GBP/USD Current price: 1.2884

- EU Commission set to start legal actions against the UK for breaching the Withdrawal Agreement.

- UK Markit Manufacturing PMI was downwardly revised to 54.1 in September.

- GBP/USD holds on to a positive stance yet limited by Brexit jitters.

The GBP/USD pair is trading a handful of pips below the 1.2900 level by the end of the American session, little changed for the day. However, it reached a fresh weekly high of 1.2978 from where it fell to 1.2819. Brexit headlines were behind the wide intraday range, with the sterling getting a boost from optimistic London authorities towards a deal. The following slump came after the European Commission announced it will send a “letter of formal notice” to start legal actions against the UK for breaching the Withdrawal Agreement. By the end of the day, it is clear that there is no common ground on fisheries and a level playing field.

British PM Johnson's spokesman reiterated that they are committed to working through the Joint Committee to find a solution to Northern Ireland protocol. In the data front, the UK Markit Manufacturing PMI shows that activity expanded less-than-expected in September, as the index was downwardly revised to 54.1. The UK macroeconomic calendar will remain empty this Friday.

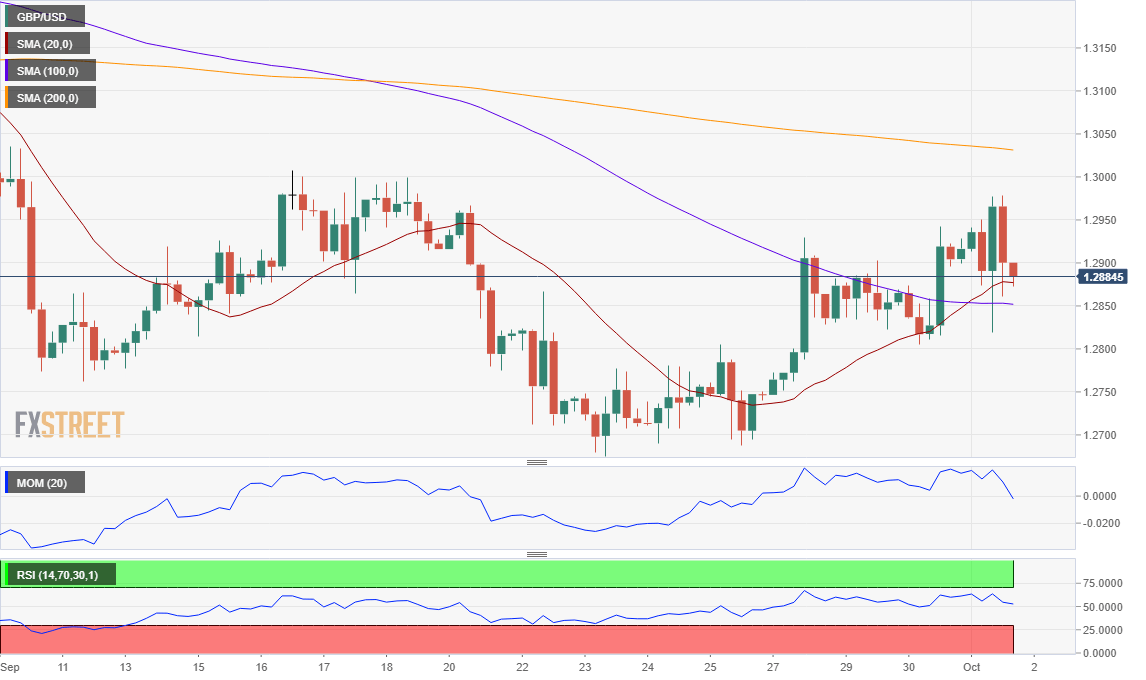

GBP/USD short-term technical outlook

The GBP/USD pair holds on to positive ground but continues to lack follow-through. The 4-hour chart shows that it settled above the 20 and 100 SMA, with the shorter one losing bullish strength above the larger one. Technical indicators, in the meantime, head nowhere holding just above their midlines. As it has been happening lately, the next movements will likely depend on Brexit headlines instead than on technical readings.

Support levels: 1.2865 1.2820 1.2770

Resistance levels: 1.2925 1.2985 1.3030

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.