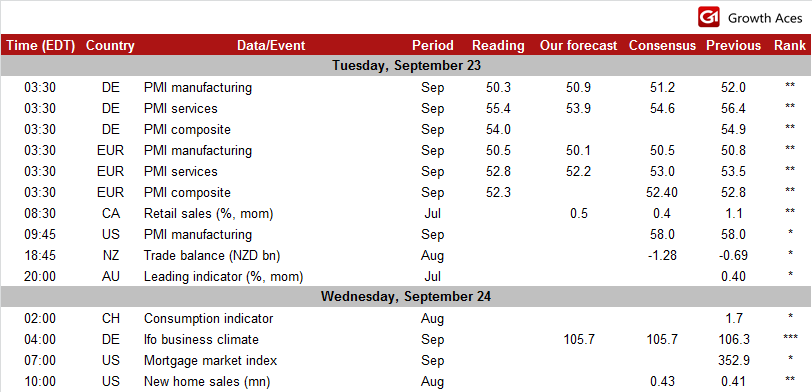

ECONOMIC CALENDAR

EUR/USD: We do not interpret Draghi’s comments as dovish. PMI slightly below forecasts.

(bullish outlook in the medium term)

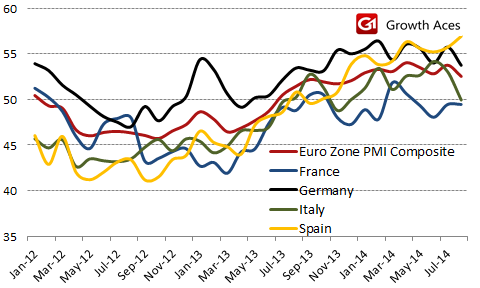

Euro area business activity grew in September at the lowest rate seen so far this year, according to the preliminary ‘flash’ PMI survey data. PMI composite index amounted to 52.3, slightly below market consensus of 52.5 and July reading of 52.5. Employment was largely unchanged once again as companies held back from hiring extra staff due to the weak sales growth. Inflationary pressures remained subdued in the face of weak demand. Companies’ selling prices fell again, albeit only marginally, while input costs rose at the weakest rate since May.

PMI services amounted in August to a three-month low of 52.8 vs. 53.1 a month earlier. PMI manufacturing amounted to 50.5 vs. 50.7 in August.

By country, growth picked up slightly in Germany from the ten-month low seen in August, led by the service sector (which was the only bright spot in the survey and that is why the EUR/USD got some relief after the release). On the other hand, French index fell again, suggesting that the country might be heading back into recession. The survey data suggest GDP growth by 0.3% at best in the third quarter, led by a 0.4% expansion in Germany but dragged down by stagnation in France and sluggish growth in the rest of the region.

Market’s attention was focused on Mario Draghi’s speech yesterday. The ECB President said the central bank stands ready to use additional unconventional tools and tweak its existing efforts to spur inflation and growth in the euro zone if needed.

What is important Draghi also said he expects more demand from banks for TLTROs, when the funding is offered again in December. In the opinion of GrowthAces.com no further action from the ECB is likely sooner than after assessing the results of TLTROs in December. In our view Draghi’s comments should not be interpreted as ‘dovish’.

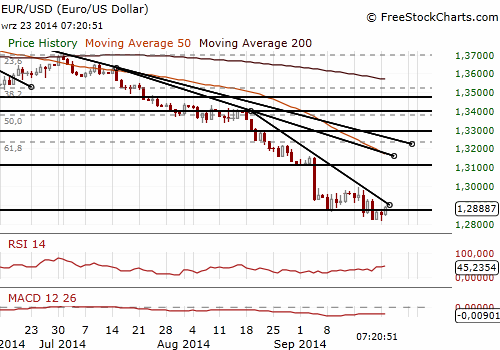

The EUR/USD fell below 1.2820 during yesterday’s US session but moved higher during Asian and European session today. We keep our bullish outlook for the EUR/USD.

Significant technical analysis' levels:

Resistance: 1.2929 (high Sep 19), 1.2931 (high Sep 18), 1.2982 (high Sep 17)

Support: 1.2843 (session low Sep 23), 1.2824 (hourly low Sep 22), 1.2816 (low Sep 22)

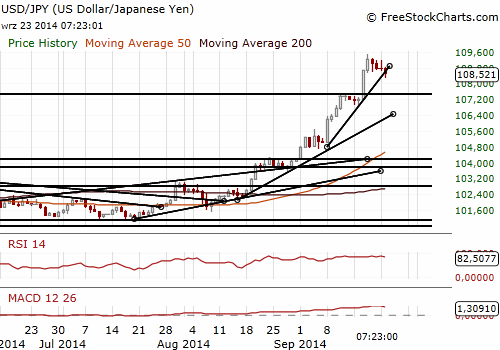

USD/JPY: Long at 108.45

(we have gone long at 108.45, in line with our scenario, the target is at 110.50)

Today is a public holiday in Japan, however the session is quite interesting. The USD/JPY opened the Asian session at 108.84 but then eased below 108.40 due to profit taking selling.

We used the correction to go long on the USD/JPY at 108.45. GrowthAces.com’s target is 110.50, however the psychological resistance at 110.00 could be a big hurdle. Our stop-loss is at 107.70. Technical situation is supportive for our long position. Both the tankan and kijun lines are positively aligned which is a sign that overall upside potential remains intact.

Significant technical analysis' levels:

Resistance: 108.85 (session high Sep 23), 109.20 (high Sep 22), 109.46 (high Sep 18)

Support: 108.25 (session low Sep 23), 107.92 (hourly low Sep 17), 107.90 (10-dma)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.