Analysis for February 19th, 2016

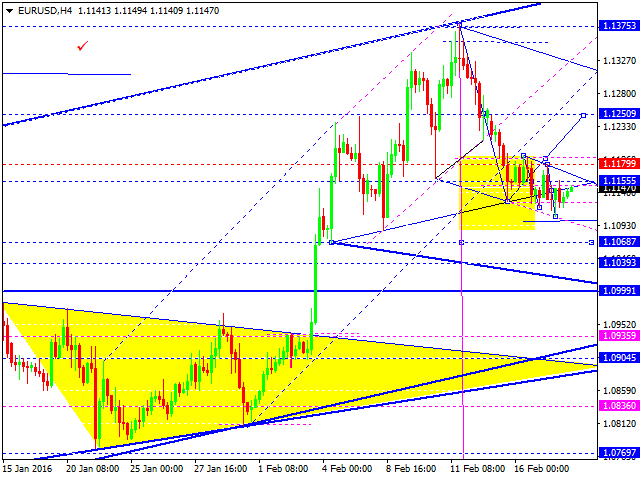

EUR USD, “Euro vs US Dollar”

At the H4 chart, Eurodollar has fallen to reach its target and broken the descending channel; the pair has almost reached the closest target of the correction. Possibly, today the price may fall towards 1.1000 and then start another correction with the target at 1.1250.

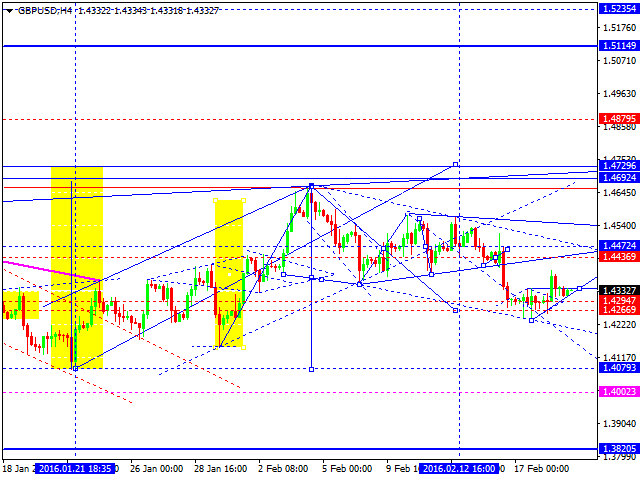

GBP USD, “Great Britain Pound vs US Dollar”

Pound has expanded its consolidation channel upwards. We think, today the price may continue growing towards 1.4440 and then fall to reach 1.4300.

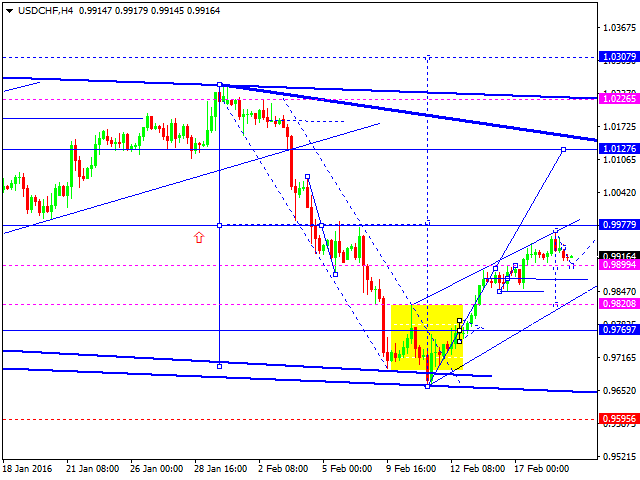

USD CHF, “US Dollar vs Swiss Franc”

Franc continues moving upwards. We think, today the price may reach 0.9980 and then grow towards 1.0127. Later, in our opinion, the market may start another correction towards 0.9820.

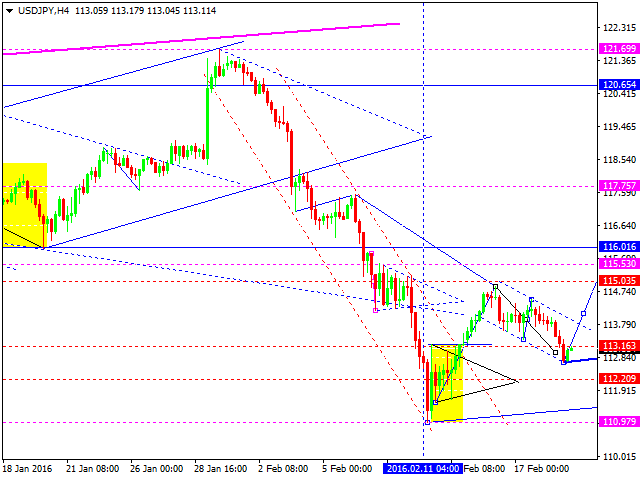

USD JPY, “US Dollar vs Japanese Yen”

Yen has completed its descending structure as a correction. We think, today the price may grow towards 115.50 and then fall to return to 113.00.

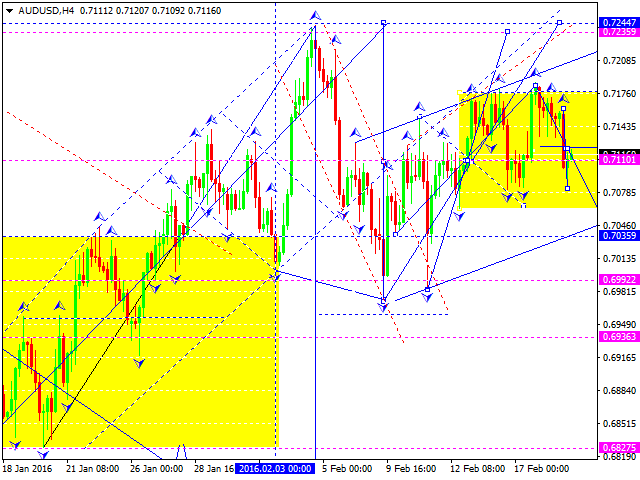

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is still consolidating and falling towards 0.7050. After reaching it, the market return to 0.7150. If the channel is broken upwards, the price may reach 0.7250; if downwards - the downtrend may continue towards 0.6660.

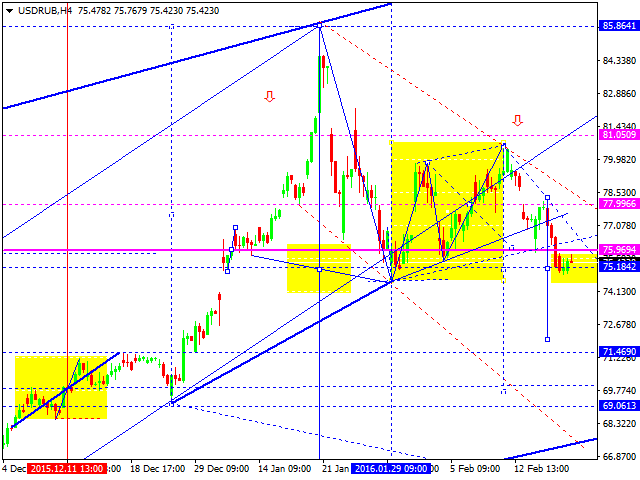

USD RUB, “US Dollar vs Russian Ruble”

Russian Ruble is still consolidating near 76. We think, today the price may continue falling the third wave inside the downtrend with the target at 69.

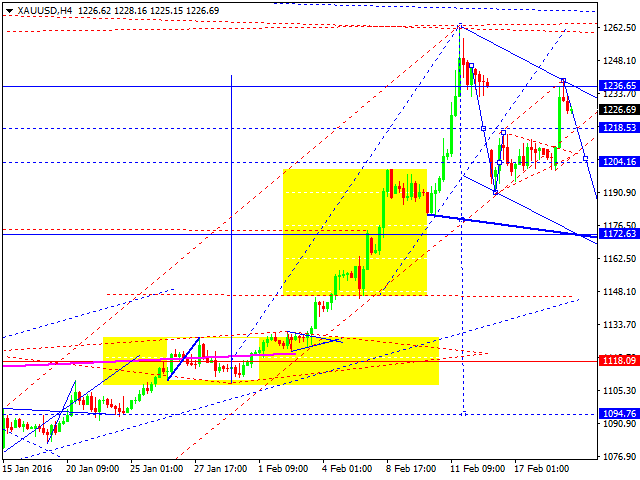

XAU USD, “Gold vs US Dollar”

Gold has expanded its consolidation channel upwards and almost reached the target of the correction. We think, today the price may fall to reach the target at 1172.60.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.