- Greece set to default if no bailout agreement is reached

- Focus remains on Greek referendum on July 5

- A vote for “No” likely to cause significant market volatility

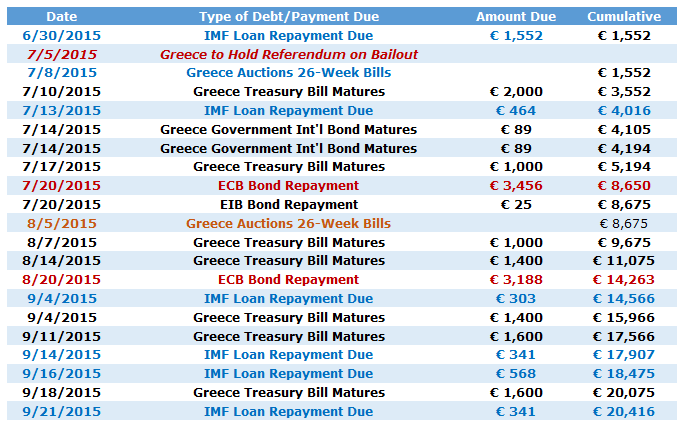

Key Dates for Greece Continue to Warn of Substantial Volatility

Data Source: Bloomberg, Wall Street Journal. Prepared by David Rodriguez

It seems as though the Greek Government has had a critical deadline in every single one of the past number of weeks, and still it remains solvent and a decline in Euro and broader financial market volatility suggests that danger has receded. Yet this is misleading for a simple reason: the central Greek Government has almost certainly run out of funds with which to pay mounting debts. Default is effectively guaranteed if it does not reach an agreement for a bailout extension with the EWG and IMF.

A Greek debt default would likely lead to a much-larger domestic crisis, an exit from the Euro Zone, and the establishment of an alternate Greek currency. This remains the major risk to broader financial markets and systemically-connected economies.

What’s the Most Important Date on the Calendar?

In concrete terms, the single most significant deadline on the calendar is likely the European Central Bank bond repayment due on July, 19—assuming that the Greek Government remains solvent up until that point. Ahead of that, a national referendum on July 5 will also prove potentially pivotal as a number of European leaders claim it is tantamount to a referendum on whether Greece will stay in the Euro Zone.

Current signs suggest that the Greek people will vote “No” and reject the current bailout offer from the Euro Working Group, and volatility is virtually guaranteed on such a result. Such an outcome would send negotiators on both sides back to the table and ostensibly strengthen Greek Prime Minister Tsipras’ hand in negotiations. It is difficult to say that this would make a deal more likely, however, and the stakes would grow ever-larger ahead of the potentially game-changing payment due to the European Central Bank on July, 19.

A look at forex market volatility prices for the Euro/US Dollar underlines the sense of urgency: some of the most sophisticated traders in the world believe that the coming four weeks will bring substantially more uncertainty than the coming year.

Euro Volatility Prices Substantially Higher in Near Term than Coming Year

Data source: Bloomberg. Chart source: R, ggvis

Data source: Bloomberg. Chart source: R, ggvisEuro Reactions are Far from Predictable

We’re entering a critical stretch for the ongoing Greek sovereign debt crisis, but the clear difficulty is pinpointing the exact moment at which traders should take extra caution.

If the upcoming referendum does indeed produce a “No” result, we could see substantial Euro volatility and broader financial market turmoil. Heightened sovereign risks could discourage market makers from making prices in EUR pairs, and in effect this means that the Euro could both rally and fall sharply on any news headlines.

Any surprises could force substantial market moves, and traders should limit trading leverage—particularly in EUR pairs—ahead of the key dates. Caution is advised until we see a true breakthrough in negotiations.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.