Analysis for September 15th, 2014

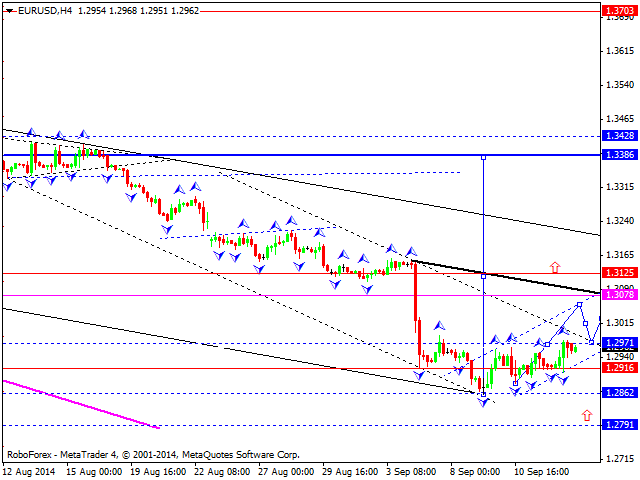

EURUSD, “Euro vs US Dollar”

Euro is moving upwards. We think, today the price may try to break a descending channel and form a continuation pattern towards level of 1.3078, or even form a correction towards level of 1.2920. Later, in our opinion, the market may move upwards to break a descending channel and reach the above-mentioned target. The pair may form an ascending correction with the main target at level of 1.3388.

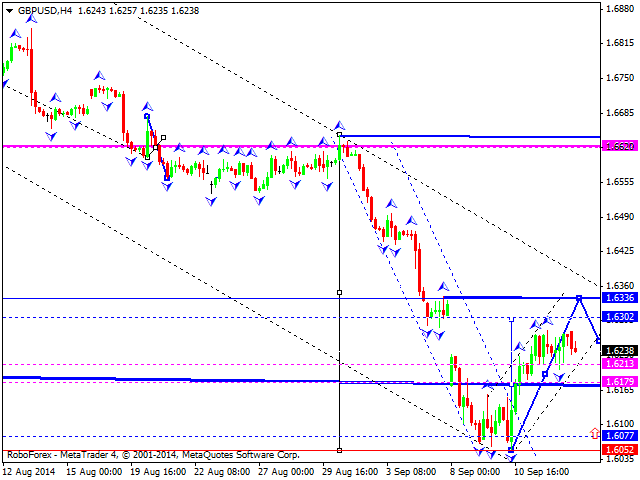

GBPUSD, “Great Britain Pound vs US Dollar”

Pound continues forming an ascending structure with the target at level of 1.6300. After reaching it, the price may fall to return to level of 1.6180. Later, in our opinion, the market may move upwards to break a descending channel and then continue growing inside an ascending correction with the target at level of 1.6630 at least.

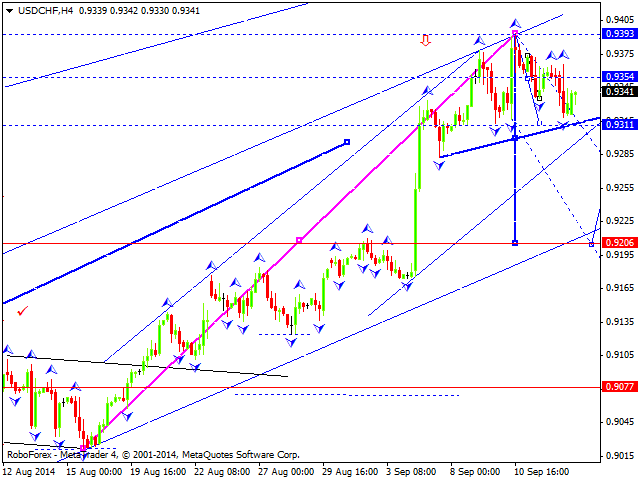

USDCHF, “US Dollar vs Swiss Franc”

Franc is still forming a descending structure with the target at level of 0.9300. After reaching it, the price may grow to return towards level of 0.9355, continue falling to break an ascending channel, and reach the main target at level of 0.9077.

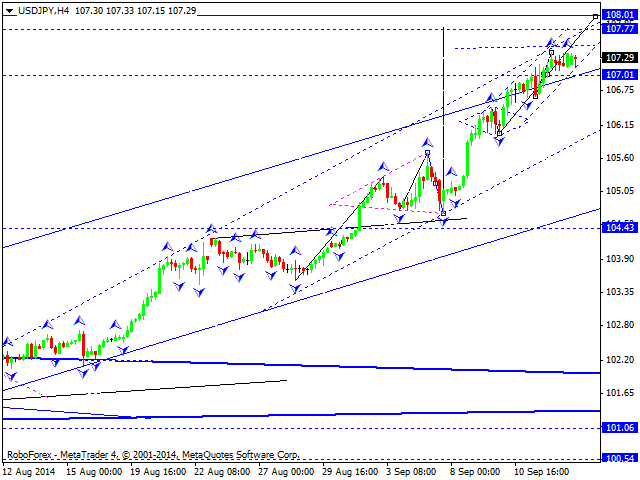

USDJPY, “US Dollar vs Japanese Yen”

Yen is still moving inside an ascending structure. We think, today the price may reach level of 108.00 and then start a correction towards level of 104.50. Later, in our opinion, the market may form another ascending structure to reach level of 108.50 and then start falling inside a new descending trend.

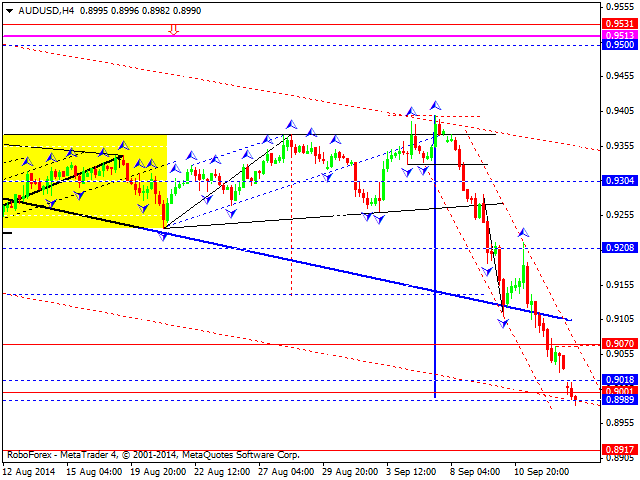

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar reached the target of its descending wave. We think, today the price may form another structure to return to level of 0.9200, at least. Later, in our opinion, the market may start a new descending movement with the target at level of 0.8940, at least.

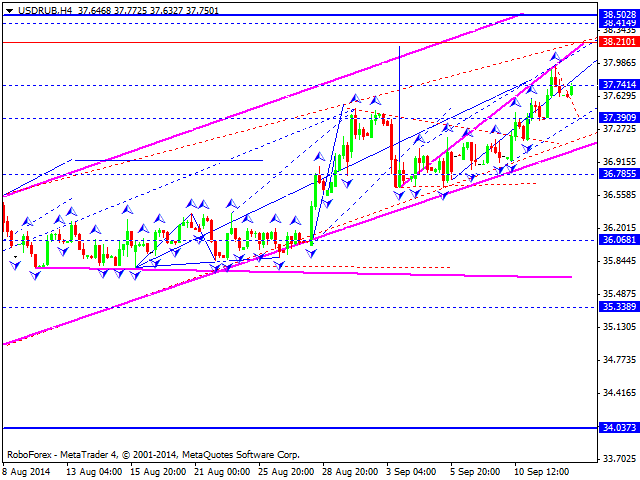

USDRUB, “US Dollar vs Russian Ruble”

Ruble is under pressure and continues growing. We think, today the price may reach level of 38.10 and then move downwards to reach level of 34.20. Later, in our opinion, the market may complete this ascending wave by growing and reaching level of 38.50. After that, the pair may start a correction as the fourth wave with target at level of 34.

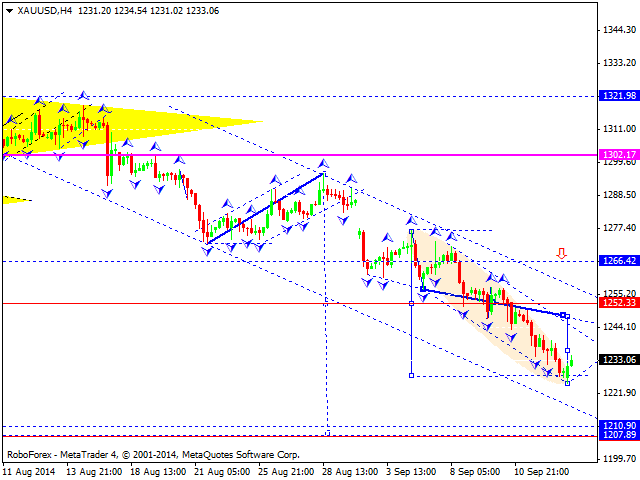

XAUUSD, “Gold vs US Dollar”

Gold continues falling inside a descending channel with the main target at level of 1208. We think, today the price may test level of 1248 from blow and then continue moving downwards to reach the above-mentioned target.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.