GBP/USD Forecast: Breaking below uptrend support as UK wants to break free

- GBP/USD has dropped as the UK wants to break away from EU rules post-Brexit.

- Speculation about the BOE's decision and further reactions to US data are high on the agenda.

- Monday's chart is pointing to a break below long-term uptrend support.

Brexit is set to bite – when this is the message from the government, pound traders take note and send the currency down.

Sajid Javid, Chancellor of the Exchequer, said that there would be no alignment between the EU and the UK after Brexit, contrary to what Brussels wants. He has also admitted that there will be an impact on business and that "some will benefit, some won't."

The Chancellor repeated the government's stance that Britain will "not be a rule-taker" and would leave the customs union and the single market.

The UK is leaving the EU on January 31, but most rights and obligations will remain in place during the transition period, which expires at year-end. Prime Minister Boris Johnson – who is skipping the World Economic Forum in Davos – wants to reach a quick deal on future trade relations and refuses to extend the implementation phase. European officials cast doubts about the prospects of clinching a rapid accord.

The admission that some businesses will suffer has kicked sterling lower at the beginning of a new week. The pound had already been struggling with disappointing economic figures such as negative growth in November, two consecutive months of retail sales drops, and weak inflation. The latter – which the Bank of England closely watches – has fallen to 1.3%, the lowest levels since 2016.

Markets are foreseeing higher chances that the BOE cuts rates in its upcoming meeting on January 30 – one day before Brexit. Two critical data points this week may cement the move – Tuesday's jobs report and Friday's Purchasing Managers' Indexes. Unless both publications beat expectations, it is hard to see the bank holding its fire.

Contrary to the UK, last week's US economic figures were upbeat, keeping the dollar bid. Inflation, retail sales, and consumer confidence all remained robust – allowing the Federal Reserve to leave rates unchanged.

American traders are off today due tot he Martin Luther King holiday. That implies lower trading volume later in the day.

Overall, Brexit and the BOE are in the spotlight.

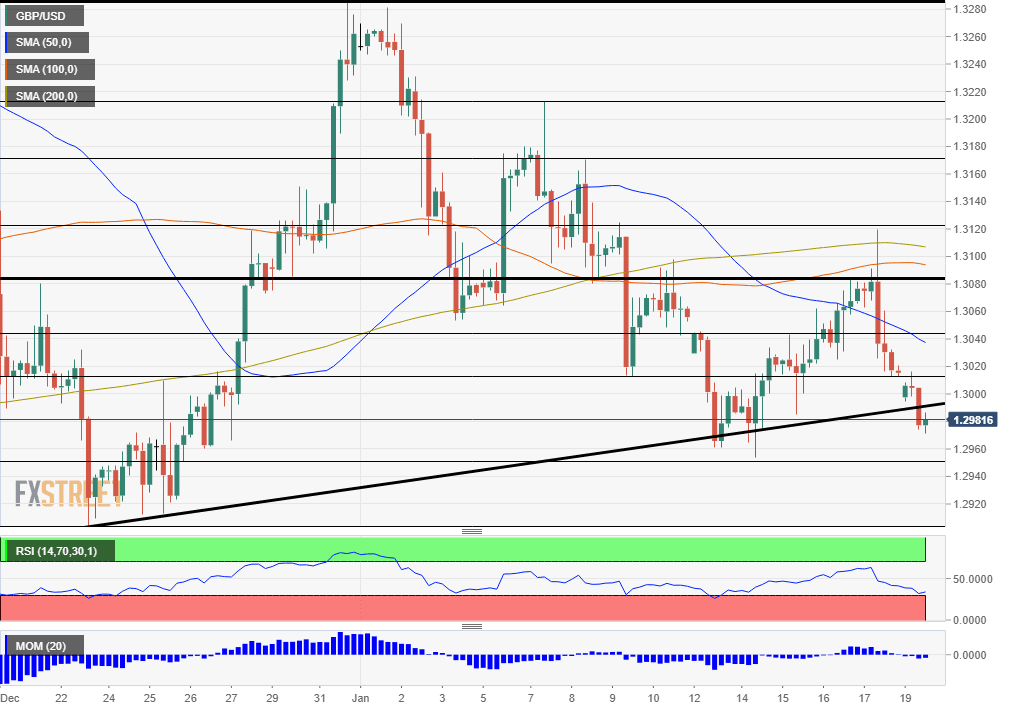

GBP/USD Technical Analysis

Pound/dollar has dripped below the uptrend support line that accompanies it since early November. Is this break real? A previous slide was followed by a swift recovery, and perhaps bears will be holding their fire.

Other indicators are bearish. Momentum on the four-hour chart is to the downside and the currency pair is trading below the 50, 100, and 200 Simple Moving Averages. The Relative Strength Index is still above 30 – thus outside oversold conditions.

Support awaits at 1.2950, which was a low point earlier in the month. It is followed by the Christmas trough of 1.29, and then by 1.2875 and 1.2820.

Resistance awaits at 1.3015, which is the gap line from the weekend, followed by 1.3040, which capped GBP/USD last week. Next, 1.3080 and 1.3120 await the pair.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.