GBP/USD Forecast: BoE/Scottish election awaited for a fresh directional impetus

- A modest USD pullback assisted GBP/USD to regain some positive traction on Wednesday.

- The uptick remained capped ahead of the BoE’s Super Thursday and the Scottish election.

The GBP/USD pair regained positive traction on Wednesday, albeit struggled to sustain above the 1.3900 mark and finally settled with only modest daily gains. In the absence of any major economic releases from the UK, a modest US dollar weakness provided a modest lift to the major. The USD eased from two-week highs following the release of softer-than-expected US macro data. The ADP report showed that the US private-sector employers added 742K jobs in April, well below consensus estimates. Adding to this, the US ISM Services PMI also fell short of market expectations and dropped to 62.7 in April from the 38-year high level of 63.7 in the previous month.

Despite the supporting factor, bulls refrained from placing aggressive bets ahead of the Bank of England monetary policy decision and the Scottish election on Thursday. The BoE is expected to maintain the status quo and leave its monetary policy settings unchanged at the conclusion of the May meeting. The decision will be accompanied by updated economic projections, which might infuse some volatility around the sterling. Apart from this, the outcome of the Scottish election – seen as a referendum on the country's independence from the UK – will also play a key role in driving the GBP in the near term. Final opinion polls suggest that the result is too close to call.

On the other hand, the USD is more likely to enter a consolidation phase as investors look forward to Friday's closely-watched US monthly employment details for a fresh impetus. The popularly known NFP report may provide clues on when the Fed would scale back its stimulus and influence the USD price dynamics. The combination of key events/data should act as a fresh catalyst, which might assist the pair to break out of a familiar trading range held over the past three weeks or so.

Short-term technical outlook

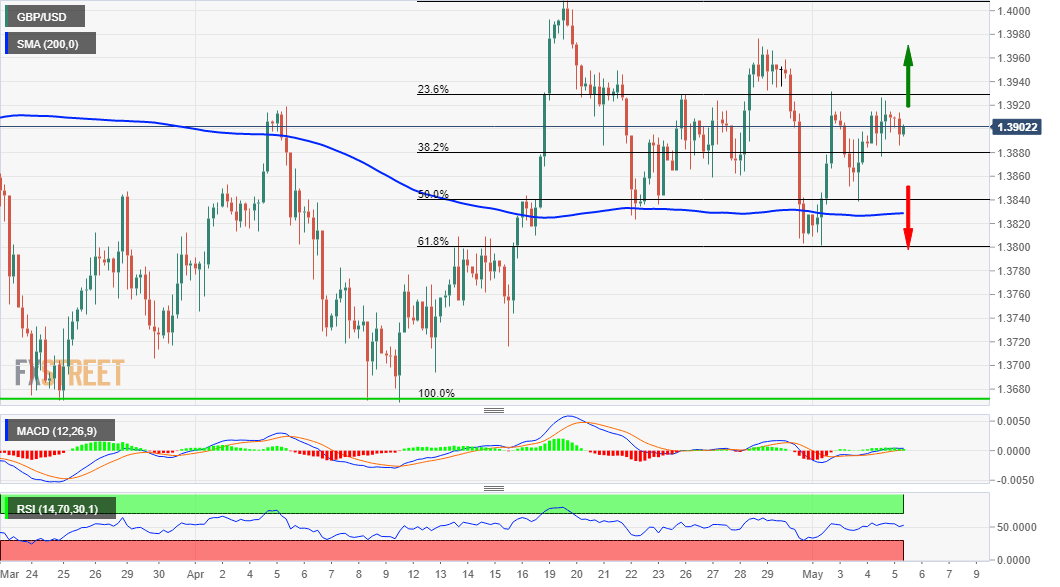

From a technical perspective, nothing seems to have changed much for the pair the emergence of some aggressive buying near the 1.3800 mark on Monday favours bullish traders. However, the lack of any strong follow-through buying and repeated failures near the 1.3925-30 region warrant some caution. The mentioned points should now act as key pivotal points and help determine the next leg of a directional move.

In the meantime, any meaningful decline might find some support near the 1.3835-30 region, marking the 50% Fibonacci level of the 1.3669-1.4009 move up. This is followed by the 1.3800 mark, which if broken decisively will be seen as a fresh trigger for bearish traders. The pair might then accelerate the slide further towards the 1.3720-15 intermediate support en-route the 1.3700 round-figure and April monthly swing lows, around the 1.3670 region.

On the flip side, a sustained move beyond the 1.3925-30 area (23.6% Fibo. level) should allow bulls to make a fresh attempt towards conquering the key 1.4000 psychological mark. Some follow-through buying has the potential to lift the pair towards an intermediate hurdle near the 1.4080 region en-route the 1.4100 mark. The momentum could further get extended towards 2021 daily closing highs resistance near the 1.4135-40 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.