Analysis for February 12th, 2016

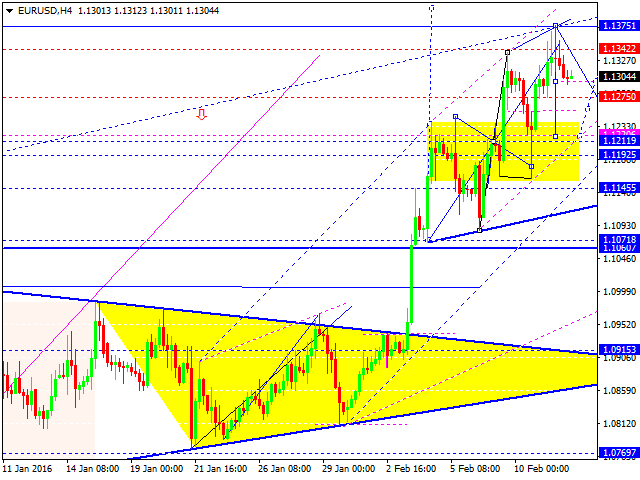

EURUSD, “Euro vs US Dollar”

Eurodollar has completed its descending impulse and corrected it. We think, today the price may form another descending wave to break the minimum of the impulse and continue falling to reach the next target at 1.0990. An alternative scenario implies that the pair may reach another new high at 1.1350 and then continue falling inside the downtrend.

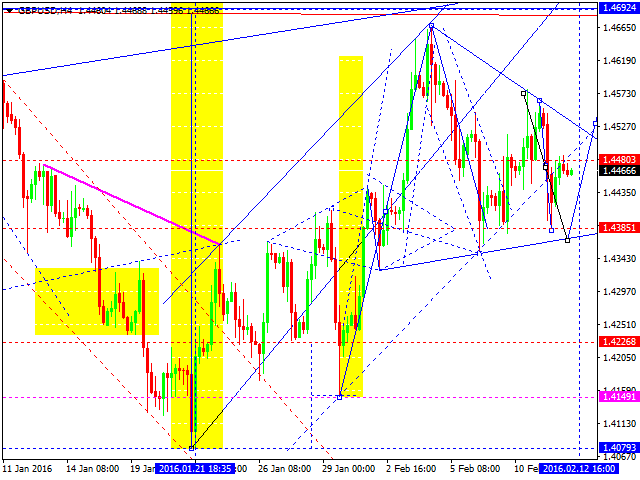

GBPUSD, “Great Britain Pound vs US Dollar”

Pound is forming an ascending structure with the target at 1.4700. We think, today the price may complete it and then start forming a five-wave correction to return to 1.4385.

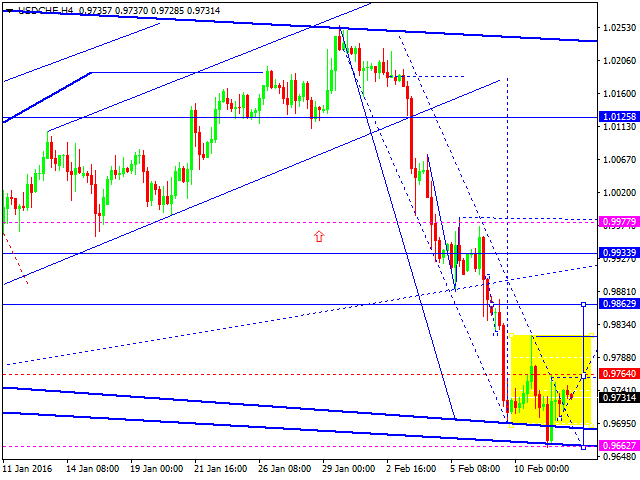

USDCHF, “US Dollar vs Swiss Franc”

Franc has completed its ascending impulse and corrected it. We think, today the price may grow to break the maximum of the impulse. The next upside target is at 0.9950. An alternative scenario implies that the pair may reach another new low at 0.9660 and then continue moving inside the uptrend.

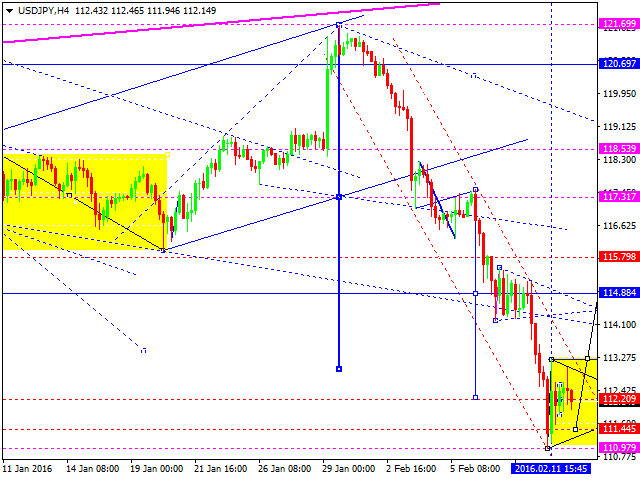

USDJPY, “US Dollar vs Japanese Yen”

Yen has reached its downside target. We think, today the price may consolidate near its lows and form a reversal structure. After that, the market may start a five-wave correction towards 120.70.

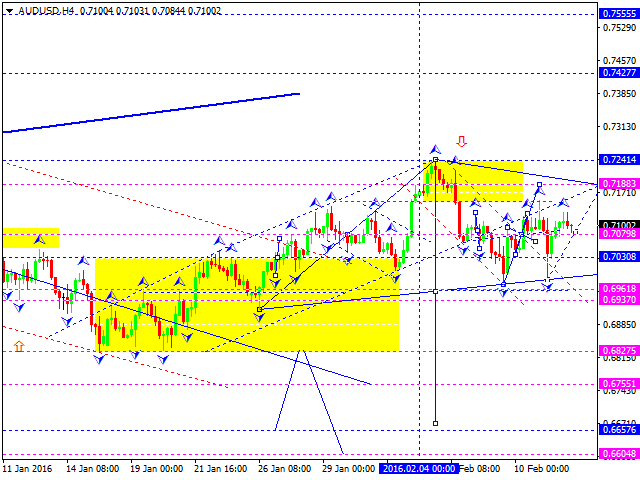

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar has reached the target of the correction. We think, today the price may form another ascending structure to reach 0.7188, thus completing this five-wave correction. After that, the market may form another descending structure towards 0.6660.

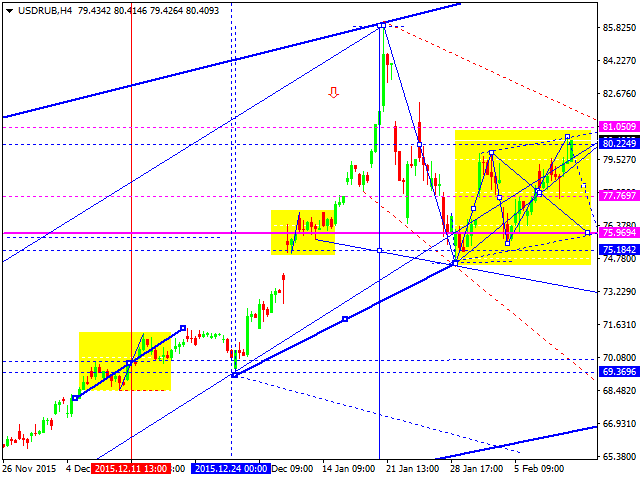

USDRUB, “US Dollar vs Russian Ruble”

Russian Ruble is growing towards 80.22. We think, today the price may reach this level and start falling towards 76.00. Later, in our opinion, the market may form another ascending structure with the target at 81.00.

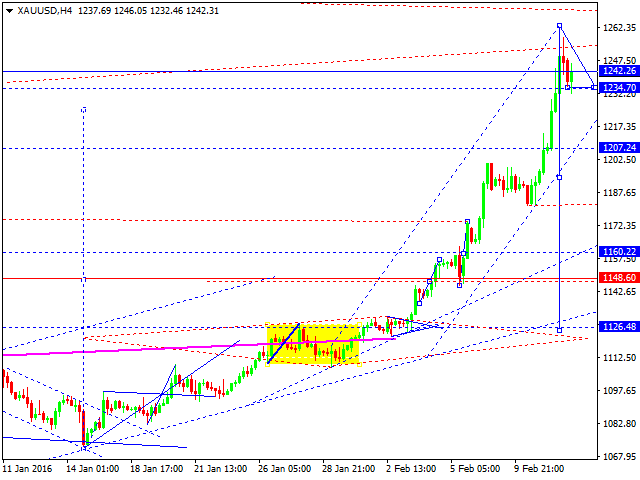

XAUUSD, “Gold vs US Dollar”

Gold hasn’t been able to finish its descending impulse. The market has reached a new high; this structure may be considered as the expansion of the channel upwards. We think, today the price may expand it downwards as well and then test the center of the channel from below. Later, in our opinion, the market may break the lows and the entire structure may be considered as a reversal pattern for a new descending movement with the target at 1117.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.