It was more or less the same pattern Monday as on Friday. With Chinese stocks collapsing and commodities continuing to fall, Fed funds rate expectations continued to retreat and the dollar lost ground against most of its G10 counterparts. The move was aided by a stronger-than-expected Ifo survey. EM currencies meanwhile generally fell against the dollar, with TRY once again leading the way on geopolitical concerns, followed by the currencies of the commodity countries, particularly the oil producers as oil prices lurched lower.

Some of the eastern European currencies did rather well, however, such as PLN, HUF and CZK. These countries are likely to benefit from stronger European growth, as indicated by yesterday's Ifo survey, and as oil importers they will also benefit from lower oil prices. It depends on how the fall in commodities is viewed. So far, it's being viewed as the equivalent of a tax cut – something that leaves more money in the hands of consumers. The question is whether if commodity prices continue to fall, will the decline be seen as an indication of weak demand? That may be the implication from the rally in US bonds. Note that European bonds did not gain yesterday, which is intriguing considering that European stocks were down sharply.

In any case, the dollar's rate advantage narrowed slightly and the currency weakened as a result. Whether this trend continues depends a lot on what the FOMC says tomorrow. I expect that the turmoil in Chinese stocks will not derail that Committee and that the statement will echo Fed Chair Yellen's recent comments about being on track to tighten later this year. That should support the dollar.

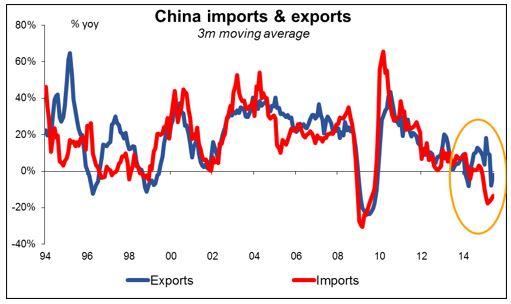

Chinese stock rout could set off another round of currency wars As Chinese stocks collapse, the Chinese government has been taking various measures to shore up the market. Some of them involve direct involvement with the market itself, while others try to improve the macroeconomic background for stocks, e.g. cutting the required reserve ratio for banks. On Friday, the State Council published a set of policy initiatives to promote trade. Exports have been falling on a yoy basis recently, a relatively unusual event for China over the last two decades. The Council probably hopes to boost exports and aid manufacturing, which has been contracting recently, according to the latest PMI report.

Among the measures the State Council announced, it said that China will increase the renminbi exchange rate's flexibility and allow the currency to trade in a wider range against the dollar. This is an unusual comment for the State Council – the renminbi's trading range is usually the purview of the People's Bank of China (PBoC), the central bank, which sets its trading band. The implication is that the PBoC may widen the band, which currently limits CNY to a daily limit of ±2% of the daily fixing rate. China has been keeping CNY relatively steady as it makes a bid for the currency's inclusion in the IMF's Special Drawing Rights (SDRs), but this may be a sign that they are getting ready to allow it to depreciate further. If that were to happen, it would of course have a major impact on the relative competitiveness of China's neighbors, as well as those countries that export to China. It could revive the "currency wars" by setting off yet another round of interest rate cuts or other measures to push currencies down and maintain competitiveness.

Today's highlights: The European day starts with Sweden's retail sales for June. Sales are expected to rise 0.7% mom, after declining -0.1% mom in the previous month. This could drive USD/SEK below the psychological zone of 8.500 and perhaps open the way for the 8.400 territory.

In the UK, the 1st estimate of Q2 GDP is due out. The forecast is for the growth rate to accelerate on a qoq basis, while the annual rate is estimated to decelerate. Given the weak industrial production in April and May and the poor retail sales figures in Q2, the Q2 growth figure could disappoint. This could encourage Cable bears to challenge the support barrier of 1.5465, defined by the low of the 24th of July. On the other hand, a strong positive surprise along with the recent hawkish stance by several central bank members could encourage the bulls to push the pound higher. A break above 1.5540 is likely to carry bullish extensions towards the next resistance of 1.5580.

In the US, the Federal Reserve Open Market Committee begins its two day monetary policy meeting. As for the indicators, the S&P/Case-Shiller house price index for May is expected to have accelerated from the previous month. The preliminary Markit service-sector and composite PMIs for July are also coming out. The service-sector index is forecast to come out fractionally higher, while no forecast is available for the composite one. The Conference Board consumer confidence index and the Richmond Fed manufacturing index, both for July, are also to be released. Most data are expected to come on the positive side and could support the greenback somewhat.

The Market

EUR/USD surges and hits 1.1130

EUR/USD raced higher on Tuesday, breaking above the resistance (now turned into support) of 1.1020 (S1). On the 4-hour chart, the price structure still suggests a short-term uptrend, Therefore, I would expect a clear break above 1.1130 (R1) to set the stage for extensions towards the 1.1200 (R2) hurdle. But before that, I believe that we are likely to experience a corrective move, perhaps to challenge the 1.1020 (S1) barrier as a support this time. Our short-term oscillators support the case for a pullback as well. The RSI exited its above-70 territory and is now pointing down, while the MACD shows signs of topping and could fall below its trigger line soon. As for the bigger picture, as long as the pair is trading between 1.0800 and 1.1500, I would see a neutral longer-term picture. I believe that a move above the psychological zone of 1.1500 is the move that could carry larger bullish implications, while a break below 1.0800 is needed to confirm a forthcoming lower low on the daily chart and perhaps turn the overall bias back to the downside.

Support: 1.1020 (S1), 1.0925 (S2), 1.0870 (S3)

Resistance: 1.1130 (R1), 1.1200 (R2), 1.1245 (R3)

EUR/GBP rallies and hits 0.7160

EUR/GBP traded higher on Tuesday, breaking above the 0.7100 (S1) barrier and hit resistance at 0.7160 (R1).

The price structure on the 4-hour chart remains higher peaks and higher troughs, and this prints a positive short-term picture in my opinion. I would expect a clear break above the 0.7160 (R1) obstacle to extend the trend and perhaps challenge the next resistance at 0.7200 (R2), marked by the high of the 13th of July. Nevertheless, I would expect a downside corrective move before the next positive leg, perhaps to challenge the 0.7100 (S1) zone as a support. Our oscillators amplify the case that a downside correction could be on the cards before the bulls shoot again. The RSI exited its above-70 territory and is pointing down, while the MACD has topped and could fall below its trigger soon. On the daily chart, I still see a longer-term downtrend, thus I would consider the short-term uptrend to be a corrective phase of the overall down path.

Support: 0.7100 (S1), 0.7050 (S2), 0.7000 (S3)

Resistance: 0.7160 (R1), 0.7200 (R2), 0.7225 (R3)

GBP/JPY hits support at 191.00 and rebounds

GBP/JPY hit support at 191.00 (S1), and rebounded. Although the short-term trend seems to be negative, I would expect the upside move to continue. The rate is now headed towards 192.50 (R1), where an upside break is possible to open the way for the next resistance of 193.90 (R2). Our short-term oscillators support the notion. The RSI hit support at its 30 line and edged higher. It is now headed towards its 50 line, while the MACD, although negative, shows signs of bottoming and could cross above its trigger line soon. On the daily chart, I see that on the 8th of July, the rate rebounded from the 185.00 psychological zone, which stands pretty close to the 50% retracement level of the 14th of April – 24th of June rally. As a result, I would consider the overall path of this pair to still be to the upside.

Support: 191.00 (S1), 189.25 (S2), 187.35 (S3)

Resistance: 192.50 (R1), 193.90 (R2), 194.50 (R3)

Gold trades somewhat lower

Gold traded above 1100 (R1) for a while, but failed to reach the next resistance of 1110 (R2), and retreated back below 1100 (R1). As long as the metal is printing lower peaks and lower troughs below the lower line of the short-term downside channel that had been containing the price action from the 18th of June until the 20th of July, I would consider the short-term outlook to remain negative. I would expect the bears to eventually take control again and to aim for another test at the 1077 (S2) hurdle. Taking a look at our short-term oscillators though, I would be careful about a further upside correction before sellers take charge again. The RSI, although below 50, has turned up again, while the MACD stands above its trigger line and is headed towards its zero line. Moreover, there is positive divergence between both these indicators and the price action. In the bigger picture, the plunge on the 20th of July triggered the continuation of the longer-term downtrend and kept the overall bias of the yellow metal to the downside in my view.

Support: 1088 (S1), 1077 (S2), 1072 (S3)

Resistance: 1100 (R1), 1110 (R2), 1120 (R3)

DAX falls off the cliff

DAX continued its plunge yesterday, falling below 11280 (R2) and reaching 11035 (S1). The short-term bias remains to the downside in my view, and I would expect a clear move below 11035 (S1) to target our next support of 10900 (S2). Our short-term momentum studies detect strong downside speed and amplify the case for further declines. The MACD stands well below both its zero and trigger lines and points down, while the RSI entered its below-30 territory. Nevertheless, the RSI shows signs that it could start bottoming and as a result I would be careful of a possible corrective bounce before the bears shoot again. As for the broader trend, given the recent plunge, I would switch my stance to neutral. Only a daily close below 10670 would confirm a forthcoming lower low on the daily chart and turn the overall bias of DAX to the downside.

Support: 11035 (S1), 10900 (S2), 10800 (S3)

Resistance: 11140 (R1) 11280 (R2), 11415 (R3)

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.