Good morning. Hope all is well. We seem to have had a moderate forecast for yesterday with only 4 pairs behaving as predicted. USDCAD, EURJPY and the Oceanic pairs were on our side. As expected the US Dollar gathered some steam (2 points on our scale) over the course of the day, while Japanese Yen continues it’s weak stance (was at the weak extreme). With our fundamental watch for today we could be in for a busy day on most of the major pairs with more emphasis on US Dollar news items coming out. We could be in for some strength on both US Dollar and Japanese Yen pairs for today. Adding two hedged pairs to offset the risk. Happy Trading!

Forecasts Outlook

US Dollar: Strong

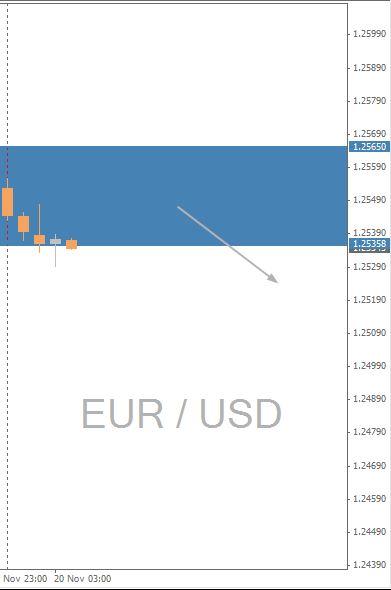

Today we're expecting the EURUSD to proceed Short below the barrier levels of 1.25358 and 1.25650.

Fundamental Watch

– FOMC Meeting Minutes

– PPI Input q/q

– French Flash Manufacturing PMI

– German Flash Manufacturing PMI

– Retail Sales m/m

– Wholesale Sales m/m

– CPI m/m

– Core CPI m/m

– Unemployment Claims

– Philly Fed Manufacturing Index

Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. Urbanforex will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.<7p>

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

AUD/USD drops below 0.6600 after RBA policy announcements

AUD/USD stays under bearish pressure and trades deep in negative territory slightly below 0.6600. The RBA left the policy settings unchanged as expected but Governor Bullock said that there was no necessity to further tighten the policy.

Gold price turns red amid the renewed US dollar demand

Gold price trades in negative territory on Tuesday amid the renewed USD demand. A downbeat US jobs data for April prompted speculation of potential rate cuts by the Fed in the coming months.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.