GROWTHACES.COM Trading Positions

USD/JPY: long at 107.60, target 109.00, stop-loss 107.10

AUD/USD: short at 0.8820, target 0.8660, stop-loss 0.8870

EUR/JPY: long at 135.20, target 137.70, stop-loss 136.10EUR/CHF: long at 1.2085, target 1.2160, stop-loss 1.2045

GBP/JPY: long at 172.00, target 175.00, stop-loss 172.30

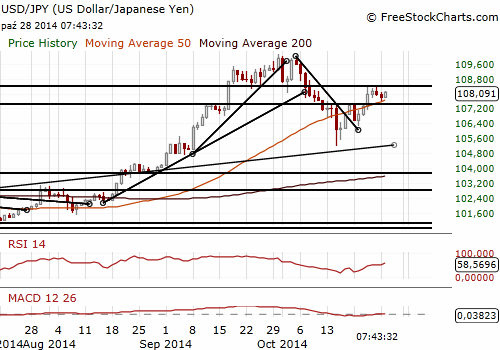

USD/JPY: Yen weaker despite strong Japan's retail sales reading

(long at 107.60, the target is 109.00)

Bank of Japan Governor Haruhiko Kuroda said there was no pre-set deadline for ending its massive monetary stimulus, signalling that the bank's two-year timeframe for meeting its inflation target is not a rigid one. He stuck to the central bank's view that the 2% goal would be met around the next fiscal year starting in April 2015, and added that policymakers would begin debating an exit strategy from the stimulus programme during that year.

Kuroda reiterated that he would "not hesitate to adjust policy" should the 2% target come under threat.

Japanese retail sales growth accelerated for the third straight month in September. Retail sales increased by 2.3% yoy, much better than the median forecast of 0.6% yoy and a rise by 1.2% yoy in August. Retail sales accelerated due to gains in apparel, food and beverage sales.

A rise in retail sale is in an encouraging sign that consumer spending could be strong enough to absorb a second sales tax increase scheduled for next year. Japanese Finance Minister Taro Aso said that he will consider compiling an economic package to support the economy after examining GDP and other economic indicators for the July-September quarter.

The JPY is still under pressure despite good retail sales reading. The BoJ’s governor Kuroda said little new in his statement and was ignored by the USD/JPY traders. Investors are focused on the FOMC meeting now – a hawkish statement from the Fed after ending the quantitative easing is likely to push the USD/JPY higher. The nearest key resistance is at 108.38 (Monday’s high). Investors are eyeing also Japanese industrial output data (scheduled for 23:50 GMT today).

We have gone long on the USD/JPY at 107.60 and set the target at 109.00. GrowthAces.com keeps also its long EUR/JPY and GBP/JPY positions.

Significant technical analysis' levels:

Resistance: 108.38 (high Oct 27), 108.74 (high Oct 8), 109.08 (76.4% of 110.09-105.20)

Support: 107.61 (low Oct 27), 107.39 (high Oct 20), 107.11 (low Oct 23)

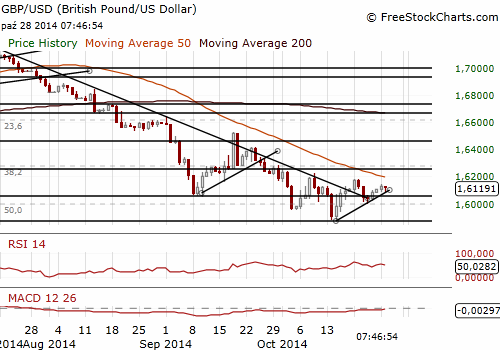

GBP/USD: Looking to get long at 1.6060

(we stay sideways, but outlook is bullish)

The GBP/USD rallied on Monday after Confederation of British Industry showed retail sales data beat expectations. The CBI said that its October retail sales balance held steady at +31, in contrast to forecasts of a fall to +25. British retailers reported the fastest sales growth in more than three years in the three months to October. The GBP/USD rose to 1.6147 yesterday but then reversed to trade in a 1.6125/1.6140 range for most of the US session.

A fall in the GBP/USD was the result of dovish comments from the Bank of England. Deputy governor of the Bank of England Minouche Shafik is the opinion that the central bank will need to see more signs of price pressures building in Britain's economy before it raises interest rates from record low levels.

Shafik's remarks came a day after her Monetary Policy Committee colleague Ian McCafferty said the central bank should start raising interest rates now because spare capacity in the economy was being used up so quickly.

We stay flat on the GBP/USD ahead of FOMC meeting. In our opinion the rate is likely to fall a bit in the short term. The medium-term outlook is slightly bullish, however. Our strategy for the GBP/USD is to buy near 1.6060.

Significant technical analysis' levels:

Resistance: 1.6147 (high Oct 27), 1.6159 (30-dma), 1.6186 (high Oct 21)

Support: 1.6088 (10-dma), 1.6083 (low Oct 27), 1.6018 (low Oct 24)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.