GROWTHACES.COM Forex Trading Strategies

Taken Positions:

EUR/USD: (Full Access - VIP Subscription Only)

USD/JPY: (Full Access - VIP Subscription Only)

USD/CHF: (Full Access - VIP Subscription Only)

USD/CAD: (Full Access - VIP Subscription Only)

AUD/USD: long at 0.7030, target 0.7190, profit locked in at 0.7120, risk factor **

NZD/USD: (Full Access - VIP Subscription Only)

EUR/GBP: (Full Access - VIP Subscription Only)

Pending Orders:

EUR/JPY: (Full Access - VIP Subscription Only)

EUR/CAD: (Full Access - VIP Subscription Only)

CHF/JPY: sell at 123.00, target 120.50, stop-loss 124.00, risk factor **

AUD/NZD: (Full Access - VIP Subscription Only)

EUR/USD: Eyes On Yellen And Fischer

(Full Access - VIP Subscription Only)

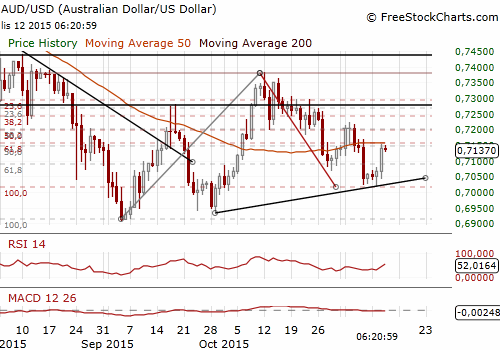

AUD/USD: Profit Locked In At 0.7120 After Strong Jobs Report

(long for 0.7190)

Australian employment surged 58.6k in October, much above the market forecast of 15k. This increase was made up of a rise of 40k in full-time employment, while part-time employment rose 18.6k. Unemployment rate dropped to 5.9% from 6.2% in September. The market expected a reading of 6.2%.

Interbank futures slid after strong jobs report as the market greatly lengthened the odds on another cut in interest rates. However, investors still expect a cut next year. In our opinion the monetary easing cycle has ended and the next rate change will be a hike.

The AUD/USD jumped to 0.7153 after the employment data. We stay long for 0.7190, but have locked in our profit at 0.7120.

Significant technical analysis' levels:

Resistance: 0.7153 (session high Nov 12), 0.7169 (high Nov 6), 0.7222 (high Nov 4)

Support: 0.7061 (low Nov 12), 0.7026 (low Nov 11), 0.7017 (low Nov 10)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD remains firmer ahead of RBA interest rate decision

The Australian Dollar continued its winning streak for the fifth consecutive session on Tuesday, driven by a hawkish sentiment surrounding the Reserve Bank of Australia. This positive outlook reinforces the strength of the Aussie Dollar, offering support to the AUD/USD pair.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.