Shares of commodities giant Glencore Plc plunged 28.9 percent in US trade on Monday. The move marked a dual milestone for the company, delivering the lowest daily closing price as well as the largest single-session drop since its IPO in 2011.

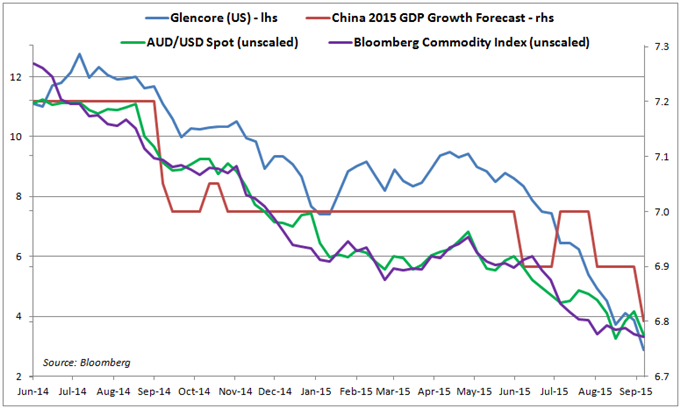

Glencore has trended lower alongside the broad slide in commodity prices since mid-2014. In turn, that move has tracked the sharp decline in Chinese economic growth expectations. The East Asian giant is a key source of demand for raw materials and a slowdown there has translated into steep losses across the asset class.

This theme has also found parallels in foreign exchange markets, with the Australian Dollar mirroring the drop in commodity prices and Glencore shares alike. China is Australia’s largest trading partner and fears of a slowdown there fueled worries about knock-on effects on the latter country’s performance, feeding RBA interest rate cut speculation and undermining demand for the currency.

Investors were unconvinced by Glencore’s claims that its trading business will act as a stabilizing force on earnings in the event of a commodities price drop, making it better-positioned than competitors solely engaged on the industrial side. That seems to stem from the firm’s high debt load. A Wall Street Journal report suggested the company’s trading activity is funded by nearly $18 billion in short-term credit.

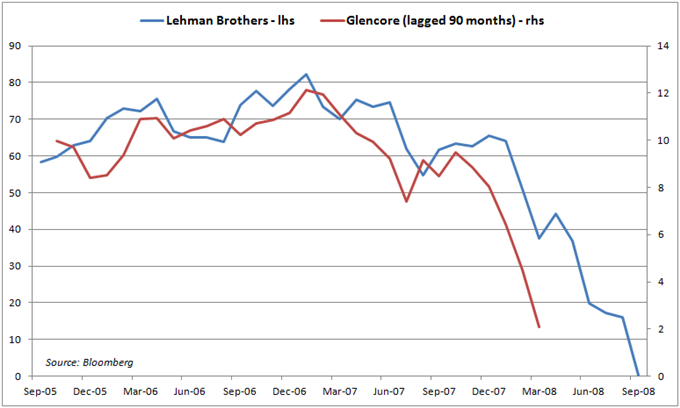

This conjures up images of another highly-leveraged firm whose ultimate failure plunged the financial markets into utter disarray in 2008: Lehman Brothers. The investment bank was undone when a downturn in the housing market doomed its debt-fueled foray into trading mortgage-backed securities. The drop in commodity prices may trigger an analogous scenario for a firm like Glencore.

The implications for global markets are likely to be no less dire in this case. Glencore is deeply entrenched in the international financial system and has credit lines with most of the world’s top banks. A disorderly collapse (or even plausible fears thereof) may inflict heavy losses on creditors, sending them scrambling for cash and unleashing another market-wide crisis.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.