GBP/USD Forecast: Boris stepping down? Not so fast, pound moving up, Fed awaited

- GBP/USD has been edging up, catching up with its peers as Brexit fears fade.

- Downing Street rejects rumors that PM Johnson will be stepping down in six months.

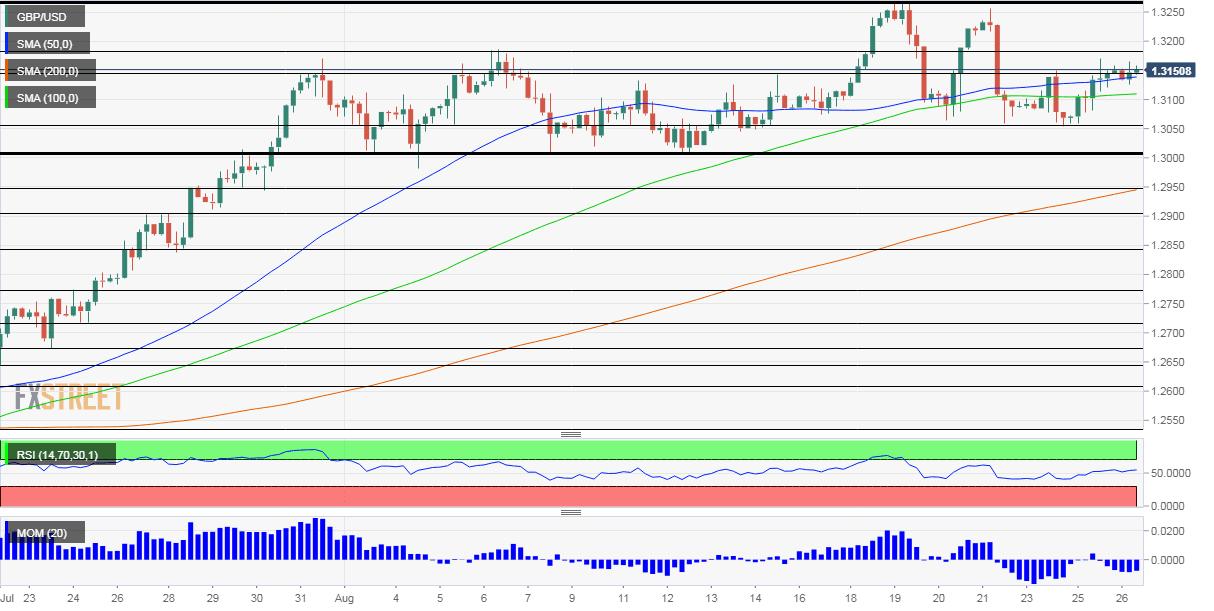

- Wednesday's four-hour chart is showing an improving picture for the bulls.

Never believe a rumor until it is fully denied? Speculation is whirling about the political future of Prime Minister Boris Johnson. According to a column in The Times, the father in law of Johnson's special adviser Dominic Cumming said that the PM is struggling with the effects of coronavirus and may step down within six months.

Sir Humphry Wakefield's observation was swiftly denied by Downing Street, yet the publication in a highly regarded paper may continue doing the rounds as the government struggles to coordinate its policy around the disease.

Johnson's rumored retirement would come after Brexit is completed – the transition period expires at year-end. The rumors have helped push concerns about a no-trade-deal exit off the headlines and allowed cable to edge higher.

Sterling has also been catching up with some of its peers after lagging behind but is now looking for direction ahead of the week's big event, also related to catching up.

Jerome Powell, Chairman of the Federal Reserve, is set to address the virtual Jackson Hole Symposium and may layout a paradigm shift in policy. Instead of aiming for 2% every year, the Fed would move to Average Inflation Targeting (AIT) which would allow for the price to surpass the 2% level and catch up with past low inflation.

Such a change implies leaving low interest rates for longer – implying a weaker dollar. Yet as the wait continues, investors are somewhat nervous and the dollar is paring its losses. Relatively low volatility is set to make way for wilder swings once Powell opens his mouth.

US Durable Goods Orders are set to show an ongoing recovery in July, in line with other upbeat figures such as New Home Sales published on Tuesday – topping 900,000 annualized, the highest since 2006. On the other hand, the Conference Board's Consumer Confidence fell to 84.8 in August, the worst in around six years.

See Durable Goods Orders July Preview: There is some catching up to do

Markets are stable as COVID-19 cases remain in their current trends – slowly rising in the UK and gradually decreasing in the US. Hopes for a vaccine – including from two British projects – remains prevalent. The University of Cambridge will receive government support for its immunization project, in addition to the University of Oxford.

Overall, the main driver is Fed speculation, yet politics and the virus remain of high interest as well.

GBP/USD Technical Analysis

Pound/dollar has overcome the 50 and 100 Simple Moving Averages that capped it beforehand, providing ammunition to the bulls. On the other hand, momentum remains to the downside.

Support awaits at 1.3050, a support line from earlier this week. It is followed by 1.3005, which was a substantial cushion earlier in August. The next level is 1.2950 – where the 200 SMA hits the price.

Resistance is at 1.3180, a high point in early August, followed by 1.3267, the August peak. Higher, 1.3330 looms.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.