Analysis for May 29th, 2015

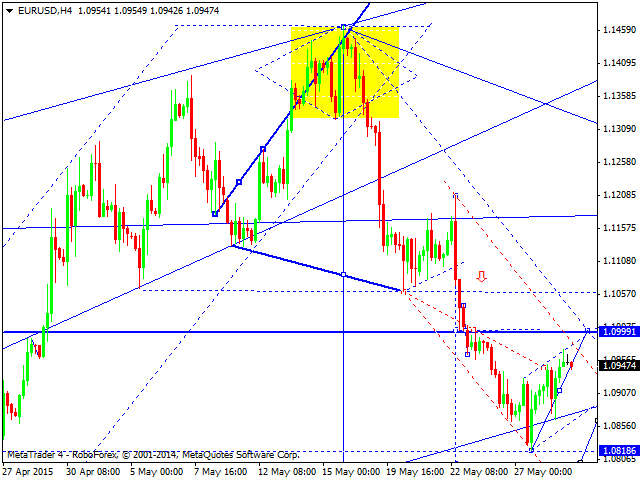

EUR USD, “Euro vs US Dollar”

Eurodollar is still consolidating. Possibly, the price may test level of 1.1000 from below and then continue falling inside the downtrend. The next target is at the level of 1.0810. Later, in our opinion, the market may return to level of 1.1000 and then start another descending movement with the target at level of 1.0500.

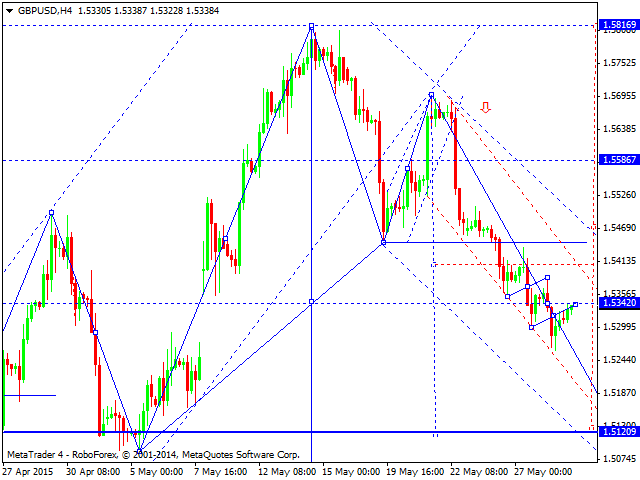

GBP USD, “Great Britain Pound vs US Dollar”

Pound is forming a descending wave with the target at level of 1.5120. We think, today, the price may break its consolidation channel downwards and continue falling to reach the local target of the first wave.

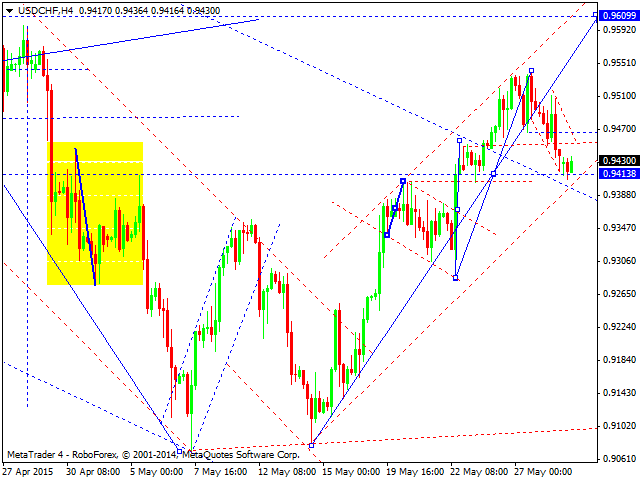

USD CHF, “US Dollar vs Swiss Franc”

Franc is still consolidating. We think, today, the price may continue growing to reach level of 0.9610 and then fall towards level of 0.9462. Later, in our opinion, the market may start another ascending movement with the target at level of 0.9813.

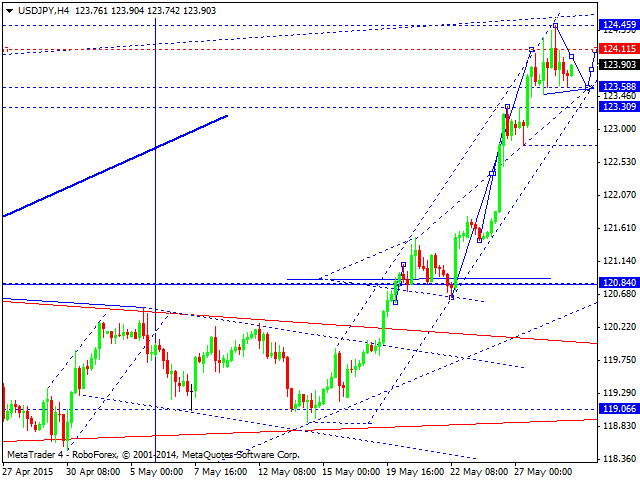

USD JPY, “US Dollar vs Japanese Yen”

Yen continues consolidating at the top of its ascending wave. Possibly, today the price may reach new highs. After breaking its ascending channel, the pair is expected to continue falling towards level of 120.84.

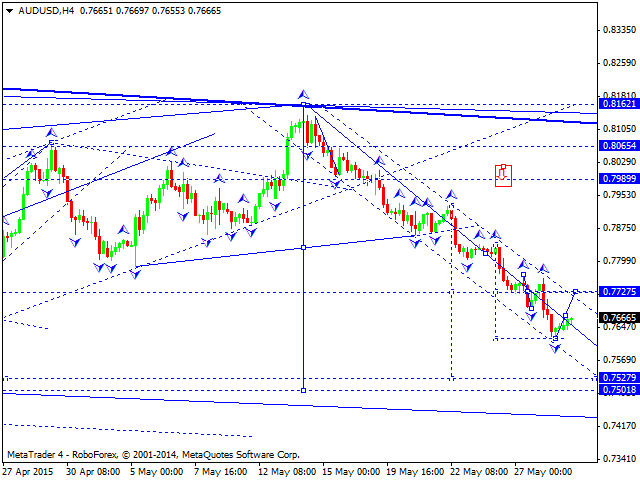

AUD USD, “Australian Dollar vs US Dollar”

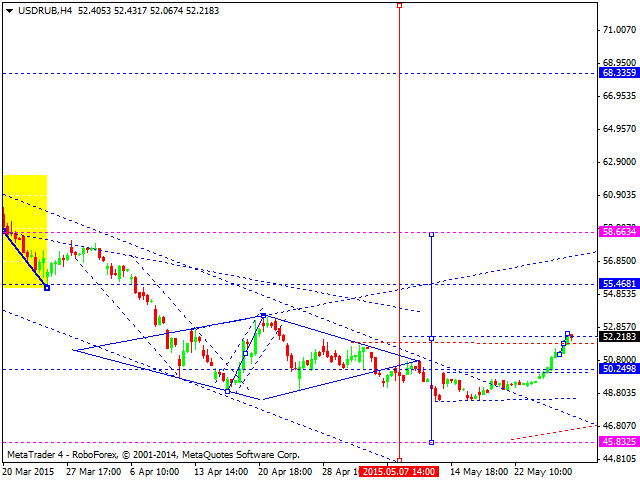

USD RUB, “US Dollar vs Russian Ruble”

Ruble has broken level of 52.00. We think, today, the price may continue growing towards level of 55.50 and then start a correction to return to level of 51.00 and test it from above. Later, in our opinion, the market may resume growing to reach level of 58.50.

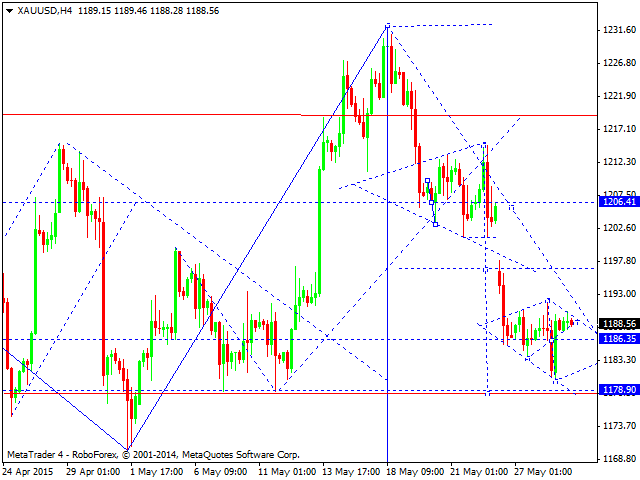

XAU USD, “Gold vs US Dollar”

Gold is forming another consolidation channel. If the price breaks it downwards, it may reach the target at level of 1178; if upwards – test level of 1198. Later, in our opinion, the market may continue falling to reach the lower border of the daily consolidation channel.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

The EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 on Monday during the early Asian trading hours. The softer US Dollar provides some support to the major pair.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.