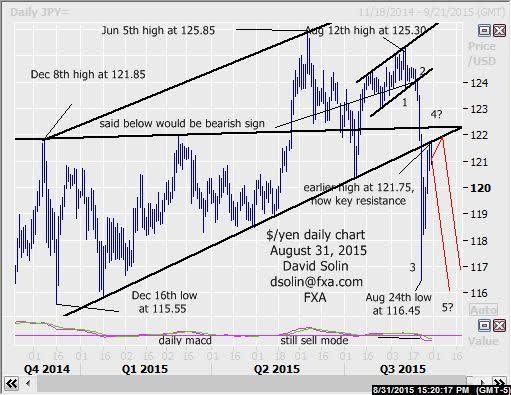

$/yen near term outlook:

The market remains firm in the sharp snapback from the Aug 24th spike low at 116.45. But with the downside pattern from at least the Aug 12th high at 125.30 not "complete", this recent bounce is seen as a correction (wave 4) and with a resumption of the declines below 116.45 favored after (within wave 5). Note too that technicals remain bearish (see sell mode on the daily macd). Currently, the market is stalling near resistance at the base of that long discussed, longer term bullish channel from Dec (currently at 121.75/90), an "ideal" area to form such a top. But at this point, there is still no confirmation "pattern-wise" of even a short term peak (5 waves down), leaving open scope for another few days of ranging/topping first (see in red on daily chart below). Further resistance above there is seen at 125.25/40 (both a 62% retracement from the Jun high at 125.85 and the rising trendline from Dec). Nearby support is seen at 118.20/35. 1.65/90 area (both the broken base of the bullish channel from Dec and the trendline from Dec 8th). Nearby support is seen at 118.85/95, 117.65/80 and that 116.35/45 low. Bottom line: though no confirmation of a short term peak so far, within "ideal" area to form an important top.

Strategy/position:

Short from the Aug 25th sell at 119.80 and for now, would continue to use that wide stop on a close 25 ticks back above that broken base of the wedge from Dec. But will want to get more aggressive on higher confidence of a near term top, and especially an approach (and break) of that 116.45 low.

Long term outlook:

As been discussing for quite some time, a downside resolution of the large bullish channel from Dec (which occurred on Aug 24th) would argue that a more major top was in place (for at least another 6-9 months or more), and with lots of longer term negatives supporting this view. Note that market is overbought after the last few years of sharp gains, is seen likely completing the 5 wave rally from the Oct 2013 low at 96.55 (wave 5, and potentially the whole 5 wave rally from the Nov 2011 low at 75.55), long term technicals remain bearish (see sell mode on the weekly macd), the seasonal chart for the yen is higher into mid Oct (see 3rd chart below, lower for $/yen) and the S&P 500 is seen in process of a major rolling over (correlated market). At this point, there is no confirmation of such a top "pattern-wise" (5 waves down for example), but with the nearer term downside pattern since Aug 12th is not "complete" (see shorter tem above) at least some further lows are favored ahead. Further, big picture support below that 116.45 spike low is seen at the bullish trendline from Sept 2012 (currently at 115.00/25) and the base of the multi-year bullish channel (currently at 111.50/75), either of which could provide significant support (month or more) within this longer term downtrend. Bottom line: major top (for at least 6-9 months) appears to be in place, though no still no confirmation "pattern-wise" (5 waves down for example).

Strategy/position:

With the nearer term downside pattern not "complete" and potential of a more major top in place, would stay with the bearish bias that was put in place on Aug 25th at 119.80.

Current:

Nearer term: short Aug 25 at 119.80, some risk for another few days of ranging/topping.

Last: long Aug 17 at 124.30, stopped Aug 19 below base of month long channel (124.10, closd 123.80).

Longer term: bearish bias Aug 25th at 119.80, major top may be in place (short term fall not complete).

Last: bull bias Aug 5th at 124.85 to neutral Aug 12th at 124.20.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.