Analysis for May 24th, 2016

EURUSD, “Euro vs US Dollar”

Eurodollar is consolidating near its lows. According to the main scenario, the price may break the descending channel and start a new ascending correction 1.1400. An alternative scenario implies that the market may fall to reach 1.1110 and then form the above-mentioned correction with the target at 1.1400.

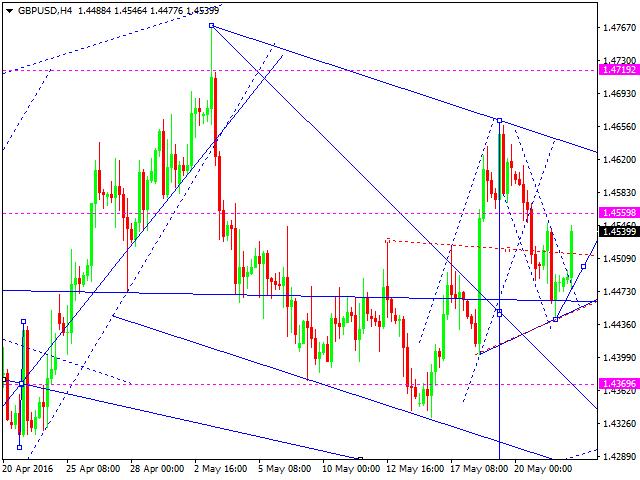

GBPUSD, “Great Britain Pound vs US Dollar”

Pound has completed its descending structure. We think, today the price may be corrected to return to 1.4560, thus defining borders of a new consolidation channel. The main scenario suggests that the market may continue falling towards 1.4200.

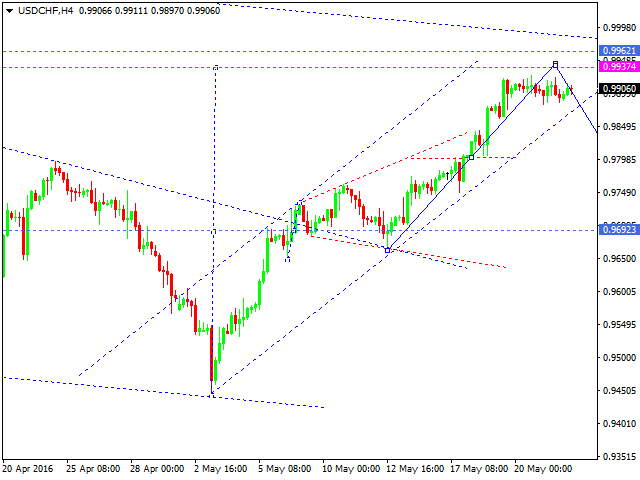

USDCHF, “US Dollar vs Swiss Franc”

Franc is still consolidating at the top of the ascending wave. We think, today the price may grow to reach 0.9944. After that, the pair may be corrected towards 0.9700.

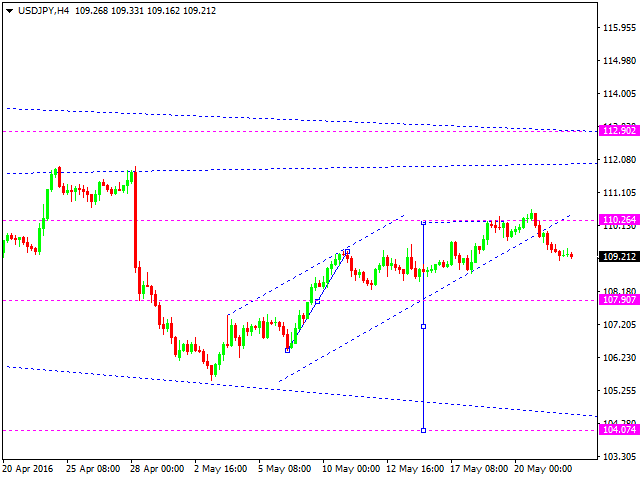

USDJPY, “US Dollar vs Japanese Yen”

Yen has reached the target of the first descending impulse. We think, today the price may return to 109.87 to test it from below. Later, in our opinion, the market may continue falling inside the downtrend to reach the local target at 104.00.

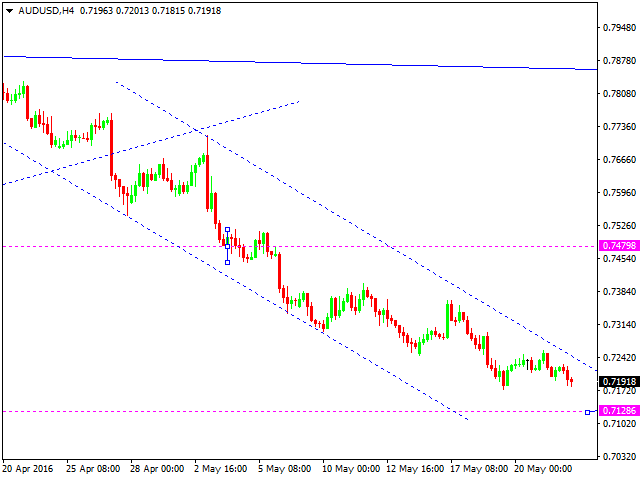

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar is falling towards the target at 0.7130. We think, today the price may reach the target and then form another consolidation channel. After that, the pair may break the channel upwards and start a new correction to return to 0.7480.

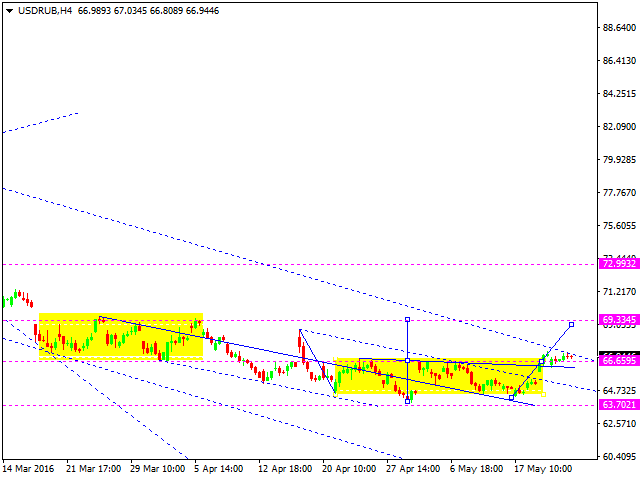

USDRUB, “US Dollar vs Russian Ruble”

Russian Ruble is moving inside its narrow consolidation range to break the descending channel. We think, today the price may continue growing towards 69.00.

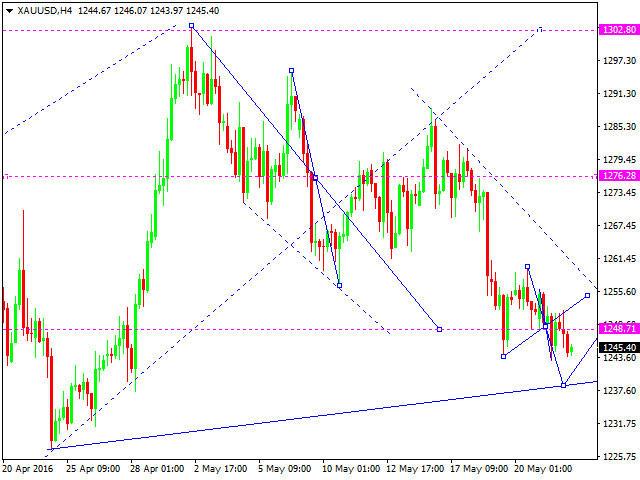

XAUUSD, “Gold vs US Dollar”

Being under pressure, Gold is falling. We think, today the price may form another consolidation range with the downside border at 1238 and then grow to break the range upwards. In this case, the correction may continue up to 1275. If the market breaks the range downwards, it may continue falling to reach 1194.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.