Commodity currencies out front as confidence returns Yesterday was a fairly quiet day, apart from a brief flurry of excitement when the Swiss National Bank (SNB) announced negative interest rates. The FOMC meeting continued to reverberate through the market and the implied interest rate on Fed funds futures rose a further 3 bps in the long end while 10-year bond yields rose another 7 bps on top of Wednesday’s 7. US economic data was pretty much in line with expectations and in line with past data and so did not change the picture of the US economy in any great way. On the other hand, the second consecutive rise in the German Ifo survey and UK retail sales rising at their fastest annual pace in over a decade, plus a calmer situation in Russia (USD/RUB fairly stable during the day, MICEX stock index +4.5%) seemed to bring greater confidence about global growth next year and the commodity currencies gained against the dollar, even though commodities themselves were generally lower. The same rationale meant less demand for safe-haven currencies and JPY and CHF were the worst-performing G10 currencies. EM currencies were mixed.

I noted yesterday that the S & P 500 had the best day of the year on Wednesday, however it beat that on Thursday with a 2.4% rise = up 4.5% in two days. The last time the market had back-to-back best days for the last 12 months was apparently in 1987, following the stock market crash then. The fact that stocks can put in such a great performance while rate expectations and bond yields are rising shows confidence in the US economy that is likely to support the USD going forward. Greek stocks also had a fairly good day (+1.5%) after the head of the opposition SYRIZA party said that he wanted a negotiated debt relief solution with the EU and wanted to keep the country in the Eurozone. It seems that as the election approaches, he is toning down some of his more extreme positions.

Oil continued to fall after the Saudi oil minister said OPEC would find it “difficult, if not impossible” to give up market share by cutting production. But he also said he was optimistic about the future, and indeed there’s good reason for him to be. Oil prices for far out in the future – 2020, for example – are rising, because so many companies are cutting their investment plans now. That may not have any impact on output this year or even next year, but it should limit the increase in output several years down the road.

The Bank of Japan kept policy unchanged, as expected. Having surprised the market with a boost in stimulus in October, it will probably be many more months before we see any change from the BoJ. The focus in Japan rather should be on PM Abe’s efforts to reform the economy, the so-called “third arrow” of his economic plans. So far however there aren’t many victories to see there, so the pressure on the BoJ will remain.

From New Zealand, both ANZ Business confidence for December and credit card spending for November were lower than expected. That didn’t prevent NZD from being the best-performing G10 currency however as commodity currencies recovered. Since New Zealand has little energy in its export basket and is little exposed to Chinese construction, I would expect the currency to perform well as confidence comes back. The only concern is fear of a change in monetary policy there.

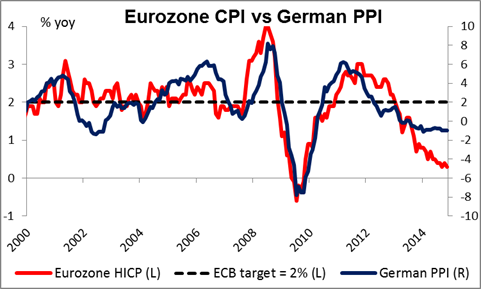

Today’s events: During the European day, German PPI for November is expected to fall at an accelerating pace of -1.1% yoy, from -1.0% yoy previously. This would show that the risk of deflation in the Eurozone is continuing or even increasing. The bloc’s current account for October is also to be released.

In Norway, the official unemployment rate for December is expected to rise a bit. On top of the falling oil prices, I expect weakening fundamentals to weigh on the Norwegian krone.

From Canada, the CPI for November is expected to decelerate, while core CPI is forecast to have accelerated. Although the BoC inflation target is specified in terms of the total CPI, for policy purposes, the Bank also monitors the “core” CPI. Overall, given that both headline and core CPIs are in the Bank’s target range, I would expect this to be CAD-supportive. Retail sales for October are also due to be out.

We have three speakers scheduled: Chicago Fed President Charles Evans, San Francisco Fed President Williams and Richmond Fed President Jeffrey Lacker. They are all voting members in 2015. Evans is considered a dove, Williams is dovish, and Lacker is a hawk. Willams and Lacker are speaking on monetary policy and the US economy so look for comments on their forecasts as well. Williams forecast 3% growth for 2015 while Lacker looked for 2%-2.5% as of their last comments.

The Market

EUR/USD just above 1.2250

EUR/USD plunged on Thursday following the decision from the Swiss National Bank to introduce negative interest rates. The rise in USD/CHF kept EUR/USD under pressure because of the EUR/CHF floor and pushed EUR/USD down to break two support lines in a row. The pair fell below 1.2300 and found support few pips above our support level of 1.2250 (S1). A break of the 1.2250 (S1) support line would make me confident about further declines. Our short-term momentum studies support the notion for an initial test of 1.2250 (S1). The RSI found support at its 30 line and is pointing down, while the MACD, already below its trigger line, moved further into its negative territory. The momentum signs amplify the case for further declines, but as mentioned above, a clear break of the 1.2250 (S1) support hurdle is necessary for further declines. In the bigger picture, the rate is still printing lower lows and lower highs below both the 50- and the 200-day moving averages and this keeps the overall path to the downside.

Support: 1.2250 (S1), 1.2160 (S2), 1.2120 (S3)

Resistance: 1.2345 (R1), 1.2410 (R2), 1.2470 (R3)

USD/JPY in a consolidating mode

USD/JPY consolidated on Thursday, staying below the psychological level of 120.00 (R1). I would wait for a break above that level to see further advances perhaps towards our next resistance of 121.85 (R2). Looking at our short-term momentum signals, the RSI remained elevated just above the 50 line, while the MACD, already above its trigger line, moved into its positive territory. The mixed momentum signs confirm the halt in the advance, at least temporarily, and I would wait for a break above the key 120.00 (R1) level to get confident for further advances. As for the broader trend, the price structure is still higher highs and higher lows above both the 50- and the 200-day moving averages and this keeps the overall path of the pair to the upside.

Support: 117.35 (S1), 115.45 (S2), 114.700 (S3)

Resistance: 120.00 (R1), 121.85 (R2), 122.44 (R3)

GBP/USD has lost some of its downside momentum

GBP/USD advanced on Thursday and recovered half of its Wednesday losses. However the move was halted just above the 1.5655 level and few pips below the 50-period moving average. With no clear trending direction on the 4-hour chart, I would still adopt a neutral stance as far as the short-term picture is concerned. This is supported by our mixed short-term momentum signals. The RSI found resistance at its 50 line and is pointing down, while the MACD crossed above its trigger line and is heading up to cross the zero line. As for the broader trend, I still believe that as long as Cable is trading below the 80-day exponential moving average, the overall path remains negative. Our daily momentums however are on a rising mode suggesting that the decline has lost some of its downside momentum and that we could see an upward correction before the sellers prevail again.

Support: 1.5550 (S1), 1.5500 (S2), 1.5420 (S3)

Resistance: 1.5740 (R1), 1.5790 (R2), 1.5830 (R3)

WTI collapsed breaking two support lines in a row

WTI collapsed and broke two support lines in a row after finding resistance near the 58.60 (R2) area. The decline was stopped few cents above our support line of 53.80 (S1). Our near-term momentum indicators suggest to take to the sidelines and wait for a break below the 53.80 (S1) support hurdle to get confident for further declines. On the daily chart, the overall path remains to the downside and our daily technical studies support this notion. Both the daily RSI and the daily MACD remain at their extreme low levels, yet they both point sideways, giving me enough reasons to adopt a neutral stance at the moment. Again, a clear break of the 53.80 (S1) level is necessary for another leg down.

Support: 53.80 (S1). 52.60 (S2), 50.35 (S3)

Resistance: 56.25 (R1), 58.60 (R2), 60.00 (R3)

Gold capped within 1210 and 1190 levels

Gold jumped briefly to test our 1210 (R1) resistance zone and retreated afterwards to continue gyrating around 1200. The price remains capped within the 1210 (R1) resistance zone and 1190 (S1) support level and a decisive break in either direction is probably going to determine the near-term bias. Looking at our short-term momentum signals, the RSI lies just below its 50 line, while the MACD, although in its negative territory, crossed above its trigger line. Both momentum indicators are pointing sideways, reflecting the indecisiveness of the market.

Support: 1190 (S1), 1186 (S2), 1175 (S3)

Resistance: 1210 (R1), 1215 (R2), 1235 (R3)

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.