After an intraday dip to the session low level of 1.2831, the GBP/USD pair regained some positive traction and climbed back above the 1.2900 handle on the first trading day of a new week. The uptick came after the UK PM Theresa May delivered her statement on Brexit “Plan B”. Despite the lack of any significant details, May's speech further decreased the likelihood of a no-deal Brexit or a second referendum and provided a modest lift to the British Pound.

The uptick, however, remained capped amid some haven-driven US Dollar buying interest after the International Monetary Fund (IMF) lowered its global growth forecast for 2019 to the weakest in three years. This against the backdrop of the latest Chinese macro data, showing that the economy recorded its weakest annual growth since 1990, prompted investors to move into traditional safe-haven currencies and kept a lid on any further up-move.

The greenback held steady near two-week tops and prompted some fresh selling during the Asian session on Tuesday. Market participants now look forward to the UK labor market report, due at 0930 GMT. The ILO unemployment rate during the 3 months to November is seen holding steady at 4.1%, and wage growth is also seen matching that of the previous month. A stronger UK wages data might provide some fresh boost to the British Pound but any immediate reaction is more likely to be short-lived amid persistent Brexit uncertainties.

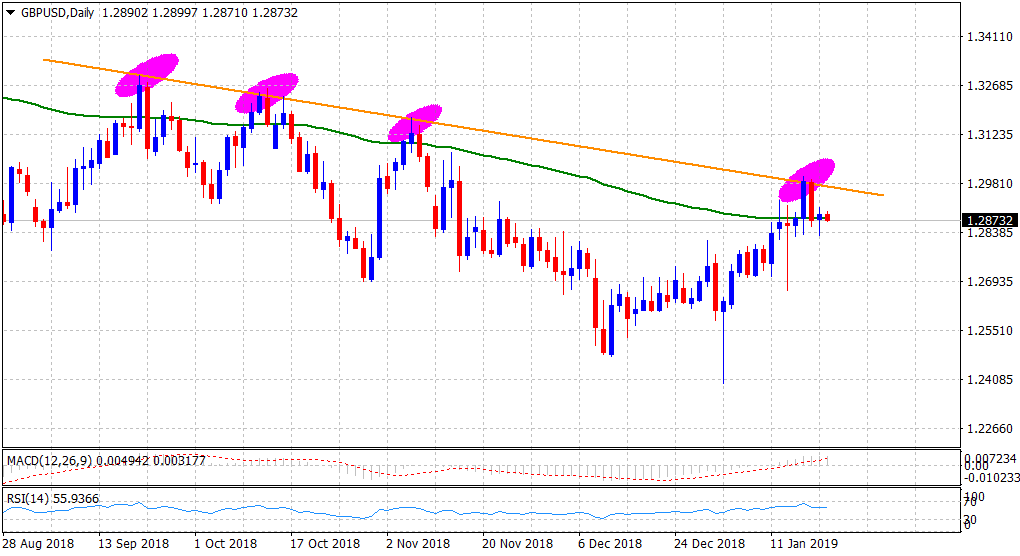

From a technical perspective, nothing seems to have changed much except that the overnight rebound reinforced strong immediate support near the 1.2830 region. Hence, it would be prudent to wait for a convincing break through the mentioned support before traders start positioning for any further near-term depreciating move. A follow-through selling might now turn the pair vulnerable to break below the 1.2800 handle and head back towards challenging the 1.2750-45 intermediate support en-route the 1.2700 round figure mark.

On the flip side, the 1.2920-30 region remains an immediate strong hurdle to clear, above which the pair is likely to make a fresh attempt towards challenging a key hurdle near the key 1.3000 psychological mark, representing a four-month-old descending trend-line. A convincing break through the mentioned barrier should accelerate the up-move towards the 1.3100 handle before the pair eventually aims to test its next major hurdle near the 1.3140-50 supply zone.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.