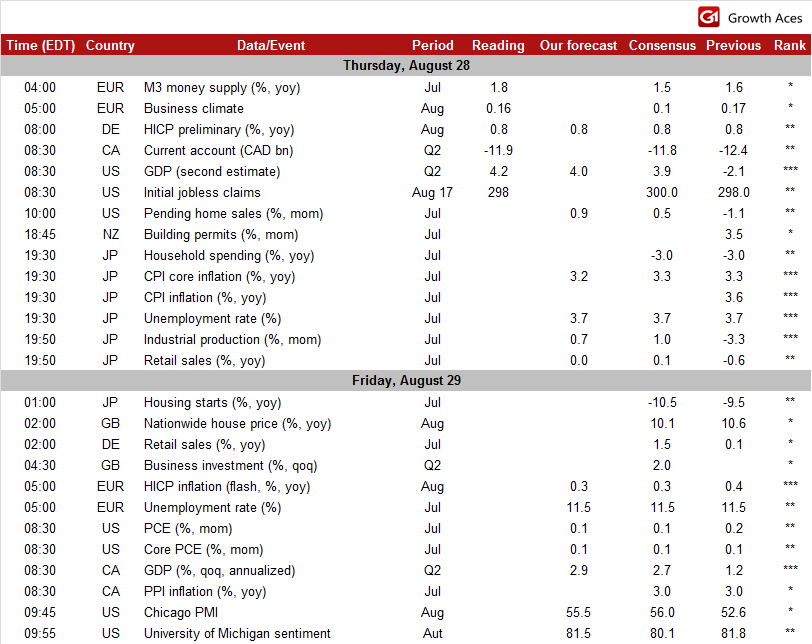

ECONOMIC CALENDAR

EUR/USD: US Q2 GDP revised up

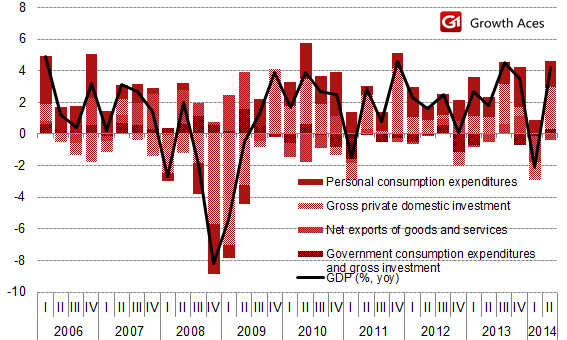

The U.S. economy rebounded more strongly than initially estimated in the second quarter. GDP expanded at a 4.2% annual rate instead of the previously reported 4.0%, reflecting upward revisions to business spending and exports. Domestic demand increased at a 3.1%, instead of the previously reported 2.8%. Growth in consumer spending was unrevised at a 2.5% rate. The relatively smaller inventory build means less stock overhang, which bodes well for third-quarter GDP growth.

Initial claims for state unemployment benefits fell for a second straight week to a seasonally adjusted 298k for the week ended August 23 vs. expectations of a rise to 300k.

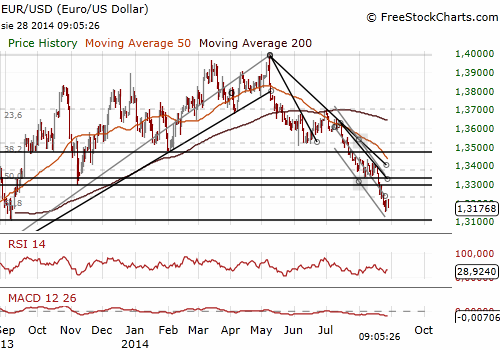

The USD appreciated against major currencies after the release. The EUR/USD was traded above 1.3200 before the reading but then fell near 1.3170. We stay flat on the EUR/USD and see a possibility of recovery in the short term. Our medium-term outlook is still bearish.

Significant technical analysis' levels:

Resistance: 1.3222 (hourly high Aug 28), 1.3297 (high Aug 22), 1.3324 (high Aug 20)

Support: 1.3105 (low Sep 6), 1.3089 (low Jul 19), 1.3051 (low Jul 16)

USD/JPY: Rising risk aversion poses a threat to our long position

Ukrainian President Poroshenko said on Thursday Russian forces had been brought into Ukraine. He called an urgent meeting of Ukraine's security and defence council to decide the next steps to take in the crisis.

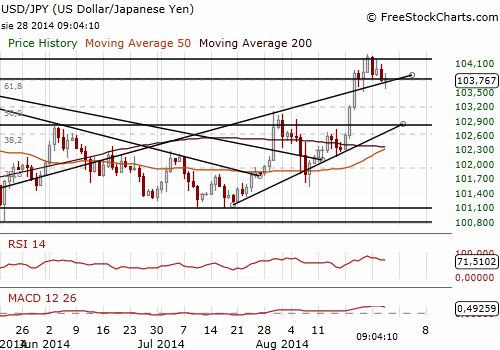

Rising risk aversion was the main reason for appreciation of safe-haven assets, including JPY. The USD/JPY fell as low as 103.56, however significant buy orders are noted in the area 103.50/60 and the rate did not manage to break below the support level. The next key support level is situated at 103.35 (38.2% of 101.51-104.49). We are ahead of important macroeconomic releases in Japan. Some weaker readings are likely to push the USD/JPY up. We maintain our long position. The main risk comes from uncertain geopolitical situation.

Significant technical analysis' levels:

Resistance: 104.16 (high Aug 27), 104.49 (high Aug 25), 104.84 (high Jan 23)

Support: 103.50 (low Aug 22), 103.35 (38.2% of 101.51-104.49), 103.15 (high Jul 30)

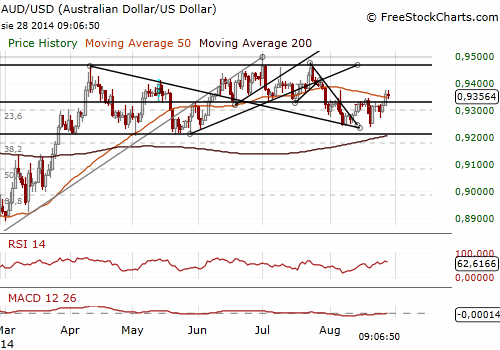

AUD/USD higher after better CAPEX data

Sales of new homes in Australia slipped by 5.7% mom in July but still remained at a historically high level. The Housing Industry Association said its survey of large builders showed sales of private sector new houses fell 4.7% mom while multi-unit sales went down by 10.9% mom after jumping in June.

Australian business investment beat expectations last quarter with an increase of 1.1% qoq (seasonally adjusted) vs. expected decline by 0.3% qoq. The Australian Bureau of Statistics' latest survey of planned spending for 2014/15 came in at AUD 145.2 bn, topping estimates of around AUD 142 bn.

The AUD/USD rose after the data to 0.9373 taking out the stops above 0.9355 and breaking above important resistance levels (50-dma at 0.9359) and then fell slightly. The strong resistance level is now in the area of 0.9375/80, breaking above which would be a clear bullish signal.

At GrowthAces.com we maintain our long position on the AUD/USD with the target of 0.9470.

Significant technical analysis' levels:

Resistance: 0.9373 (session high Aug 28), 0.9388 (high Jul 30), 0.9416 (high Jul 29)

Support: 0.9300 (low Aug 27), 0.9272 (low Aug 26), 0.9235 (low Aug 21)

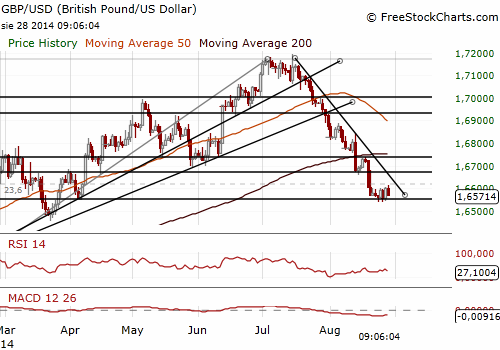

GBP/USD: Time for long position

We saw a turnaround from 1.6537 lows tested yesterday. The GBP/USD broke above the previous top and was traded near 1.6600. The picture is looking more positive for the GBP bulls now. We went long on the USD/GBP at 1.6575 with the target of 1.6690 (200-dma). Our stop-loss is at 1.6530.

Significant technical analysis' levels:

Resistance: 1.6615 (hourly high Aug 28), 1.6680 (high Aug 20), 1.6690 (200-dma)

Support: 1.6568 (hourly low Aug 28), 1.6537 (low Aug 27), 1.6501 (low Aug 25)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.