GROWTHACES.COM Trading Positions

USD/JPY: long at 116.50, target 120.90, stop-loss 119.10

USD/CAD: long at 1.1570, target 1.1740, stop-loss 1.1540

EUR/CHF: long at 1.2025, target 1.2090, stop-loss 1.1995

GBP/JPY: long at 186.70, target 189.10, stop-loss 185.80

GROWTHACES.COM Pending Orders

EUR/USD: sell at 1.2360, target 1.2180, stop-loss 1.2410

USD/CHF: buy at 0.9735, target 0.9890, stop-loss 0.9690

EUR/GBP: sell at 0.7880, target 0.7770, stop-loss 0.7910

EUR/JPY: buy at 146.30, target 148.00, stop-loss 145.70

EUR/USD: Sell Again On Upticks

(profit taken, looking to get short again)

Philadelphia Federal Reserve Bank President Charles Plosser dissented against the Fed's decision Wednesday to say it will be “patient” on raising interest rates and said in a statement the Federal Reserve should have left itself more flexibility to raise interest rates sooner should the U.S. economy continue to improve. He added: “The failure to adjust forward guidance to reflect the improvement in the outlook for the economy and its continued reliance on the passage of time as a governing factor in the decision to increase rates were the underlying factors warranting my dissent. I believe that waiting too long to initiate a gradual increase in rates could result in the need for more aggressive policy in the future, which could lead to unnecessary volatility and instability.”

Minneapolis Fed President Narayana Kocherlakota also dissented against the Fed's decision Wednesday. He feels that by signaling an intent to normalize monetary policy in mid-2015 the Fed is creating "unacceptable" downside risks to the inflation outlook. In his opinion the statement should have included a pledge to maintain administered rates at the zero bound until inflation and inflation expectations surpass the Fed's 2% target.

Richmond Fed President Jeffrey Lacker said he supported the central bank's addition of the word "patient" to describe its interest rate guidance in its policy statement this week. Lacker said he wants to see more data before he would support the hike.

San Francisco Federal Reserve Bank President John Williams mentioned that the shift to the statement's use of the word "patient" from "considerable time" forms a bridge to the eventual date that rate normalization begins. In his opinion U.S. inflation will likely stay "well below" the Fed's 2% target next year, but that won't stop the central bank from pressing ahead with plans to raise interest rates.

Hawkish comments from the Fed’s officials (except from Kocherlakota) strengthened the USD. The EUR/USD broke below 28-month low on Friday, in line with our expectations. The rate fell to 1.2220 (new 2104 low). Today the USD gave back some of Friday’s gains and the rate did not reach the target of our short position at 1.2180. The EUR/USD rose to the lowered stop-loss level of our short position, but we took quite significant profit on the position opened at 1.2440 and closed at 1.2260.

The EUR/USD will likely remain under pressure of divergences between monetary policies of the Fed and the ECB. The market is becoming more convinced that the ECB will announce sovereign bond buying or quantitative easing at their January 22 meeting and is pricing in the start of the Fed tightening cycle for June.

We are looking to get short again near 1.2360. If our sell order is filled, the target will be at 1.2180.

Significant technical analysis' levels:

Resistance: 1.2302 (high Dec 19), 1.2352 (high Dec 18), 1.2393 (21-dma)

Support: 1.2220 (low Dec 22), 1.2167 (low Aug 3, 2012), 1.2133 (low Aug 2, 2012)

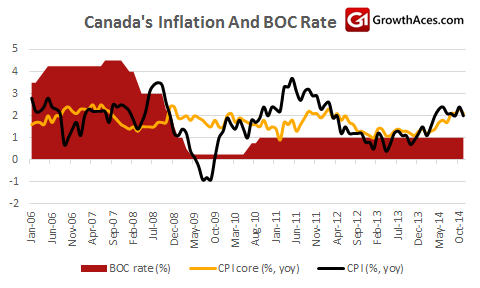

USD/CAD: Canada’s CPI Cooled Expectations For A Rate Hike

(stay long)

Canada’s inflation rate pulled back in November to 2.0% yoy from October's strong 2.4% yoy, falling short of the median forecast of 2.2% yoy. A 5.9% drop in gasoline prices was the main driver of the slower yearly rise in overall inflation.

Core inflation, which strips out volatile items and is closely watched by the Bank of Canada, pulled back to 2.1% yoy, which was also short of expectations for a rise to 2.4% yoy.

Canadian retail sales were unchanged in October from September after a rise by 0.8% mom in the previous month. A fall by 0.2% mom was expected. Sales at motor vehicle and parts dealers fell 0.6% mom, while gasoline stations declined 1.1% mom. Retail sales excluding autos and parts were up by 0.2% mom.

Inflation cooled expectations for a rate hike. The USD/CAD jumped to 1.1632 after CPI reading but returned near 1.1600 soon. We keep our long position opened at 1.1570. Our target is 1.1740, above highs from July 2009.

Significant technical analysis' levels:

Resistance: 1.1674 (high Dec 15), 1.1680 (high Jul 9, 2009), 1.1725 (high Jul 8, 2009)

Support: 1.1536 (38.2% of 1.1314-1.1674), 1.1516 (low Dec 12), 1.1448 (low Dec 11)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.