EUR/USD: Time To Switch To Sell EUR/USD?

Payrolls processor ADP said US private employers added 200k jobs in September, the strongest reading since June. It beat a forecast 194k increase. Private payroll gains in August were revised down to 186k from an originally reported 190k. The reading suggests strong US jobs report on Friday – the most important event for financial markets this week. We expect +225k vs. the market forecast of +203k.

Chicago PMI fell in September to 48.7, its weakest since May, from August's 54.4. The reading was significantly below the market consensus of 53.0.

New York Fed President William Dudley said the Federal Reserve will strive to have as little effect as possible on the functioning of financial markets when it eventually begins to shrink its USD 4.5-trillion balance sheet. The Fed has said it will stop topping up its balance sheet, and may even sell assets, some time after it raises interest rates.

Markets were waiting for Fed Chair Janet Yellen’s speech yesterday. However, she did not comment on the US economy or monetary policy in brief welcoming remarks to a community banking symposium.

Final Eurozone manufacturing PMI eased to a five-month low of 52.0 in September, below August’s 52.3 and unchanged from the earlier flash estimate.

Export orders rose at a slower rate in September, in part reflecting weaker demand from emerging markets, with the darkening global economic picture dampening business optimism and causing companies to pull-back on their hiring plans. The manufacturing sector is likely to provide only a minor boost to the overall economy in the third quarter, restraining GDP growth to around 0.4%.We took a small profit on our EUR/USD long at 1.1190 and now we switch our strategy to ‘sell EUR/USD’. We expect a good US jobs report tomorrow that may be followed by hawkish comments from Fed Vice Chairman Stanley Fischer. What is more, recent Fed policymakers’ opinion suggest that a hike in October cannot be ruled out.

The market still does not believe in a Fed hike this year. In our opinion these very dovish expectations may change as soon as tomorrow.

Subscribe to Growth Aces newsletter to receive forex strategies with rationale updated twice a day.

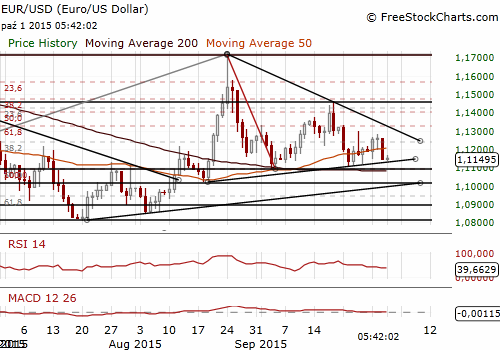

Significant technical analysis' levels:

Resistance: 1.1173 (200-dma), 1.1204 (10-dma), 1.1261 (high Sep 30)

Support: 1.1116 (low Sep 25), 1.1105 (low Sep 23), 1.1090 (low Sep 4)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.