Analysis for September 19th, 2014

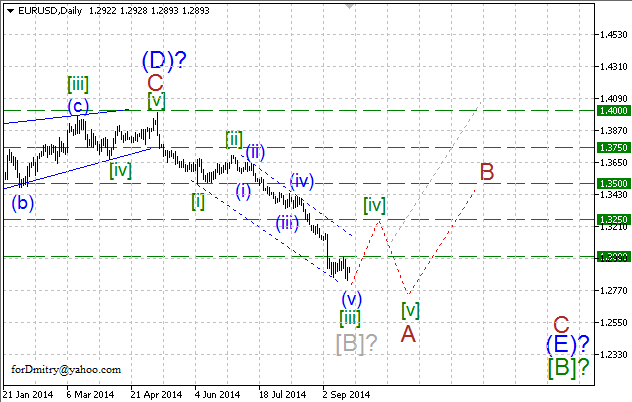

EUR USD, “Euro vs US Dollar”

One of the possible scenarios implies that Euro is forming the final descending wave (E) of [B], which may take the form of a large zigzag. The pair is forming a descending impulse A of (E); right now, it is expected to start an ascending correction [iv] of A of (E) of [B].

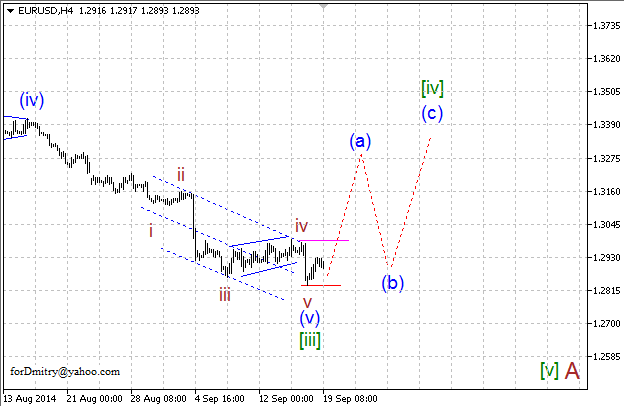

Possibly, the price finished a descending impulse [iii] of A and right now is starting an ascending correction [iv] of A.

Probably, the pair completed a descending impulse (v) of [iii] of A and started an ascending correction [iv] of A.

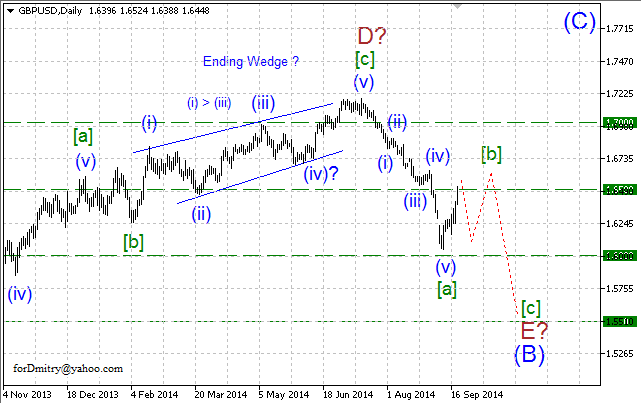

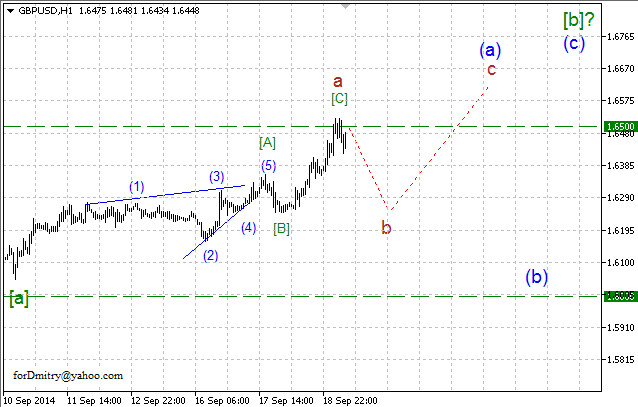

GBP USD, “Great Britain Pound vs US Dollar”

Probably, Pound is forming the final descending wave E of (B) of a large skewed triangle (B), which may take the form of zigzag.

Probably, the price is forming an ascending correction [b] of E of a descending zigzag E of (B), the form of which isn’t quite clear yet.

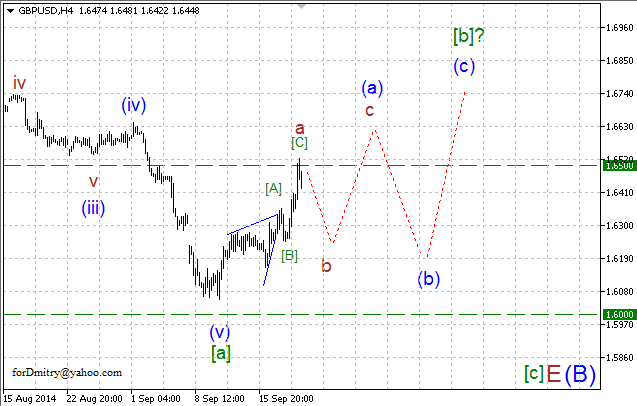

Possibly, the pair is forming an ascending correction [b], which may take the form of several different patterns.

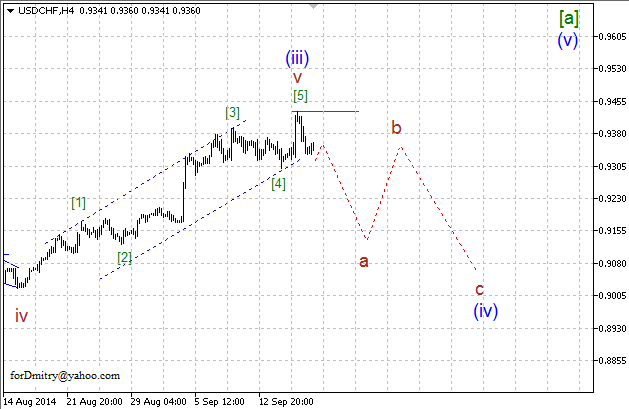

USD CHF, “US Dollar vs Swiss Franc”

One of the possible scenarios implies that Franc is forming the final ascending wave E, which may take the form of a large zigzag. The price is forming an ascending impulse [a] of E; right now, it is expected to start a descending correction (iv) of [a] of E.

Possibly, the pair finished an ascending impulse (iii) of [a] and right now is starting a descending correction (iv) of [a], the form of which isn’t quite clear yet.

Probably, the price completed an ascending impulse v of (iii) of [a] and started a descending correction (iv) of [a].

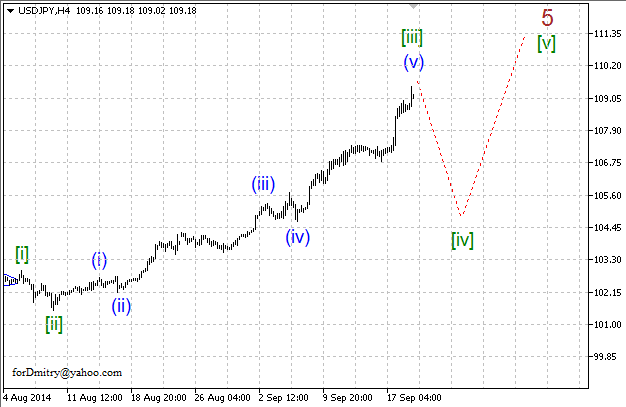

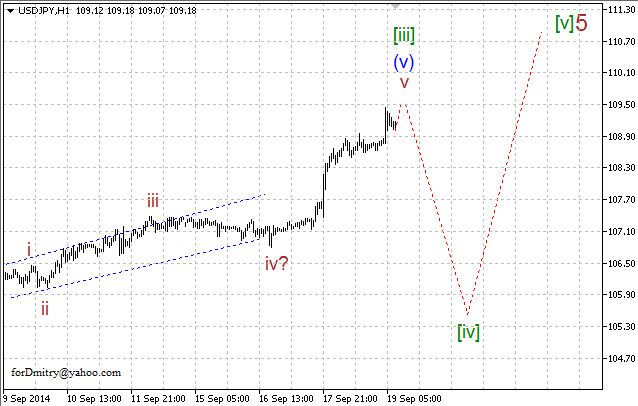

USD JPY, “US Dollar vs Japanese Yen”

Probably, Yen is about to complete a large ascending impulse (A). Right now, the price is forming its final ascending impulse 5 of (A).

Possibly, the pair is completing an ascending impulse [iii] of 5, which may be followed by a descending correction [iv] of 5.

Probably, the price is finishing an ascending impulse (v) of [iii] of 5, which may be followed by a descending correction [iv] of 5.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.