Analysis for July 17th, 2014

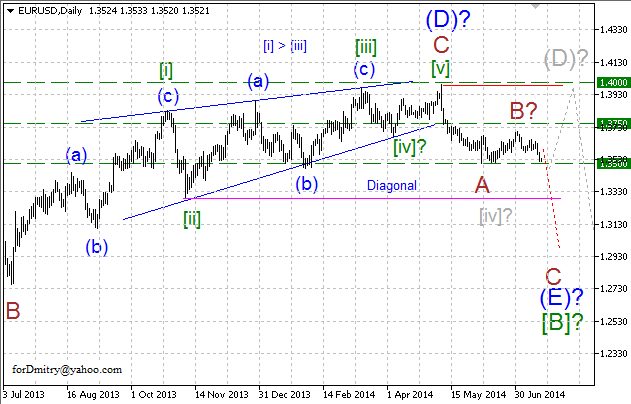

EUR USD, “Euro vs US Dollar”

Probably, Euro finished ascending zigzag (D) of [B]. In this case, price is expected to continue forming final descending zigzag (E) of [B]. However, alternative scenario (colored in grey) may still continue.

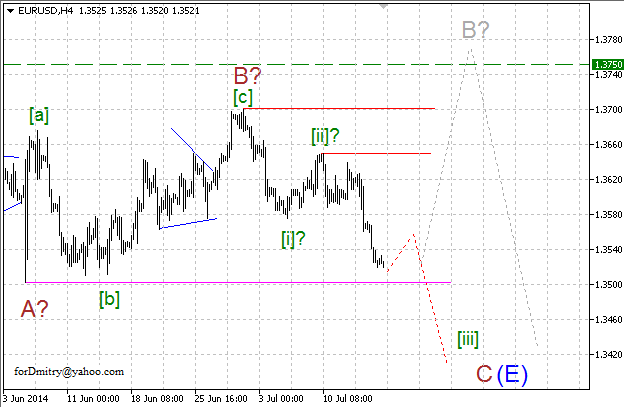

Possibly, price is forming final descending zigzag (E). It looks like Euro finished ascending correction B of (E) and started falling down inside final descending wave C of (E).

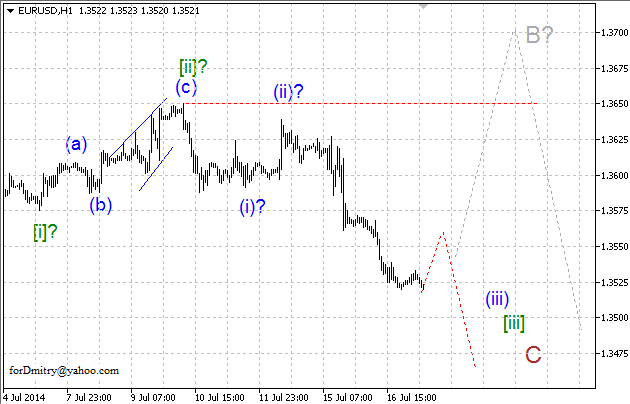

Probably, pair is forming descending wave C, which may take the form of impulse. In this case, price is expected to continue falling down inside impulse [iii] of C.

GBP USD, “Great Britain Pound vs US Dollar”

Probably, Pound completed final wedge [c] of D of ascending zigzag D of (B) of large skewed triangle (B), which may be followed by final descending zigzag E of (B).

Probably, price finished ascending impulse (v) of [c] of D of (B) of large skewed triangle (B), which may be followed by final descending zigzag [a]-[b]-[c] of E of (B).

Possibly, price completed ascending impulse (v) of [c] of D with long horizontal correction iv of (v) and ascending wave v of (v), which is equal to above-mentioned correction in height. If this assumption is correct, pair is expected to start falling down inside descending zigzag E.

USD CHF, “US Dollar vs Swiss Franc”

Probably, Franc completed descending zigzag D of (4). In this case, price is expected to continue forming final ascending zigzag E of (4). However, alternative scenario (colored in grey) may still continue.

Possibly, price is forming final ascending zigzag E. Right now, Franc is forming its final ascending wave [c] of E.

Probably, pair is forming final ascending wave [c] of E, which may take the form of impulse. In this case, price is expected to continue growing up inside impulse (iii) of [c].

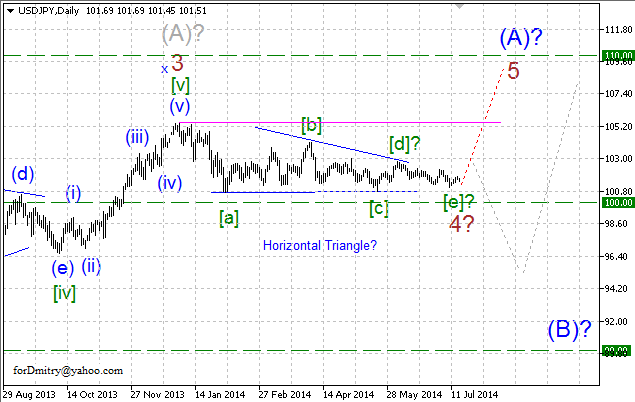

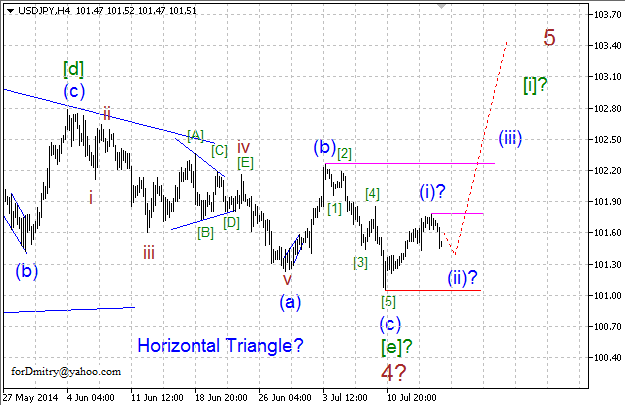

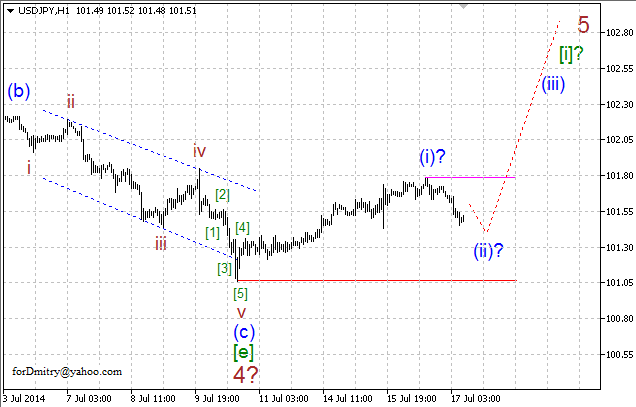

USD JPY, “US Dollar vs Japanese Yen”

Probably, Yen finished long horizontal correction 4 of (A). In this case, later price is expected to start final ascending movement inside wave 5 of (A).

Possibly, pair finished descending zigzag [e] of 4 and the whole horizontal triangle 4. In this case, price is expected to start ascending wave 5.

Probably, price completed descending impulse (c) of [e] of 4 and the whole correction 4. In this case, later pair is expected to form ascending wave 5, which may take the form of impulse.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.