Talking Points:

- US Dollar Faces a Heavy Week of Economic Data with FOMC, US 2Q GDP and NFPs taking the Lead

- Euro Inflation Continues to be the Focus for Market Participants

- Weekly Trading Forecast: FX Markets Brace for US GDP, NFPS and FOMC

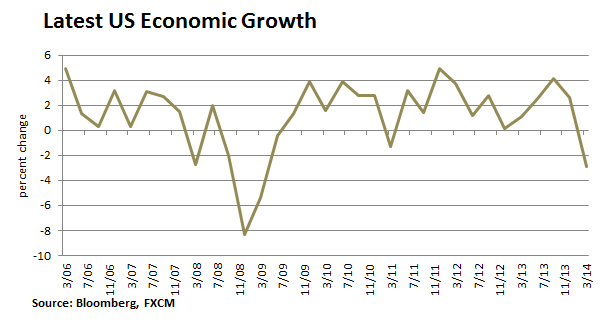

Wednesday may prove to be a pivotal week for the US Dollar as two pieces of economic data could have a meaningful impact on interest rate expectations and risk trends. First, the second quarter US growth report (US 2Q GDP) is released and expected to show economic output rose at a pace of 1.4 percent in the second quarter. Notably, last week the IMF downgraded its 2014 growth forecast sharply to 1.7 percent from 2.8 percent, but it seems that market participants and the Fed remain hopeful for a sharp rebound in the 2Q. Later in the day, the US Federal Open Market Committee (FOMC) is expected to continue with its pace of tapering another 10 billion in asset purchases. The FOMC will not be providing an update to their employment, inflation or interest rate forecasts nor will Chairwoman Yellen be giving a press conference. With this in mind, the spotlight turns to the monetary policy statement where market participants will parse through the words to gauge the Fed’s tone and outlook.

Suggested Story: US Dollar Turn Can Forge Trend on Fed Decision, NFP’s, 2Q GDP

Suggested Story: US Dollar Technical Analysis: Prices Push to 5-Week High

Two pieces of economic data may spark volatility in the Euro currency during the European trading session on Thursday. Germany’s July labor market report is expected to show the economy lost 5,000 jobs while the unemployment rate remains unchanged at 6.7 percent. What may peak trader’s interest is Eurozone’s consumer price index report that is expected to show inflation unchanged at 0.5 percent in the month of July. Moreover, this may show the European Central Bank’s latest stimulus measures have had little impact. Despite last week’s Eurozone, German, and French PMI surveys that beat expectations, providing a short-term relief rally it seems the market remains focused on the weak inflation component (output prices) of the Eurozone composite PMI. With output prices reporting below 50, it may suggest that inflation remains market focus.

Suggested Story: Euro’s Low Growth, Disinflationary Rut Weighs on Traders

Suggested Story: EUR/USD Technical Analysis: Continuing to Hold Short

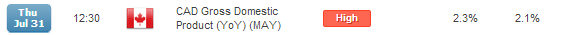

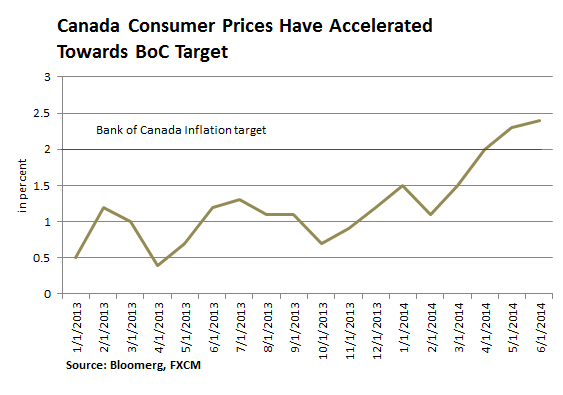

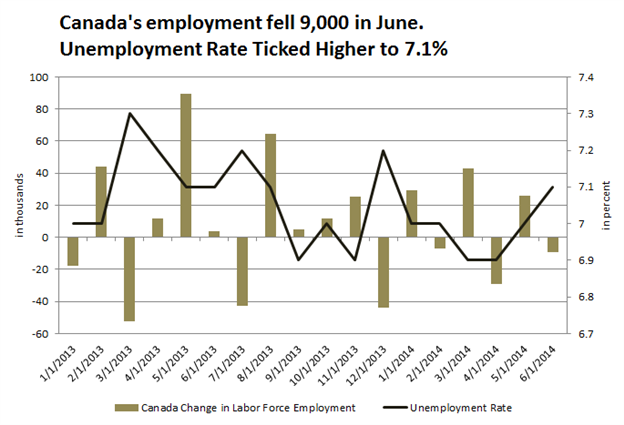

The Canadian Dollar has fallen against its major peers on concerns of Canada’s economic outlook. Last week the loonie sank to a five-week low against the US Dollar. The turn of events come after the Loonie enjoyed a rally due to a rise in consumer prices. Inflation rose past the central bank’s 2 percent inflation target over the course of two months. Despite a rise inflation, economic figures have weighed on the Loonie as they show that Canada is lagging behind its US counterpart. Further fueling the pessimism is the Bank of Canada that cut its growth forecast on July 16th, saying the nation’s economy is not expected to reach its full capacity until mid-2016. The latest employment report showed the labor market unexpectedly shrank in June. On Thursday, Canada is to show the economy grew 2.3 percent in May.

Suggested Story: USD/CAD Trades into March High Trendline as BoC Talks Down Economy

Suggested Story: Canadian Labor Market Disappoints in June, USD/CAD Rips

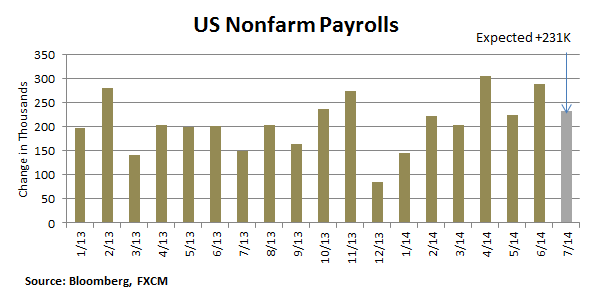

The market ends the week facing a high-profile event that may induce volatility across the major currencies. US Non-Farm Payrolls (NFPs) for July is expected to show 231,000 jobs were added to the economy. The outcome would mark the sixth consecutive month that the economy added more than 200,000 jobs in the economy.

Suggested Reading: USD/JPY Rallies to Multi-Week Highs, but What Could Force it Higher?

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.