GROWTHACES.COM Forex Trading Strategies:

Trading Positions:

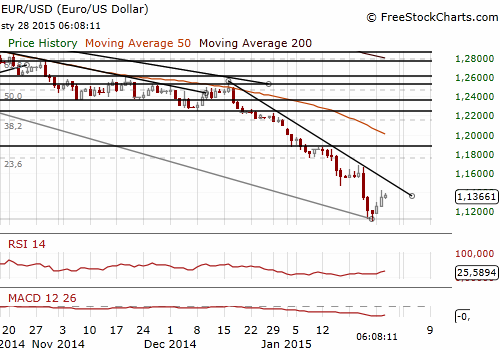

EUR/USD trading strategy: long at 1.1220, target 1.1550, stop-loss 1.1280

GBP/USD trading strategy: long at 1.5080, target 1.5250, stop-loss 1.5100

USD/CHF trading strategy: long at 0.8980, target 0.9180, stop-loss 0.8930

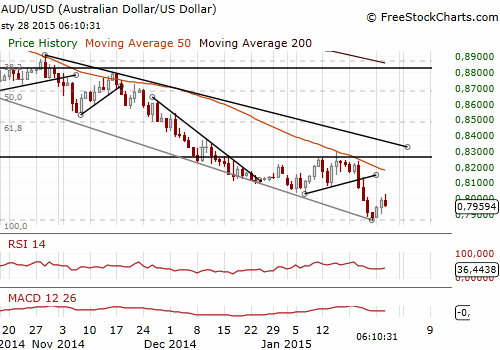

AUD/USD trading strategy: long at 0.7905, target 0.8250, stop-loss 0.7840

NZD/USD trading strategy: long at 0.7430, target 0.7750, stop-loss 0.7370

EUR/GBP trading strategy: long at 0.7470, target 0.7650, stop-loss 0.7390

EUR/JPY trading strategy: long at 133.90, target 136.10, stop-loss 132.90

EUR/CHF trading strategy: long at 1.0160, target 1.0650, stop-loss 1.0075

GBP/JPY trading strategy: long at 179.00, target 182.00, stop-loss 177.55

AUD/NZD trading strategy: short at 1.0680, target 1.0350, stop-loss 1.0770

Pending Orders:

USD/JPY trading strategy: sell at 119.20, if filled target 116.60, stop-loss 120.00

USD/CAD trading strategy: buy at 1.2350, if filled target 1.2720, stop-loss 1.2250

AUD/JPY trading strategy: buy at 93.10, if filled target 96.20, stop-loss 92.20

EUR/USD: FOMC Becomes More Dovish This Year

(long for 1.1550)

Federal Reserve ends its policy meeting today and is widely expected to repeat the pledge it made in December that it will be patient in raising rates. The decision will be announced at 19:00 GMT. Although the real economy figures improved significantly, inflation is far below the Fed’s target because of plunge in oil prices and strength of the USD.

There will be no Yellen news conference after this meeting and no updates to the Fed's economic forecasts. That is why nothing extraordinary should be expected today.

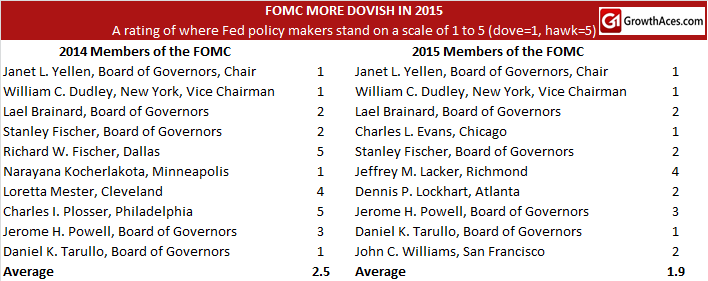

We should remember that there will be a new set of voters at FOMC meetings this year, probably more “dovish”. Two strong “hawks” Charles Plosser, head of the Fed's regional bank in Philadelphia, and Richard Fisher, head of Fed’s bank in Dallas, no longer have votes this year under the rotation system for Fed bank presidents. Take a look at our Fed dove-hawk scale and see that the Fed becomes more dovish this year.

In line with our medium-term EUR/USD scenario, investors are starting to push back their predicted timetable for the first rate hike to December or even 2016. On the other hand, the ECB did what it had to do and no additional action by the ECB should be expected in the near future.

We expect a continuation of the EUR/USD rise and keep our short-term target at 1.1550.

Significant technical analysis' levels:

Resistance: 1.1423 (high Jan 27), 1.1453 (10-dma), 1.1646 (high Jan 22)

Support: 1.1224 (low Jan 27), 1.1098 (low Jan 26), 1.1047 (low Sep 8, 2003)

AUD/USD Rose After CPI Data, Eyes On The RBNZ Now

Australian inflation braked to 1.7% yoy in the fourth quarter from 2.3% in the third quarter, below the median forecast of 1.8%. The Australian Bureau of Statistics reported outright price falls for petrol, consumer electronics, mobile phones, drugs and fruit and vegetables in the quarter. The largest increases came in tobacco, holiday travel and the cost of buying a home.

However, key measures of underlying inflation amounted to 0.7% in the fourth quarter, above market forecasts of 0.5% yoy. This reading was taken as diminishing the chances of an imminent cut in rates from the Reserve Bank of Australia. The expectations for monetary policy easing have strengthened especially after surprising rate cut in Canada last week. Moreover, the Monetary Authority of Singapore unexpectedly reduced the slope of its monetary policy band today, adding to pressure on other central banks in the region.

The RBA meeting is scheduled for next week and we do not expect any changes in interest rates.

Our buy order on the AUD/USD was filled at 0.7905, just ahead of the release of CPI reading and the AUD/USD rose strongly after Wednesday’s data. The move was pretty in line with our forecasts. Our AUD/USD trading strategy is to stay long for 0.8250.

The AUD rose also against the NZD after the CPI data. In our opinion the rise was short-lived and the AUD/NZD rate is likely to go down again today after the Reserve Bank of New Zealand meeting (today 20:00 GMT), as we do not expect monetary easing in New Zealand.

If the RBNZ keeps interest rates unchanged, it will be supportive not only for the NZD/USD but also for the AUD/USD.

Significant technical analysis' levels:

Resistance: 0.8026 (hourly high Jan 28), 0.8056 (high Jan 23), 0.8070 (10-dma)

Support: 0.7900 (hourly low Jan 28), 0.7850 (low Jan 26), 0.7814 (low Jul 14, 2009)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.