Introduction

Golden week in Asia and Ascension Day in Europe leads to a day of holiday in many countries globally, and thus lower currency market turnover ensues. The USD saw some renewed weakness yesterday during NY trading after a poorer than expected ADP employment report printed, perhaps giving an indication for the NFP figure tomorrow in the states. 200k is the estimated figure for change in non-farm payrolls for April, compared to the 215k number in March.

Asian Session

Retail sales figures in Australia proved better than expected at 0.4% MoM for March. This buoyed AUD, which has gained 0.61% versus US dollar and 0.59% against the euro. The Caixin services PMI figure out of China may have dampened AUD buying somewhat, with that figure coming in at 51.8 as opposed to 52.6 expected and 52.2 last.

Despite a poor publication of crude oil stocks data by the EIA in NY yesterday, WTI crude oil futures trade towards the US$45 mark. This has buoyed commodity currencies a touch, with USD/MYR holding above the 4.00 mark as a result.

Political difficulties in Turkey between President Recep Tayyip Erdogan and Prime Minister Ahmet Davutoglu are likely to lead to one or both of these leaders stepping down from their post. As a result, Turkish Lira lost close to 4% in late afternoon trading yesterday against the greenback. The pair climbed to a high of 2.9763 and has stabilised a touch overnight to stand at the current 2.9240 level now.

The day ahead in Europe and NY

Cable trades just above the 1.4500 figure as London begins to trade, ahead of house price data released by Halifax building society today and a services PMI number released at 09:30 BST. Sterling took a hit yesterday after the construction PMI number printed lower than anticipated.

In the states later, the weekly initial jobless claims data will be released. After the EIA released crude oil stocks data yesterday, natural gas inventory info. will be published today.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1489 | +0.02% | 1.1494 | 1.1482 |

| USDJPY | 107.06 | +0.14% | 107.21 | 106.89 |

| GBPUSD | 1.4511 | +0.11% | 1.4529 | 1.4495 |

| AUDUSD | 0.7505 | +0.60% | 0.7514 | 0.7453 |

| NZDUSD | 0.6902 | +0.30% | 0.6912 | 0.6872 |

| USDCHF | 0.9583 | -0.06% | 0.9585 | 0.9569 |

| EURGBP | 0.7915 | +0.12% | 0.7926 | 0.7905 |

| EURCHF | 1.1000 | -0.10% | 1.1009 | 1.0996 |

| USDCAD | 1.2835 | +0.26% | 1.2873 | 1.2814 |

| USDCNH | 6.5118 | +0.08% | 6.5212 | 6.5091 |

FXO

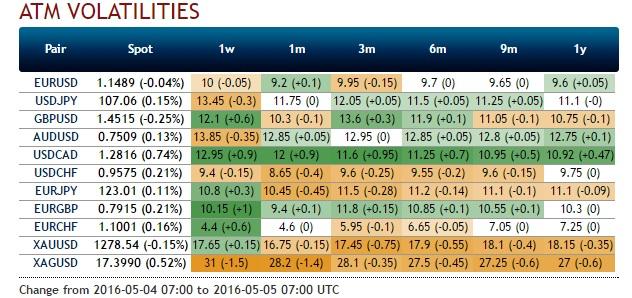

Overnight EUR/USD strikes do not trade at particularly high levels compared to some other pre-NFP dates. A 1.1500 strike currently stands in the inter-dealer brokers with a mid. volatility of 17.5%. Some large expiries, in the region of one billion, are rolling off today at the New York cut-off time of 3pm BST. Strikes are at the 101475 and 1.1500 levels.

Sentiment within the currency options space has taken a further shift regarding USD/JPY. 89% of traders within the bank are now long puts and/or short calls, a shift of 6% over the last 24 hours.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

AUD/USD drops below 0.6600 after RBA policy announcements

AUD/USD stays under bearish pressure and trades deep in negative territory slightly below 0.6600. The RBA left the policy settings unchanged as expected but Governor Bullock said that there was no necessity to further tighten the policy.

Gold price turns red amid the renewed US dollar demand

Gold price trades in negative territory on Tuesday amid the renewed USD demand. A downbeat US jobs data for April prompted speculation of potential rate cuts by the Fed in the coming months.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.