GBP/USD Forecast: Brexit hopes continue to underpin Sterling

GBP/USD Current price: 1.2833

- BOE’s Ramsden dismissed chances of using negative rates in the near term.

- Brexit trade talks will resume this Tuesday with representatives cautiously optimistic.

- GBP/USD pulled back from a daily high of 1.2929, but bulls retain control.

Pound longs returned with a vengeance this Monday, driving GBP/USD to 1.2929 its highest in almost a week. The pair got boosted by mounting hopes for a UK-EU trade deal, as representatives from both economies head into the ninth round of talks with cautious optimism. UK PM Johnson’s spokesman stated that a deal is still possible while there remains much to be done. The British currency found additional support in comments from BOE’s Ramsden who dismissed chances of using negative rates in the near-term.

The UK macroeconomic calendar was empty at the beginning of the week, and this Tuesday it will offer some minor figures, as the UK will publish Mortgage Approvals and money data from August.

GBP/USD short-term technical outlook

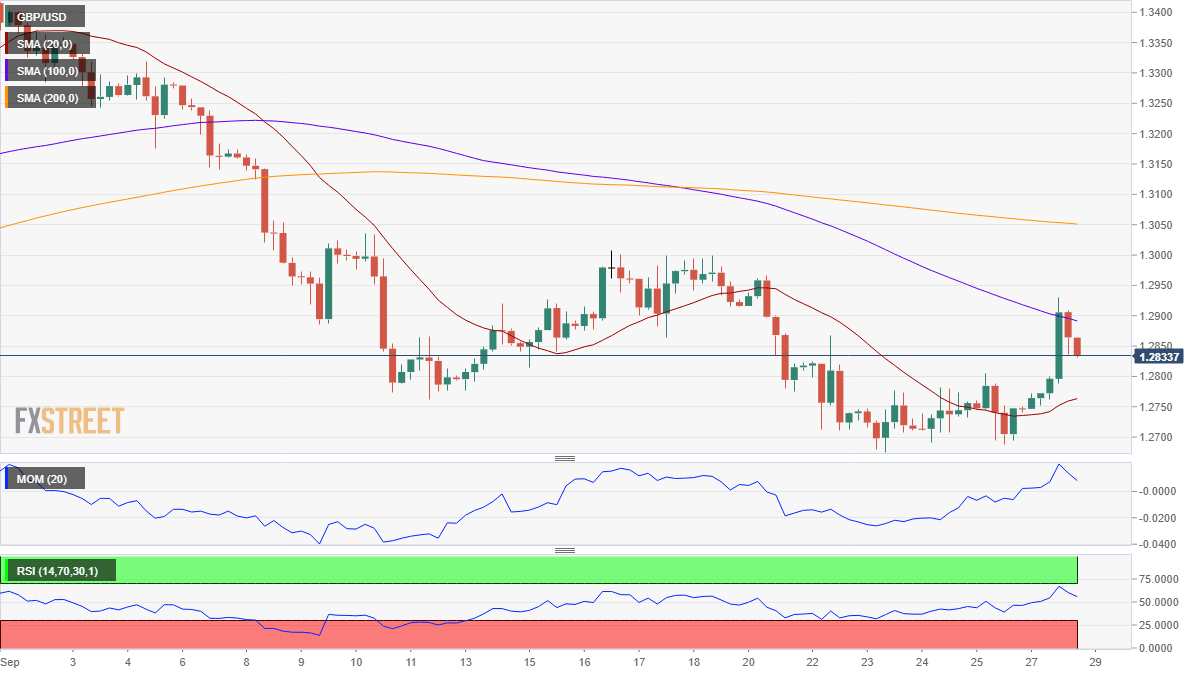

The GBP/USD pair is trading around 1.2835 at the end of the day, as the dollar recovered some of its attractiveness in the last trading session of the day. The 4-hour chart shows that the pair was rejected by selling interest aligned around a bearish 100 SMA, currently at 1.2900. The 20 SMA gains some bullish strength below the current level, while technical indicators retreat from overbought levels but hold above their midlines. Overall, the upside remains favored, as long as Brexit-related hopes persist.

Support levels: 1.2820 1.2770 1.2715

Resistance levels: 1.2900 1.2940 1.2990

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.