an exclusive driver

This was followed by reports, which cited senior EU officials saying that they are not optimistic about chances of the UK PM Boris Johnson getting a Brexit deal through parliament and exerted some additional downward pressure on the British Pound. Meanwhile, the latest optimism over a positive outcome from the much-hyped US-China trade negotiations turned out to be short-lived and was reinforced by a cautious mood around equity markets, which benefitted the US Dollar's perceived safe-haven status against its British counterpart and further collaborated to the pair's intraday slide.

The pair stalled its sharp intraday pullback during the early North-American session and managed to attract some decent buying interest just ahead of the key 1.2500 psychological mark. The pair finally ended the day off around 85 pips from daily lows and regained some positive traction during the Asian session on Tuesday amid reports that negotiators turned cautiously optimistic about nearing a potential solution to the Irish backstop problem. With the incoming Brexit-related headlines acting as an exclusive driver of the broader market sentiment surrounding the Sterling, traders on Tuesday will further take cues from the UK monthly jobs report in order to grab some short-term opportunities.

Short-term technical outlook

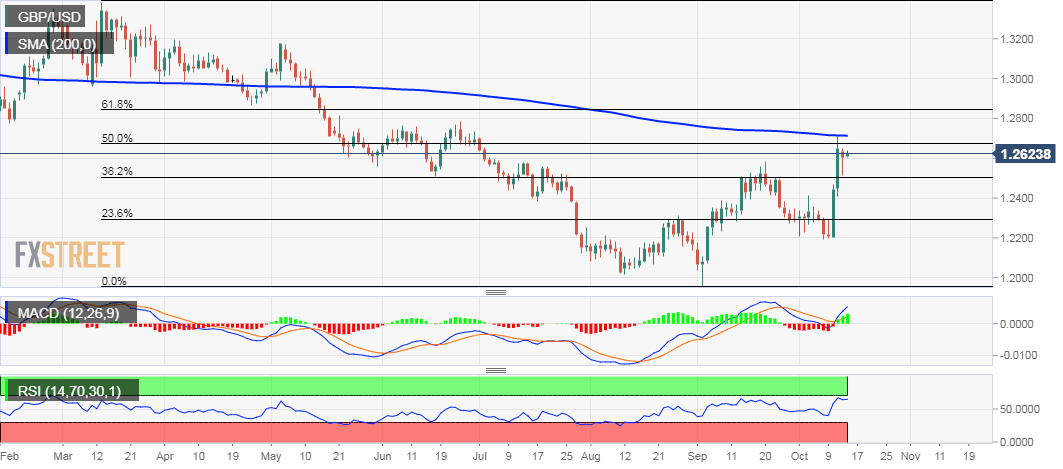

From a technical perspective, nothing seems to have changed much and the pair still needs to find acceptance above 50% Fibonacci level of the 1.3381-1.1959 downfall to support prospects for any further near-term appreciating move. The mentioned hurdle, around the 1.2675 region, is closely followed by the very important 200-day SMA near the 1.2700-1.2710 area, which should act as a key pivotal point for short-term traders.

A sustained move beyond the 200-DMA might further fuel the recent strong bullish bias and lift the pair further towards the 1.2785 intermediate resistance en-route the 1.2800 round-figure mark and 61.8% Fibo. level – around the 1.2835 region.

On the flip side, the 1.2520-15 region – nearing 38.2% Fibo. level – now seems to have emerged as immediate strong support, which if broken might be seen as a key trigger for bearish traders and set the stage for a further near-term downfall back towards the 1.2400 round-figure mark.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.