Analysis for June 2nd, 2015

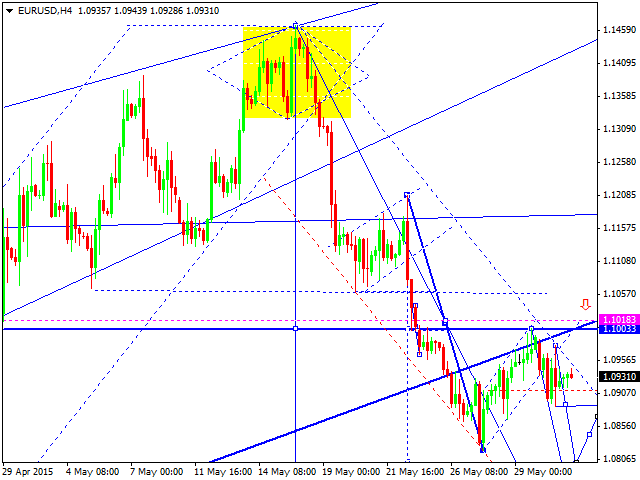

EUR USD, “Euro vs US Dollar”

Eurodollar is consolidating. Possibly, today the price may reach the channel’s lower border at level of 1.1018. Later, in our opinion, the market may break it downwards and continue falling towards level of 1.0801. After that, the pair may return to level of 1.0900 and then continue moving inside the downtrend toward level of 1.0500.

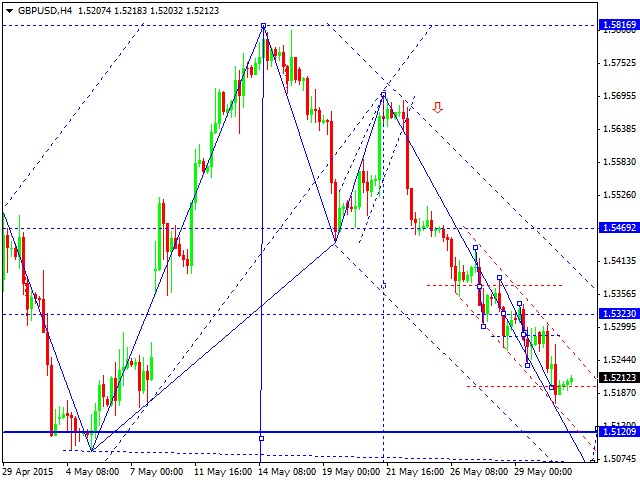

GBP USD, “Great Britain Pound vs US Dollar”

Pound continues moving downwards. The main target of this descending wave at level of 1.4400. We think, today, the price may reach level of 1.5120 and complete the first wave or maybe extend it up to level of 1.4950.

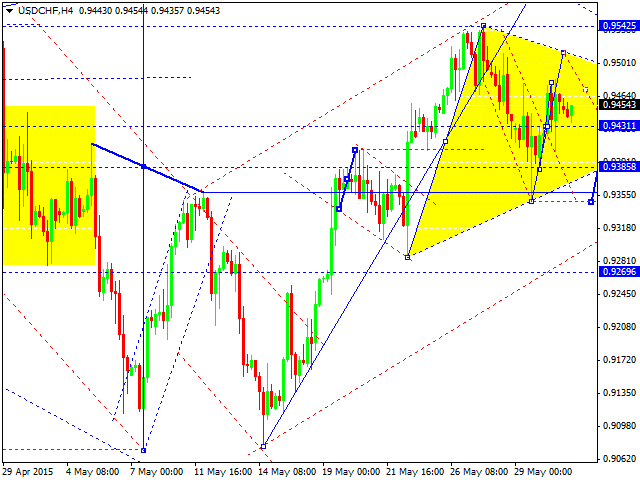

USD CHF, “US Dollar vs Swiss Franc”

Franc is moving inside its consolidation channel. We think, today, the price may grow to reach level of 0.9500 and then return to level of 0.9430. Later, in our opinion, the market may start another ascending movement with the target at level of 0.9745.

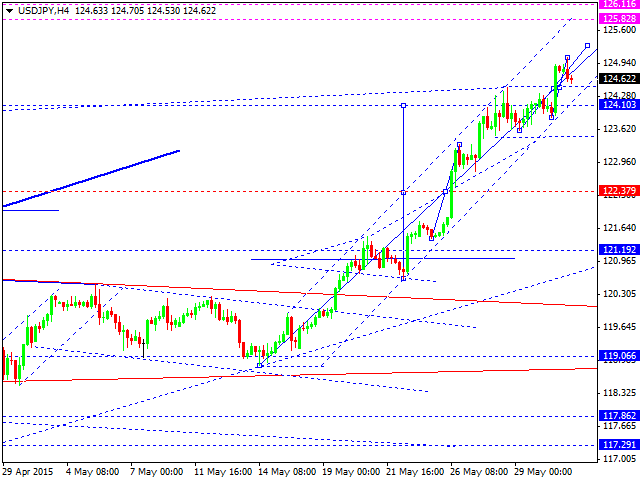

USD JPY, “US Dollar vs Japanese Yen”

Yen has broken its another consolidation channel upwards and may continue growing towards level of 125.83. We think, today, the price may test level of 124.45 and then continue growing towards the main target.

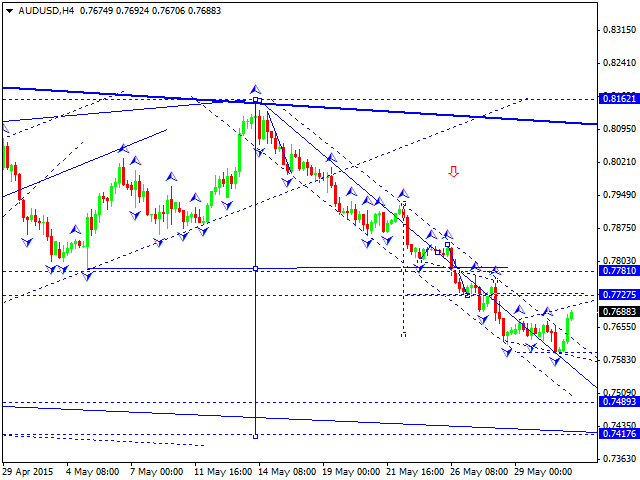

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has broken its descending channel and today may return to level of 0.7781. This structure may be considered as a correction. Later, in our opinion, the market may continue falling towards level of 0.7500.

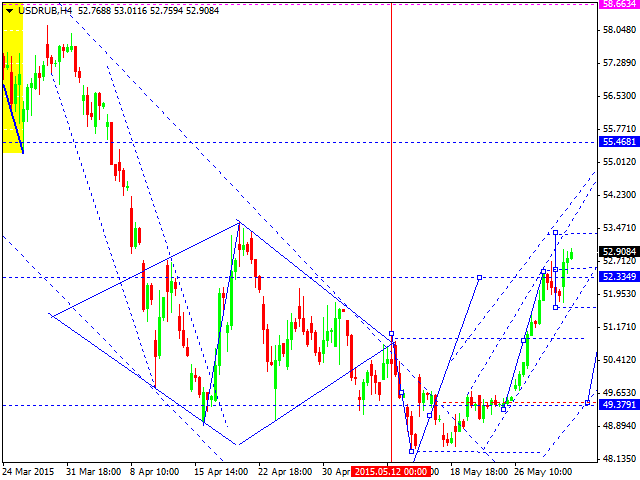

USD RUB, “US Dollar vs Russian Ruble”

Ruble has broken level of 52.30 upwards and continues forming its consolidating channel. We think, today, the price may continue growing towards the target of the third wave at level of 55.50. However, according to an alternative scenario, the market may yet return to level of 49.50. After that, the pair is expected to continue growing.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD trades on a stronger note 1.2530, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The United States Employment report will be released by the Bureau of Labor Statistics at 12:30 GMT. The US Dollar looks to employment data after the Fed signaled its intention to hold rates higher for longer on Wednesday.