Analysis for December 15th, 2015

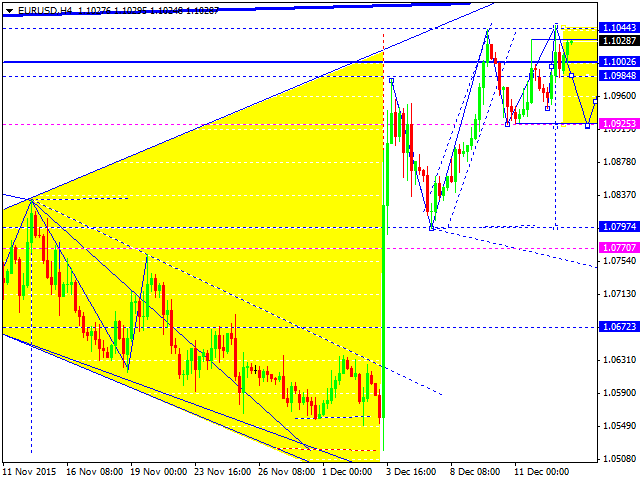

EURUSD, “Euro vs US Dollar”

Eurodollar is expanding its consolidation channel upwards. We think, today, the price may prefer to move according to an alternative scenario and grow to reach 1.1068. Later, in our opinion, the market may fall and expand the channel downwards to reach 1.0925. After that, the instrument may return to the center to test 1.1000 from below.

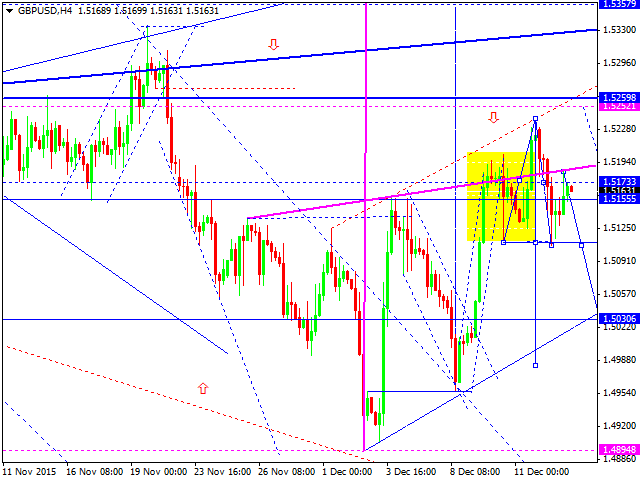

GBPUSD, “Great Britain Pound vs US Dollar”

Pound has expanded its consolidation channel upwards and then downwards. We think, today, the price may return to the center of the channel at 1.5196, breaks the lows, and then continue falling inside the downtrend with the target at 1.5030. An alternative scenario suggests that the pair may expand the channel upwards to reach 1.5260.

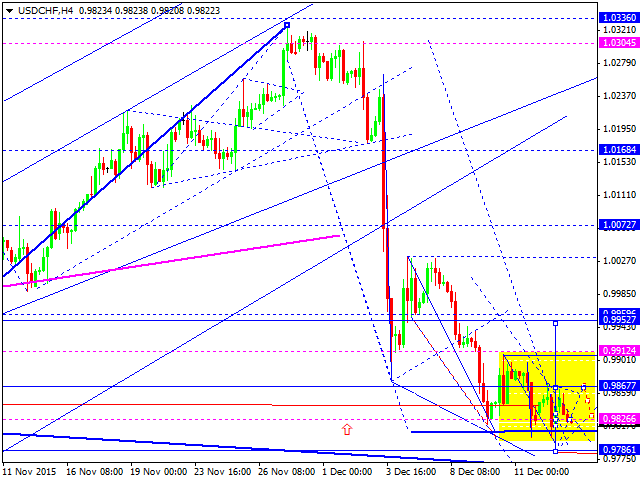

USDCHF, “US Dollar vs Swiss Franc”

Franc has completed its descending structure and already formed two ascending impulses. We think, today, the price may form the third one with the target at 0.9867. Later, in our opinion, the market may test 0.9826 from above and then grow to reach 0.9953.

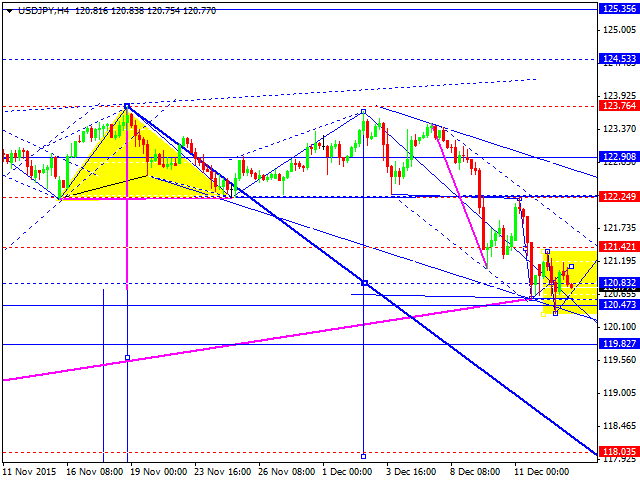

USDJPY, “US Dollar vs Japanese Yen”

Yen has reached the target of the third wave and right now is consolidating. If the price breaks this consolidation channel upwards, it may be corrected to return to 122.25; if downwards – expand the third wave towards 118.03.

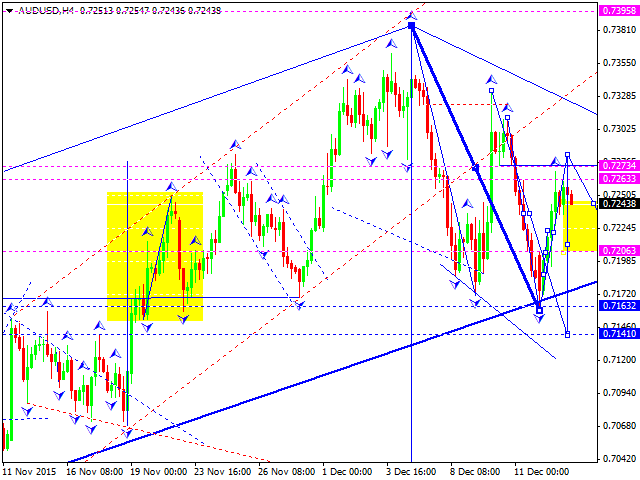

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar has almost completed the correction of the descending five-wave structure. We think, today, the price may fall towards 0.7206 and then return into the consolidation channel at 0.7240. If the price breaks this channel upwards – the market may grow to reach 0.7420; if downwards, the downtrend may continue to reach 0.7141.

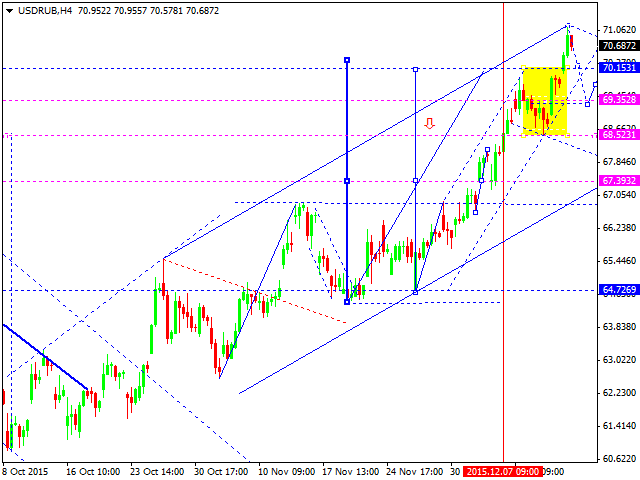

USDRUB, “US Dollar vs Russian Ruble”

Russian Ruble has expanded its trading range upwards. We think, today, the price may return to 69.25 and then to 70.00. After that, the instrument may fall towards 68.50 and form a reversal structure.

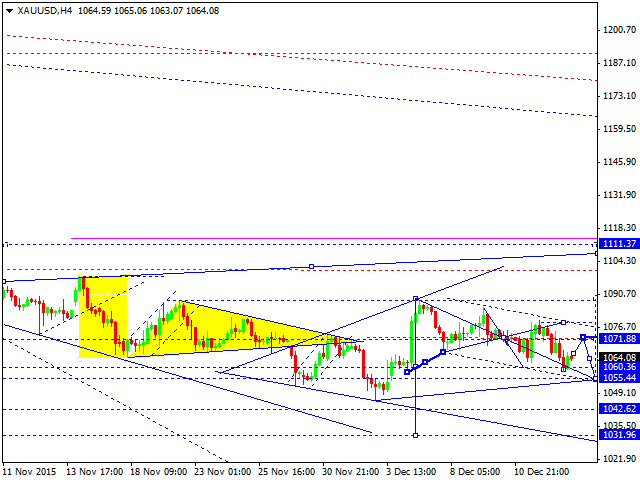

XAUUSD, “Gold vs US Dollar”

Gold has reached the local target of the flag correctional pattern. We think, today, the price may form the fourth correctional structure towards 1071.88 and then the fifth one with the target at 1055.44.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.