Introduction

The Bank of Canada kept their benchmark interest rate on hold at 0.5% during NY trading yesterday. This was the expected outcome from the recent meeting in Toronto, and led CAD to strengthen against USD. The USD/CAD pair traded from the 1.3450 level down to the current area below 1.3300. The BoC monetary policy statement then mentioned that inflation growth in Canada was moving with the pace and direction that was essentially anticipated and that risks to the inflation outlook are balanced. Later yesterday evening, a surprise then came from Wellington when The RBNZ slashed its base interest rate to 2.25% from 2.5%. Global economic concerns were cited as a reason for this and without any pricing in of the event from the market, Kiwi tumbled. The market now awaits the ECB meeting with a monetary statement and press conference from Mario Draghi taking place at lunchtime too.

Asian Session

Lower dairy prices were noted by market analysts as another reason for the RBNZ cut last night. AUD/NZD was unsurprisingly a notable mover as it rose to a session high of 1.1285. Across The Tasman Sea, iron ore prices have risen leading many traders of Antipodean currencies to remain convinced that the actions from The RBNZ are not an indication of any potential forthcoming moves from The RBA.

Chinese PPI and CPI info. has been released and proved relatively positive. Equities have not had the most positive day in the region with both the SHCOMP and SHSZ300 (CSI300) indices losing approx. 2%. The CPI figure was the highest since July 2014 and USD/CNH trades currently at 6.5180.

USD/JPY has consistently traded with a ‘113’ handle throughout the night and sits at 113.50 right now. The market is less convinced regarding any moves from The BoJ next Thursday in Tokyo, particularly after comments overnight from central bank advisor Etsuro Honda to suggest as such. Rumours of a postponement of the forthcoming sales tax increase are also beginning to gather volume.

The day ahead in Europe and NY

Trade balance data has recently been released out of Frankfurt and proved a touch lower than expected. The market has not reacted a great deal, with EUR/USD moving down from 1.0980 to 1.0969. This is unsurprising ahead of an ECB meeting which is garnering huge attention.

In an open letter at the start of March, Mario Draghi stated that a potential reconsideration of monetary policy was something that would be possible, if necessary. Forecast for the years 2016 to 2018 will be refreshed and announced today too. The current fiscal level of the monetary policy stimulus stands at €1.5trillion.

The unemployment rate in Sweden came in at 07:00 GMT and printed at 4.1% compared to 4.3% prior. Inflation figures also print out of neighbouring Norway at 09:00 GMT whilst similar figures from the home of Saxo Bank A/S have printed and proved a touch lower than anticipated.

In The States later today, the EIA will release storage figures for natural gas stocks as the active futures contract for the fuel trades at US$1.76 right now. Jobless claims data will be released out of New York whilst in Canada, central bank governor Stephen S. Poloz speaks at an important time; after yesterday’s base interest rate decision and ahead of unemployment data for the nation released tomorrow afternoon.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.097 | -0.26% | 1.1004 | 1.0961 |

| USDJPY | 113.5 | 0.21% | 113.81 | 113.15 |

| GBPUSD | 1.4218 | 0.01% | 1.4222 | 1.4183 |

| AUDUSD | 0.7483 | -0.04% | 0.7489 | 0.7456 |

| NZDUSD | 0.6669 | 0.22% | 0.6672 | 0.6619 |

| USDCHF | 0.9972 | 0.02% | 0.9984 | 0.9964 |

| EURGBP | 0.7719 | 0.23% | 0.7741 | 0.7715 |

| EURCHF | 1.0946 | 0.24% | 1.0975 | 1.0935 |

| USDCAD | 1.3257 | -0.06% | 1.3283 | 1.3238 |

| USDCNH | 6.518 | -0.09% | 6.5213 | 6.5103 |

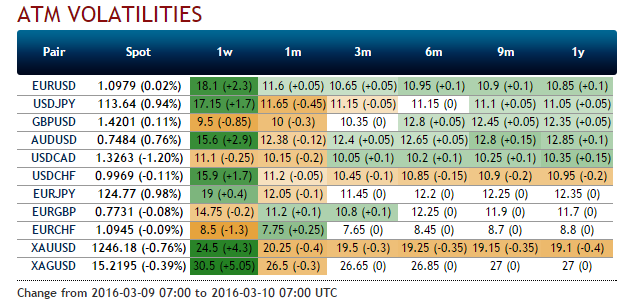

FXO

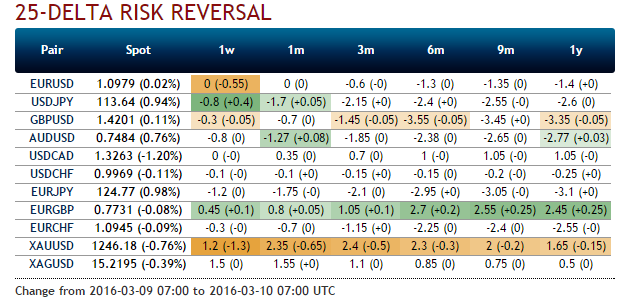

Overnight EUR/USD options are trading at around the 38.0% volatility with buyers prevalent of course. Both downside and upside strikes are bid at around the same level, showing no directional bias and an overnight risk-reversal that trades at around par.

Sentiment within the retail currency options space Saxo Bank A/S shows no bias in terms of EUR/USD options either; 52% of traders favouring long put and/or short call positions. In the AUD/USD and Cable space, 70% of traders favour the upside strikes. Within the inter-dealer market it comes as no surprise that NZD puts have been in demand overnight and into the morning.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.