Introduction

The Nikkei 225 index followed suit after stock indices fell across the board, driven by a decline in European banking equities with heightened talk of the problems in Greece REARING once again. WTI crude oil futures are trading heavily at around the US$30 mark amidst relatively low liquidity and nervous times.

Asian Session

EUR/USD has traded above 1.1200 overnight with the risk-off sentiment driving USD/JPY to a low of 114.21. It also comes as no surprise that gold and CHF were paid up as the scurry for safe-haven assets took place.

In Australia, business confidence data proved largely in line with expectations. Antipodean currencies trade lower against USD with CAD following suit too.

The British Retail Consortium printed a positive retail sales figure overnight. Cable trades right now above the 1.4400 level whilst the US dollar index stands close top lows so far for the year at 96.73.

The day ahead in Europe and NY

A lack of real data and liquidity will inevitably lead to market attitude being the main driving force today. In Switzerland, unemployment data has already been released and proved in line with expectations. Industrial production data and trade balance figures for Germany have recently been published too and pulled EUR lower.

Trade balance info. will print out of London at 09:30 GMT today. EUR/GBP reached a high for the year of .7757 today. Later in the states, a string of data containing only tepid importance will take be released. The weekly crude oil stock data will be a focus when released at 21:30 GMT today.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1182 | -0.10% | 1.1238 | 1.1178 |

| USDJPY | 115.34 | -0.43% | 115.85 | 114.21 |

| GBPUSD | 1.4459 | 0.19% | 1.4462 | 1.4391 |

| AUDUSD | 0.7061 | -0.37% | 0.7088 | 0.7019 |

| NZDUSD | 0.6619 | -0.12% | 0.6629 | 0.6576 |

| EURCHF | 1.102 | 0.25% | 1.1056 | 1.1011 |

| USDCAD | 1.3908 | 0.14% | 1.3961 | 1.3892 |

| USDCNH | 6.5766 | 0.06% | 6.5825 | 6.5699 |

FXO

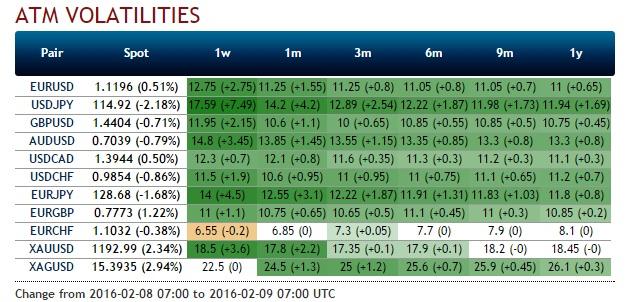

Volatility is higher than may be expected when a look at certain major currencies such as EUR/USD is taken. The one month straddle trades at a volatility of 11.3% which is a high for volatility in this space for the year so far.

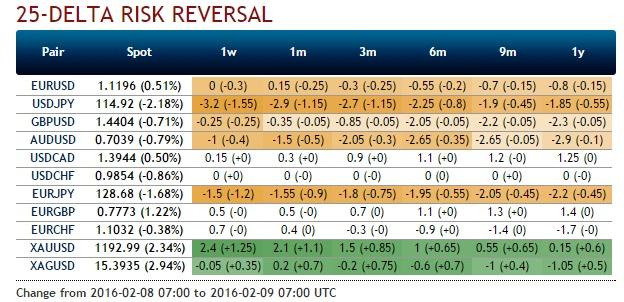

Low liquidity is leading curves to move quite dramatically in the currency options space. The USD/JPY one month 25-delta risk re3versalhas moved from a volatility differential of 1.5% to close to 3.0% today, favouring the downside.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.