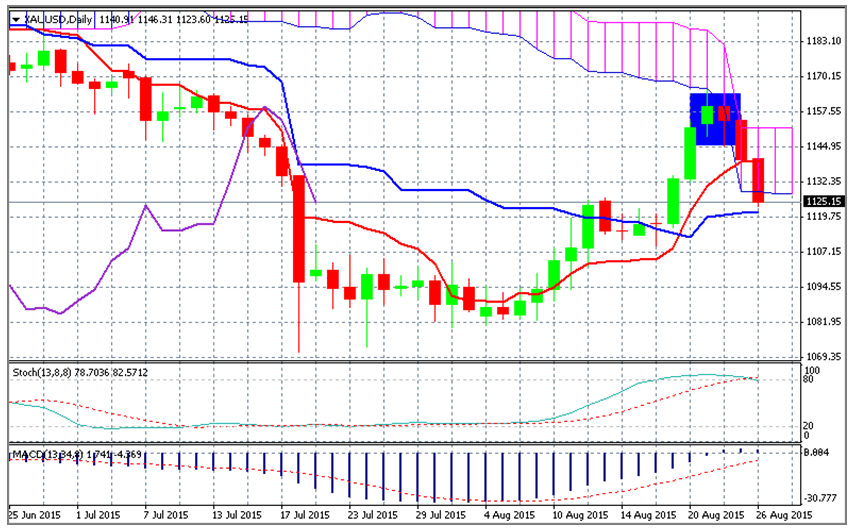

Technical Analysis

From the gold day-chart we can see last Friday’s and this Monday’s candles have formed a double top formation (blue area), this is usually an indication of trend reversal. It also coincided with the Ichimoku cloud (vertical pink lined area) which acts as a resistance area. Looking at the Stochastic Oscillator we can see that price is beginning to look like it has reached overbought territory. I wouldn’t be surprised to see price continue its correction downwards, or return to its original bear trend, over the next week. The MACD is still showing upward momentum, but that is in contradiction to the last three days, which dictates further weakness may yet to come.

The following examples traded on the ORE web-platform explain how to take advantage of gold price action with Options.

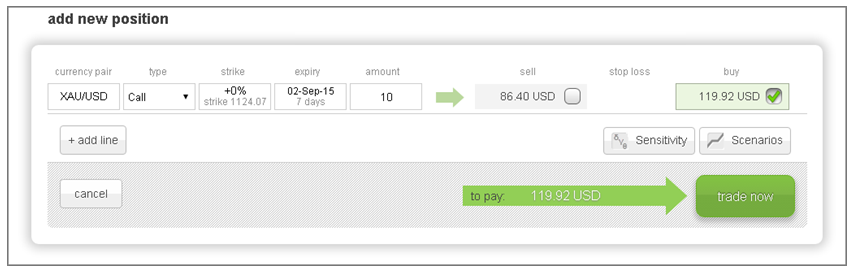

Trade 1 - Trading an Uptrend

If you think the rally in gold is set to continue over the next week then you may buy a Call option, which gives you the right to buy gold at a specific price (strike) with a specific date (expiry). As you can see from the screenshot a Call option to buy 10 ounces of gold at $1124.07 strike, over the next 7 days would cost you 119.92 USD, which is your maximum risk. As the price of gold rises above the strike price $1124.07, the option’s value will rise and you may profit. You may also close the position before expiry to lock-in a profit or loss.

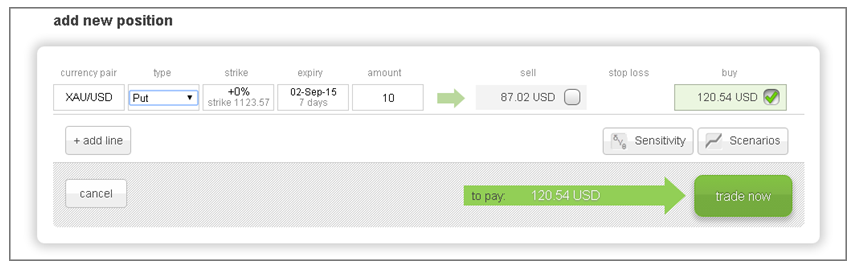

Trade 2 - Trading a downtrend

On the other hand, if you think that the price of gold will continue to fall over the coming week then you may buy a Put option, which gives you the right to sell gold at a pre-determined strike, expiry and amount. Looking at the screenshot you can see that a Put option to sell 10 ounces of gold at strike $1123.57 over the next 7-days would cost you 120.54 USD, which is also your maximum risk. As the price of gold declines below the strike price $1123.57, the option’s value will rise and you may profit. You may also close the position before expiry to lock-in a profit or loss.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

These cryptocurrencies could face selling pressure according to an analyst: STRK, ENA, OMNI, JUP, ONDO

Thor Hartvigsen, investor at Heartcore Capital and a crypto analyst has identified a list of cryptocurrencies that are expected to see a massive increase in their supply. Typically, an increase in selling pressure negatively impacts an asset’s price.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.