Talking Points:

- Durable Goods, Consumer Confidence Tuesday for US Dollar.

- Will FOMC knock back buck on inflation concerns?

- US growth hummed along in Q3.

Volatility has settled this past week, but likely in reverence for the event risk that is coming up this week. However, instead of moving from day to day and week to week for event risk to rouse activity in the markets; we continue to see the gradual rise in volatility. This is what we would expect to see from a systemic change in market activity moving forward.

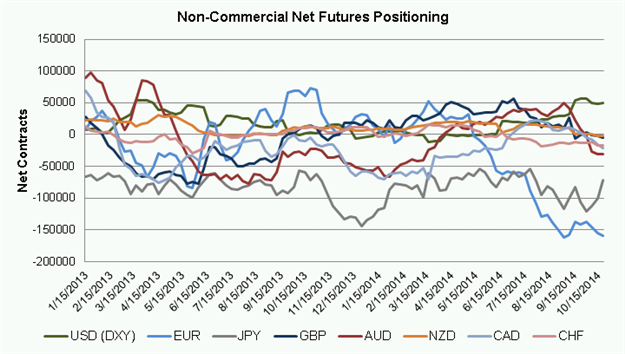

As for event risk, our docket is loaded. Top tier listings are the FOMC rate decision on Wednesday and the US Q3’GDP reading on Thursday. These have the clout to move not only the US Dollar, but sentiment trends themselves. Disappointment could have a profound impact thanks to where traders currently stand: notional USD long positioning among speculators is at its second highest level of all-time, per the CFTC's most recent COT report.

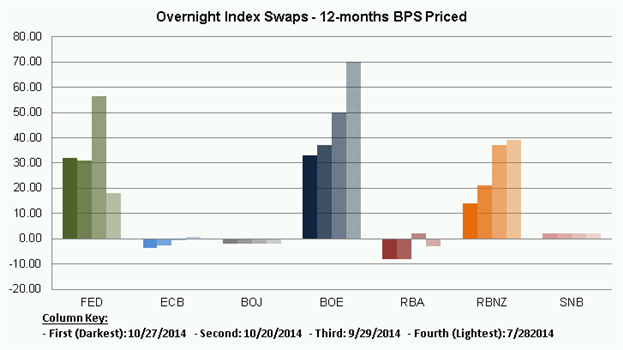

Rate Hike Probabilities / Basis-Points Expectations

10/29 Wednesday// 18:00 GMT: USD FOMC Rate Decision

At present the U.S. economy remains embedded in a larger economic conundrum; employment is near robust levels yet wage pressures have not followed. Forward guidance shifts to this puzzle as the Federal Reserve looks to conclude QE this month. The debate: should monetary policy be tightened sooner in response to an improved labor market or kept loose in light of growing deflation concerns. If inflation is believed to lead output than the Fed may have reason to keep rates low and significantly reduce rather than eliminate bond buying altogether, without overshooting the target. Given growing concerns over a negative global feedback loop, rates are expected to be maintained at 0.25% and should elicit additional commentary on the timeframe-expected to be considerable-between the end of QE and the first rate hike.

10/29 Wednesday // 20:00 GMT: NZD Reserve Bank of New Zealand Rate Decision (OCT)

The Reserve Bank of New Zealand is expected to keep the current official cash rate at 3.50%. This upcoming headline reading would be the third consecutive decision by New Zealand federal officials to leave the rate unchanged at a five-year high. According to analyst estimates, the New Zealand economy growth expectation has been revised to expand +0.7% in Q3’14, which was originally expected to weigh in at +0.8%. The RBNZ stated in September that they believed the Kiwi to be over-valued, which inevitably signaled a pause in the cash rate hikes.

10/30 Thursday// 12:30 GMT: USD Gross Domestic Product (3Q A)

After contracting -2.1% in Q1’14, real GDP increased +4.6% in Q2’14. The momentum continues as annual estimates for Q3 are expected to be +2.9%. Following a rise in disposable income (+0.3%) and PCE (+0.5%), lower borrowing rates and depressed oil prices could offer a small boost GDP above forecasted levels. Such an elevation would likely lead to a rise in the dollar. Conversely if the slowdown in foreign demand, a stronger than expected US dollar, and weaker equity/credit markets dominate than GDP could lag behind estimates.

10/31 Friday // 10:00 GMT: EUR Euro-Zone Consumer Price Index (OCT)

The Euro-Zone Consumer Price Index Core and the CPI Estimate are both big focal points this week as market participants look to the ECB for action during a time of sliding inflation. Recently the Core CPI numbers have stabilized relative to past performance with a prior reading of +0.8%. Deflationary forces are becoming a severe concern for the ECB as they look to the main refinancing rate of 0.05%. If current conditions continue into 2015 we can expect to see ECB interventions like QE in order to slow sliding inflation.

Non-Commercials Net Futures Positioning

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD trades on a stronger note 1.2530, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The United States Employment report will be released by the Bureau of Labor Statistics at 12:30 GMT. The US Dollar looks to employment data after the Fed signaled its intention to hold rates higher for longer on Wednesday.