GBP/USD Analysis: Bulls eyeing recent highs despite stalled Brexit talks

- GBP/USD regained positive traction on Friday and moved back closer to weekly tops.

- Bulls seemed unaffected and largely shrugged off not so positive Brexit developments.

- A sustained move beyond 1.3310 level is needed to support prospects for further gains.

The GBP/USD pair gained some positive traction on the last day of the week and built on the previous day's goodish rebound from sub-1.3200 level. The uptick was supported by a subdued US dollar demand – amid conflicting signals from the US regarding COVID-19 stimulus – and got an additional boost following the release of upbeat UK retail sales figures.

Reports indicated that US Senate Republican and Democrat leaders had agreed to resume negotiations on another coronavirus stimulus package. The positive development, to a larger extent, was offset by the US Treasury Secretary Steven Mnuchin's decision to end some of the pandemic relief for struggling businesses. The announcement took its toll on the global risk sentiment and extended some support to the greenback's safe-haven status. However, concerns about the economic fallout from the imposition of new COVID-19 restrictions in several US states and dovish Fed expectations held the USD bulls from placing aggressive bets.

On the other hand, the British pound was underpinned by Friday's stronger-than-expected UK macro data. In fact, the headline retail sales recorded a growth of 1.2% MoM in October as against consensus estimates pointing to a flat reading. Meanwhile, the core retail sales (stripping the auto motor fuel sales) also came in better-than-expected and stood at 1.3% MoM during the reported month. That said, the pair remained below its recent highs amid persistent Brexit-related uncertainties. It is worth recalling that in-person talks were suspended on Thursday after a member of the EU team was tested positive for COVID-19. This might have raised the possibility for an extension to the transition period and extended some support to the sterling.

Meanwhile, the EU negotiating team reportedly briefed envoys of the bloc's 27 member states that Brexit talks remain unresolved on three main issues – level playing field, fisheries and state-aid rules. The comments did little to prompt any meaningful selling around the pair, which was last seen hovering near the top end of its daily trading range, just below the 1.3300 round-figure mark. In the absence of any major market-moving economic releases from the US, the incoming Brexit-related headlines will continue to play a key role in driving the near-term sentiment surrounding the major.

Short-term technical outlook

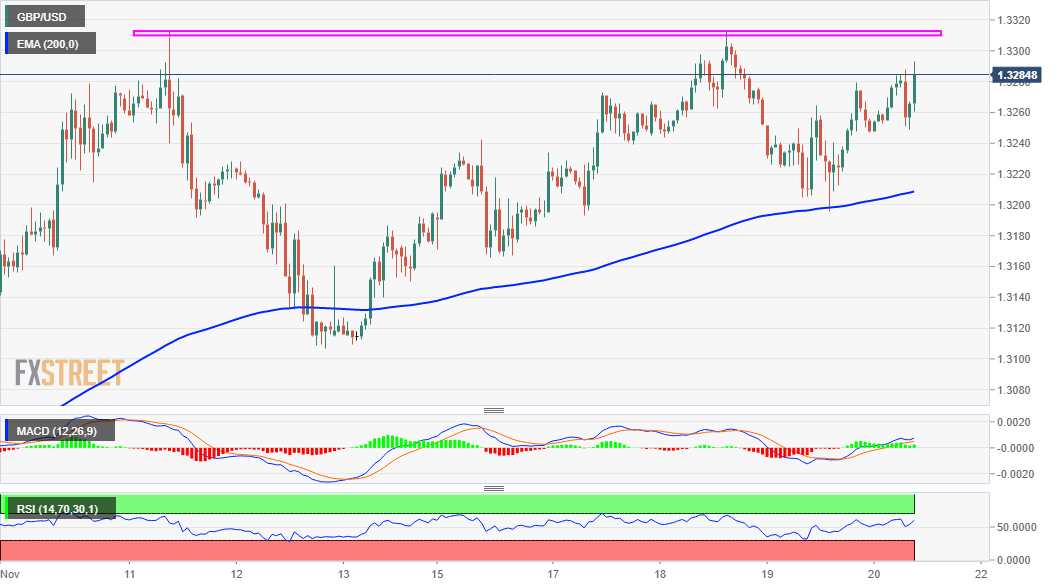

From a technical perspective, the pair on Thursday showed some resilience below the 1.3200 mark and bounced off 200-hour EMA. The subsequent positive move favours bullish traders and supports prospects for additional gains. However, it will be prudent to wait for some follow-through buying beyond the 1.3300-1.3310 region before positioning for any further near-term appreciating move. A convincing breakthrough will be seen as a fresh trigger for bullish traders and set the stage for a move towards September daily closing highs, around the 1.3385 region, en-route the 1.3400 mark.

On the flip side, immediate support is pegged near the 1.3250-45 region ahead of 1.3220 level (200-hour EMA) and the overnight swing lows, around the 1.3195 zone. Failure to defend the mentioned support levels might prompt some technical selling and turn the pair vulnerable to accelerate the slide further to weekly lows, around the 1.3160 region. The downward trajectory could further get extended towards the next major support near the 1.3110-05 zone.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.