European officials get worried The main theme yesterday was attempts by Eurozone officials to talk down the single currency. It started with EU Commission vice-president for industry, Antonio Tajani, who said that the single currency at 1.40 “hurts the economies of Spain, Italy, France and, in the long run, Germany.” This was the first comment we’ve gotten from the EU Commission about the EUR/USD rate. Then Bundesbank President and ECB Governing Council member Jens Weidmann said that negative interest rates are an option that the Bank could use to prevent the single currency from strengthening further, and that quantitative easing was not out of the question to combat deflation. That’s significant for two reasons: first off, Mr. Weidmann is the most hawkish ECB member and if even he’s getting concerned, it means there is a general consensus. Secondly, it corroborates comments from ECB President Draghi that the currency rate, although strictly speaking not a target of the ECB, is nonetheless becoming a concern for the Bank. Weidmann later said that the euro “doesn’t warrant monetary policy action at this point” and that the risk of deflation in the euro area is “very low,” which sent EUR/USD back up somewhat. But Jozef Makuch, another Council member, said that the Bank is preparing additional measures to avoid a deflationary environment and that he wouldn’t oppose QE if needed, which put further pressure on EUR/USD.

Overall though, the amazing thing about EUR/USD is its stability. Even after all that, EUR/USD had less than a 1% range on the day. Looking at the rates we take every morning, EUR/USD has had either a 1.37, 1.38 or 1.39 handle (except for one day at 1.3687) for the last 28 working days (since 17 February). That’s a remarkably narrow range considering that the period includes the Russian invasion of Crimea, an FOMC meeting that changed everyone’s view on the outlook for US interest rates, and the first-ever default by a Chinese corporate bond. One-month historical volatility is more than one standard deviation below the average since 2010 for several of the main currency pairs, including EUR/USD, GBP/USD, USD/CHF, NZD/USD, USD/NOK, USD/SEK, and EUR/GBP. This seems unrealistic to me. There’s an old saying in the market, “nothing matters to anybody until it matters to everybody.” I’m concerned that eventually, the end of Fed largess, the geopolitical tension in Europe, the deflation facing the Eurozone, the structural shifts occurring in China, and the growing realization that “Abenomics” is a failure in Japan are going to start changing the market’s sanguine view of the future. Years of zero rates and QE have made investors confident in the ability of the central banks to manage events, but what happens when several central banks – the Fed, the Reserve Bank of New Zealand and probably the Bank of England next – start normalizing their policy? Then we are likely to see greater differentiation among currencies and the return of trends.

But for now, the ruble was the main gainer among the EM currencies we track for a third day, as Russian companies bought the local currency to meet a tax deadline, while the Russian equity markets were up 2% (outpacing the +1.4% gain for the Eurostoxx index) as concerns about tougher sanctions from the US and the EU have eased. This demonstrates to me how optimistic the markets are.

Today starts with the German GfK Consumer confidence for April, which is forecast to remain unchanged. Italy’s retail sales are estimated to have risen slightly in January, a turnaround from a fall in December, while Italy’s consumer confidence for March is expected to be up somewhat in February. These indicators are not particularly market-moving.

In the US, durable goods orders for February are coming out. The headline figure is expected to have risen 0.8% mom, after falling 1.0% mom in January, while durable goods excluding transportation are expected to have slowed to +0.3% mom from +1.1% mom in the previous month. The figure could be mildly USD-negative. Also, the preliminary Markit service-sector PMI for March is expected to be up to 54.0 from 53.3 in February.

On Thursday morning, New Zealand’s trade surplus is estimated to have risen to NZD 600mn in February from NZD 306mn in January.

St. Louis Fed President James Bullard and Reserve Bank of Australia Governor Glenn Stevens speak at the Credit Suisse forum in Hong Kong.

THE MARKET

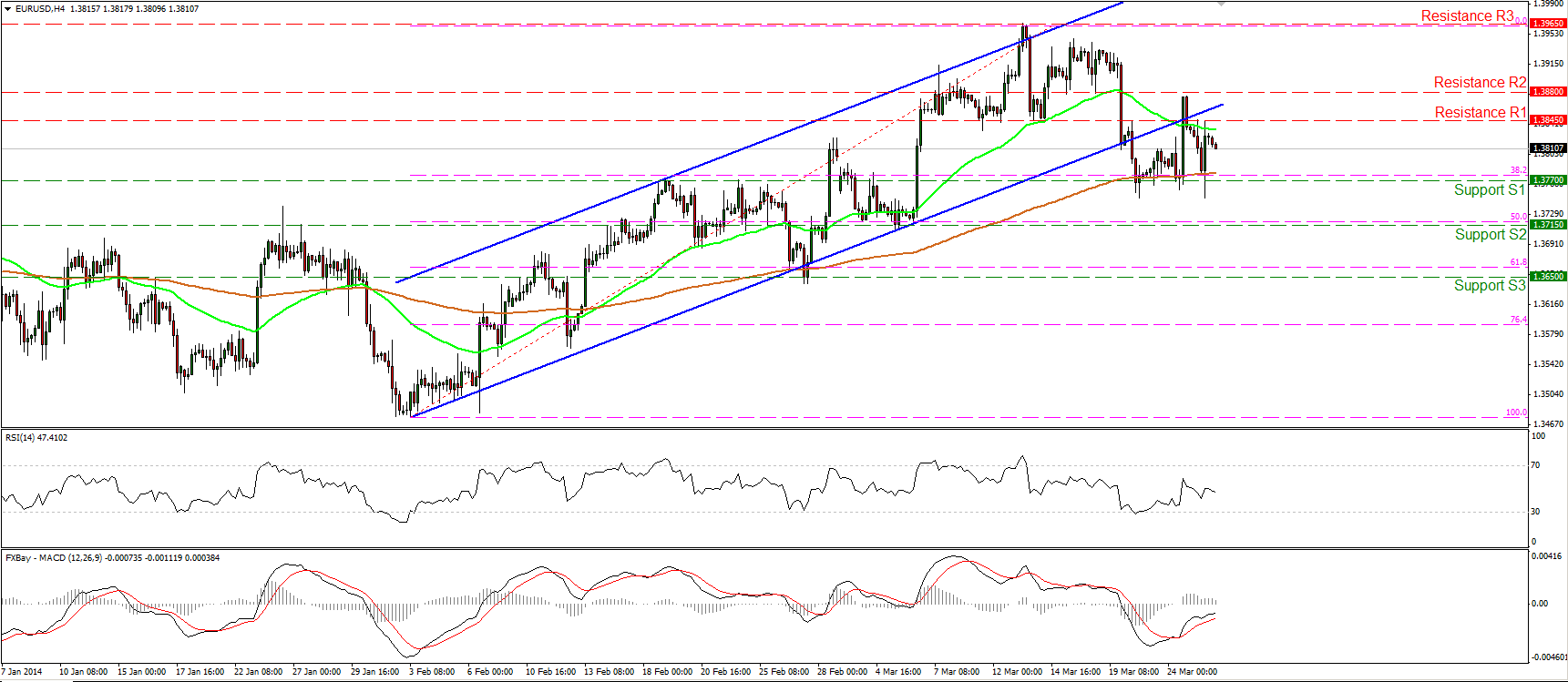

EUR/USD

EUR/USD rebounded once again from the 1.3770 (S1) support and the 200-period moving average but the advance was halted by the bar of 1.3845 (R1). I maintain my neutral view, since a clear dip below the aforementioned support zone is needed to confirm a forthcoming lower low. Such a break may challenge the next support at 1.3715 (S2), near the 50% retracement level of the 3rd Feb. – 13th Mar. short-term uptrend. On the other hand, an upward violation of the 1.3965 (R3) resistance may confirm that the recent decline was just a 38.2% retracement of the prevailing uptrend.

Support: 1.3770 (S1), 1.3715 (S2), 1.3650 (S3).

Resistance: 1.3845 (R1), 1.3880 (R2), 1.3965 (R3).

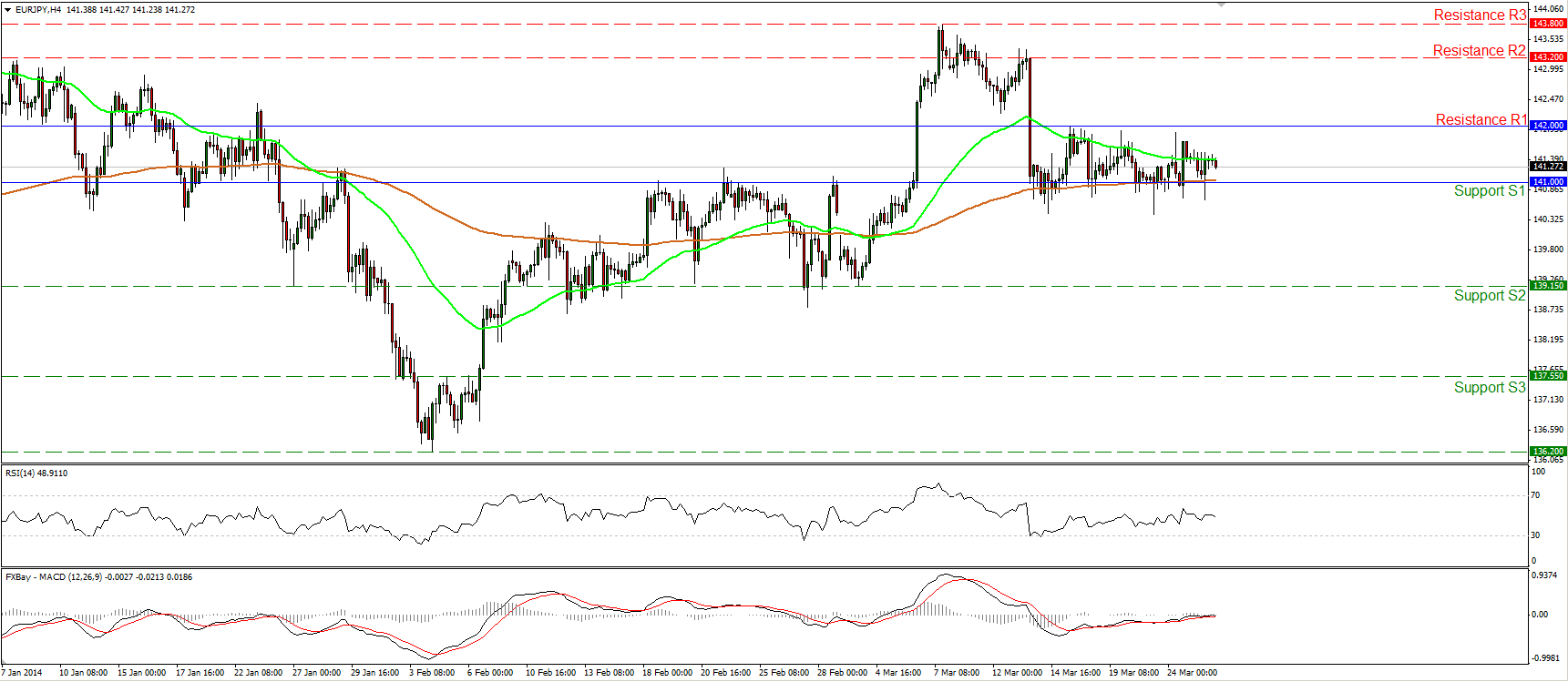

EUR/JPY

EUR/JPY continued its sideways path between the support level of 141.00 (S1) and the resistance at 142.00 (R1). The pair remains well supported by the 200-period moving average and an upward violation of the 142.00 resistance may trigger extensions towards the next hurdle at 143.20 (R2). On the downside, a dip below the 200-moving average and the support of 141.00 (S1) may pave the way towards the 139.15 (S2) bar. Both the RSI and the MACD indicators lie near their neutral levels, confirming the non-trending phase of the currency pair.

Support: 141.00 (S1), 139.15 (S2), 137.55 (S3)

Resistance: 142.00 (R1), 143.20 (R2), 143.80 (R3).

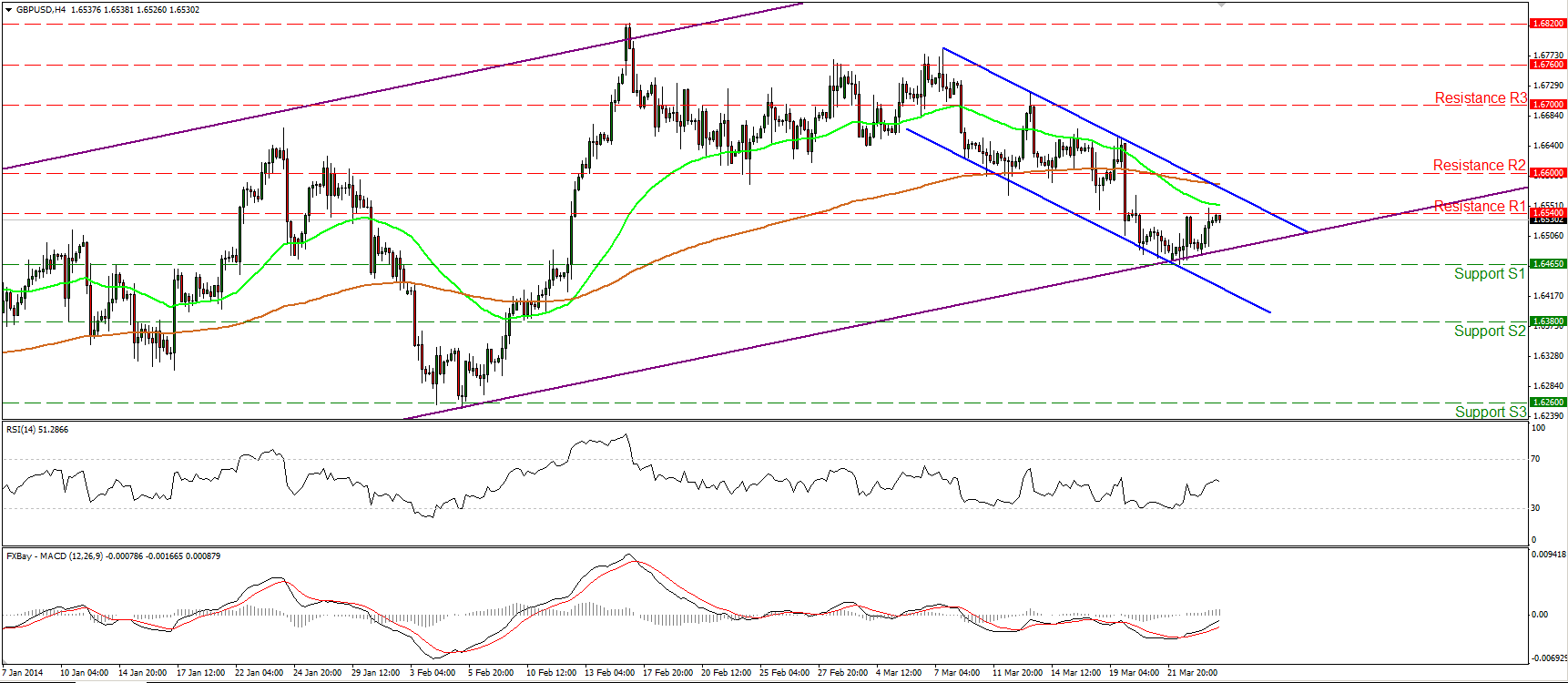

GBP/USD

GBP/USD moved higher after finding support at 1.6465 (S1), the lower boundary of the blue downward sloping channel and the lower bound of the purple long-term uptrend channel. A break above the 1.6600 (R2) resistance may confirm that the long-term upside path is still intact. Nonetheless, considering negative divergence between the daily momentum indicators and the price action, a dip below the 1.6465 (S1) support may have larger bearish implications and target the 1.6260 (S3) barrier.

Support: 1.6465 (S1), 1.6380 (S2), 1.6260 (S3).

Resistance: 1.6540 (R1), 1.6600 (R2), 1.6700 (R3).

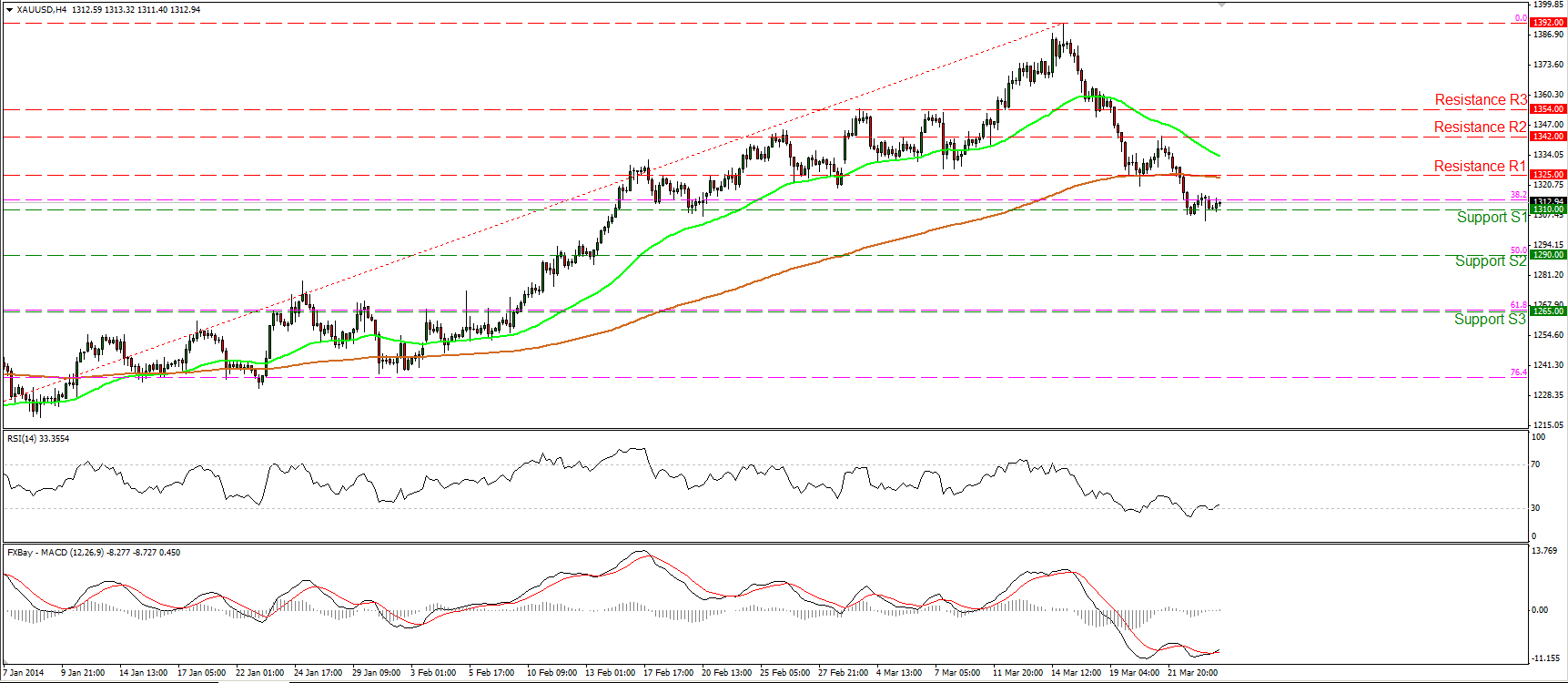

GOLD

Gold moved in a consolidative mode, remaining near the support of 1310 (S1). A decisive dip below that support may pave the way towards the 1290 (S2) bar, which coincides with the 50% retracement level of the 20th Dec. - 14th Mar. advance. The RSI exited its oversold zone, while the MACD crossed above its trigger lined, thus I would expect an upward corrective wave before the bears prevail again.

Support: 1310 (S1), 1290 (S2), 1265 (S3).

Resistance: 1325 (R1), 1342 (R2), 1354 (R3)

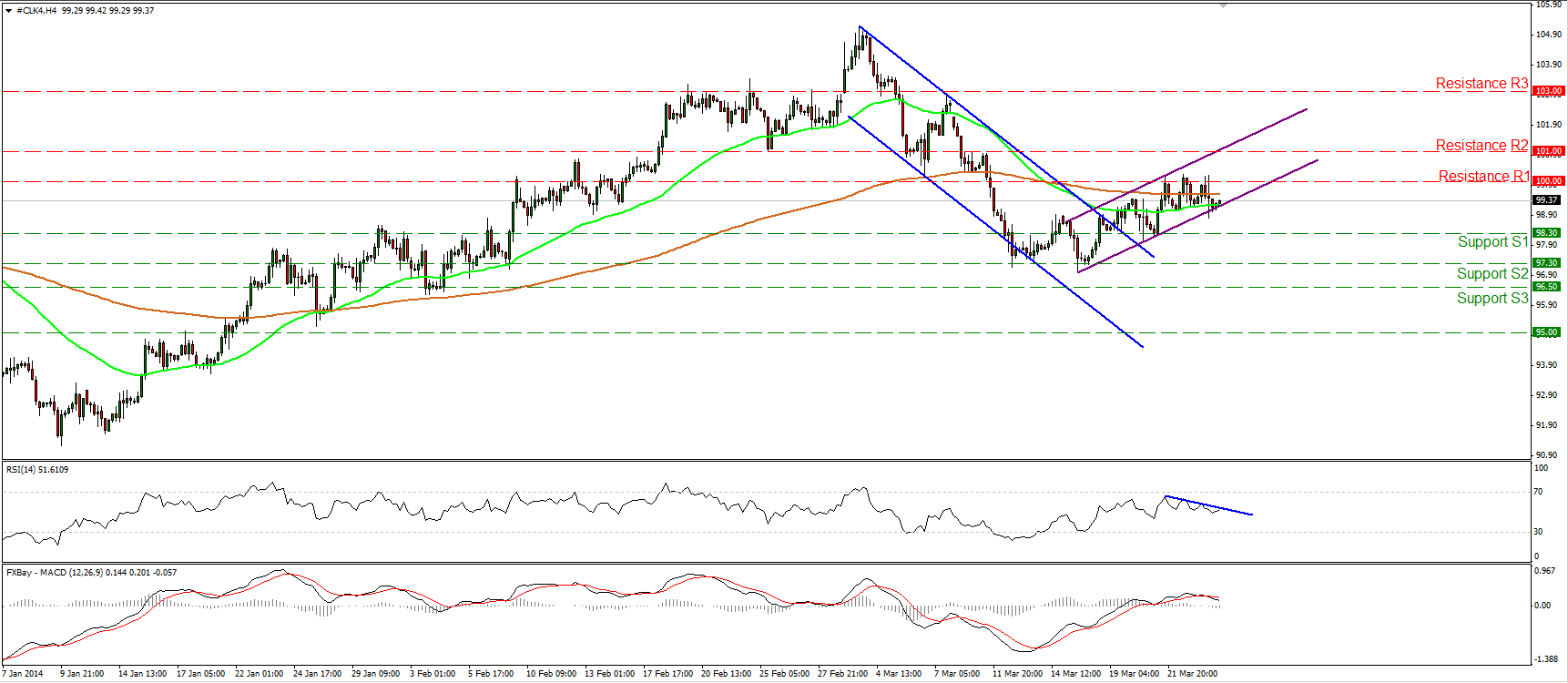

OIL

WTI tried for a third time to overcome the 100.00 (R1) resistance, but failed once again. However, the price remains supported by the lower boundary of the purple upward sloping channel. A successful violation of the 100.00 (R1) key level may target the next resistance at 101.00 (R2). Only a break below the 98.30 (S1) support would indicate the recent advance has ended. The RSI lies below its blue resistance line, while the MACD crossed below its signal line, confirming the weakness of the bulls to drive the battle higher, at least for now.

Support: 98.30 (S1), 97.30 (S2), 96.50 (S3)

Resistance: 100.00 (R1), 101.00 (R2), 103.00 (R3).

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.