Quick Recap

Greece voted No. But, for all the euphoria in Athens and across the nation not much seems to have changed. Of course the Euro is lower this morning along with the Aussie dollar while the Yen has rallied against everything.

But the political situation in Europe remains as fractious as it was previously. The line of EU leaders lining up to tell Athens the ball is in their court and highlight nothing has changed grows by the hour since it became apparent that the ‘No’ vote was in the ascendancy.

I’ve highlighted the fact that nothing has changed and a Grexit is closer it in a piece I’ve just written at Business Insider. But the key comment is probably the one from Dutch finance minister Dijesselbloem who said the result of the Greek referendum is “very regrettable for the future of Greece”.

None of this has gone unnoticed by traders with stock futures in Sunday trade in the US getting absolutely smashed. The Dow is down over 200 points while the S&P 500 is off close to 40 points. That sets up a bad morning for the local ASX 200 even if the Chinese have now thrown everything, including the kitchen sink, at the crashing stock market.

In China new measures, were announced over the weekend, to support the stock market. The government is backstopping $19 billion of buying into the market by brokers on margin and cancelling IPOs. It’s hard to stop air running from a bursting bubble.

Uncertainty has risen everywhere – I’m watching the Aussie dollar and Yen as the lead indicators of what is going to happen. With a meeting not until tomorrow night in Europ we face a couple of days of vacuum trading where markets drift and react to comments from officials.

It’s going to be a bit hairy. But as we have seen recently the technicals are doing a good job of guiding our way as traders.

On the day

Data today in Australia kicks of a very busy week. The TD monthly inflation gauge is out along with ANZ Job Ads. German factory orders are out tonight and Markit services and ISM non-manufacturing are out in the US.

But, here’s the overnight scoreboard(8.55 am AEST):

- Dow Jones Closed

- Nasdaq down Closed

- S&P 500 Closed

- London (FTSE 100) down 0.67% to 6,585

- Frankfurt (DAX) down 0.37% to 11,058

- Tokyo (Nikkei) up 0.08% to 20,539

- Shanghai (composite) down 5.84% to 3,684

- Hong Kong (Hang Seng) down 0.83% to 26,064

- ASX Futures overnight (SPI September) -7 points to 5,474

- US 10 Year Bonds Closed

- German 10 Year Bonds -5 to 0.80%

- Australian 10 Year Bonds – 18 points to 2.90%

- AUDUSD: 0.7491

- EURUSD: 1.1027

- USDJPY: 122.33

- GBPUSD: 1.5566

- USDCAD: 1.2591

- Crude: $55.04

- Gold: $1,174

- Dalian Iron Ore (September): 402

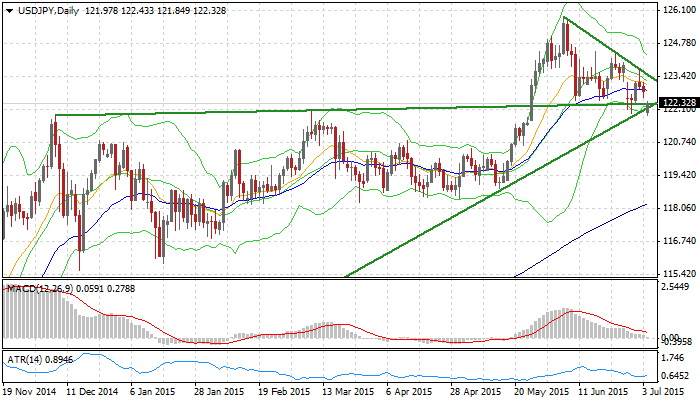

CHART OF THE DAY: USDJPY.

There is a little recovery happening in Asian trade this morning as bigger markets head toward Monday and the first few hours of specy trade are out of the way. That’s seen USDJPY trade higher from the lows with EURJPY doing likewise.

Key here is that on EURJPY we have last weeks low at 133.75/80 as key support while USDJPY we have 121.80ish.

Both levels were touched and both proved support again. These remain the levels to watch

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.