Analysis for March 10th, 2016

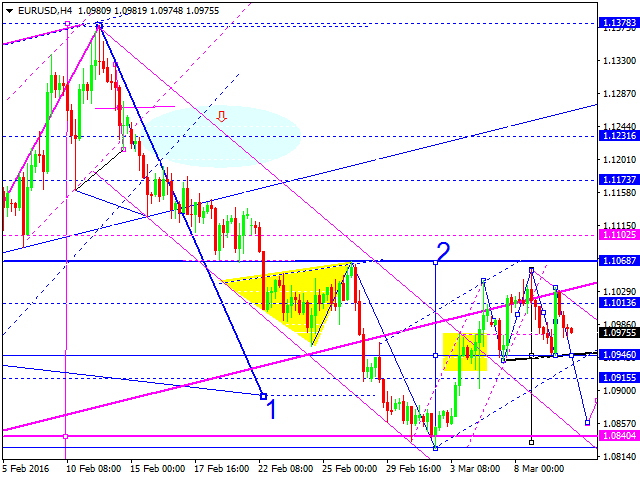

EUR USD, “Euro vs US Dollar”

Eurodollar is forming another descending impulse. We think, today the price may break its consolidation channel downwards and then continue forming this wave with the target at 1.0860. Later, in our opinion, the market may test 1.0946 from below and then continue falling to reach 1.0840.

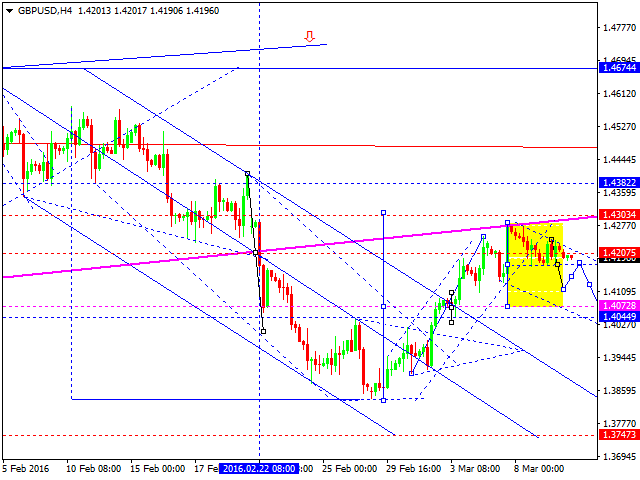

GBP USD, “Great Britain Pound vs US Dollar”

Being under pressure, Pound is falling. We think, today the price may reach 1.4073 and then complete this correction by growing towards 1.4300. After that, the pair may start another decline with the target at 1.3750.

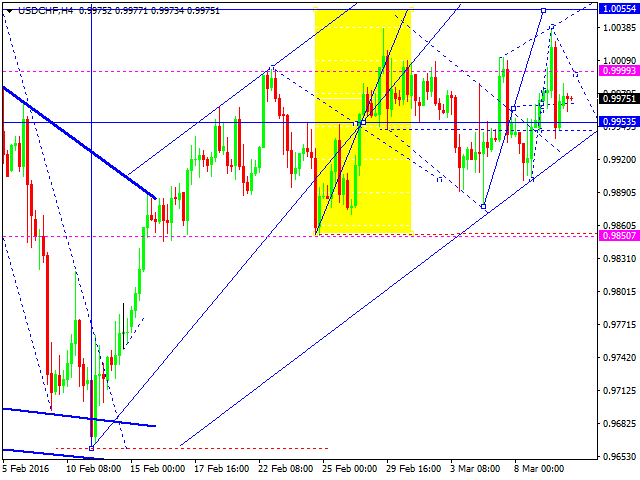

USD CHF, “US Dollar vs Swiss Franc”

Franc is moving at the top of its consolidation channel. We think, today the price may reach 1.0055 and then test 0.9955 from above. Later, in our opinion, the market may start another growth with the target at 1.0250.

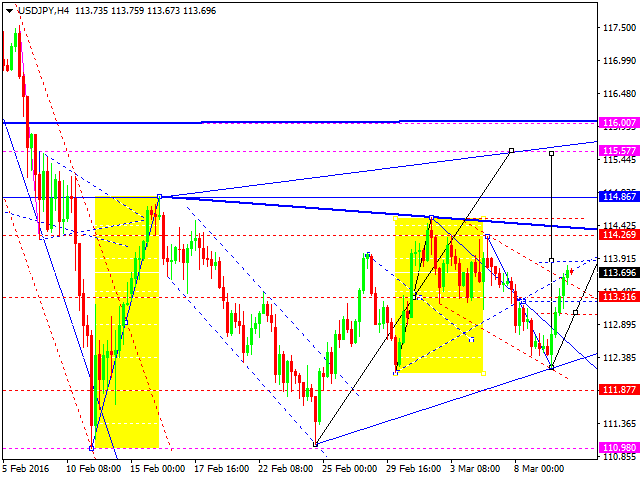

USD JPY, “US Dollar vs Japanese Yen”

Although Yen has grown a bit higher than we expected, the main scenario still implies that the pair may fall towards 111.88. Later, in our opinion, the market may grow to reach 114.27. in fact, the pair is consolidating and forming triangle pattern.

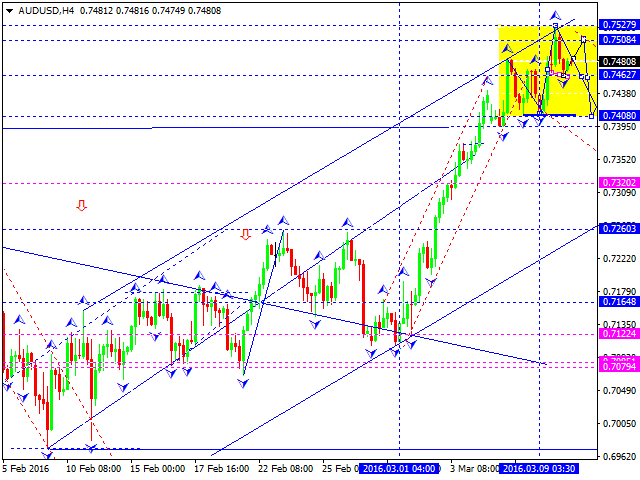

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is forming another descending impulse. We think, today the price may reach the target at 0.7400. After that, the pair may test 0.7460 from below and then start another decline with the target at 0.7200.

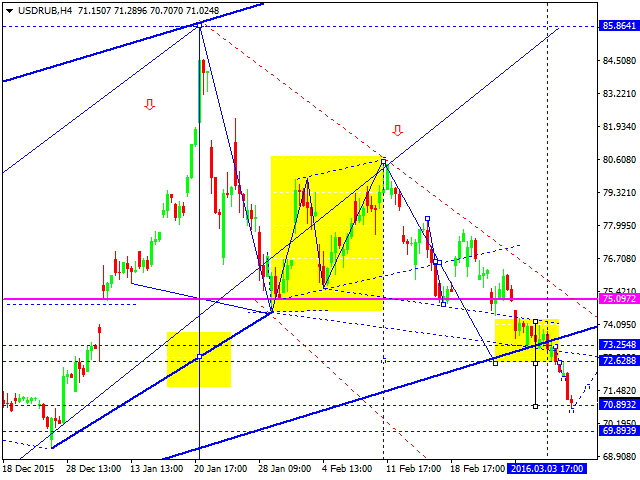

USD RUB, “US Dollar vs Russian Ruble”

Russian Ruble has expanded its trading range downwards. In fact, the pair is forming the third wave inside the downtrend with the target at 65.00. We think, today the price may test 72.60 from below and then continue falling.

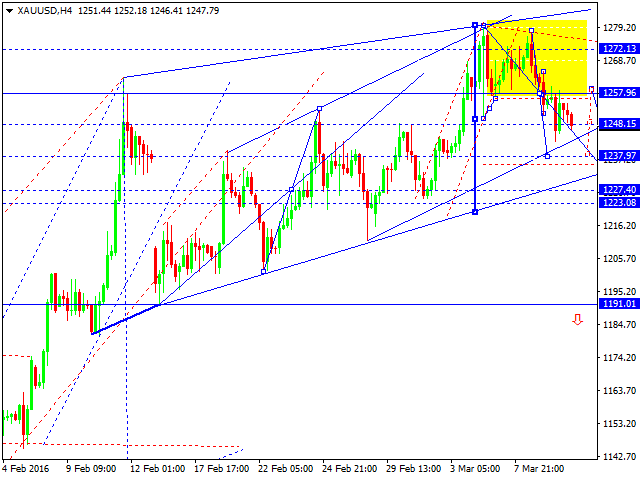

XAU USD, “Gold vs US Dollar”

Gold is still falling to reach 1237. Later, in our opinion, the market may grow towards 1257 and then continue falling with the target at 1191.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.