Analysis for December 26th, 2013

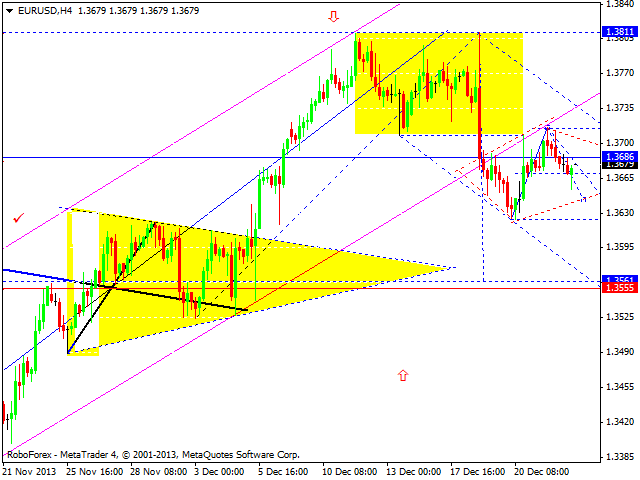

EUR/USD

Euro is still forming consolidation channel, which may be considered as triangle pattern. After the market opening, price may fall down to reach level of 1.3644, return to triangle’s upper border, and then complete this correction by moving downwards and reaching level of 1.3560. Later, in our opinion, instrument may continue growing up with target at 1.4100.

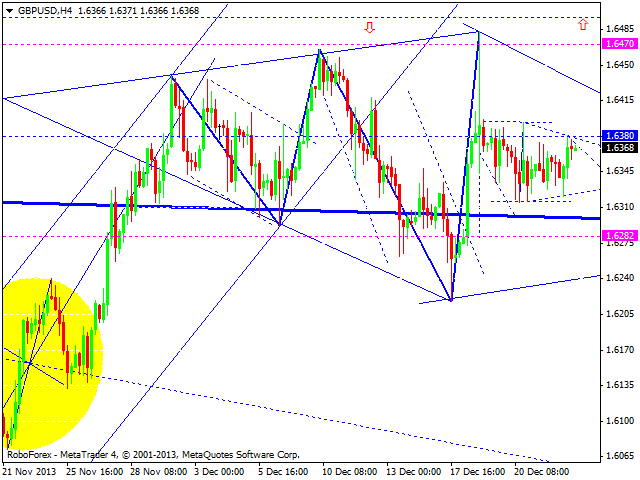

GBP/USD

Pound is still consolidating below 1.6380. After the market opening, price may continue its correction and reach level of 1.6300 (at least). Later, in our opinion, instrument may continue moving upwards to reach predicted target at 1.7150.

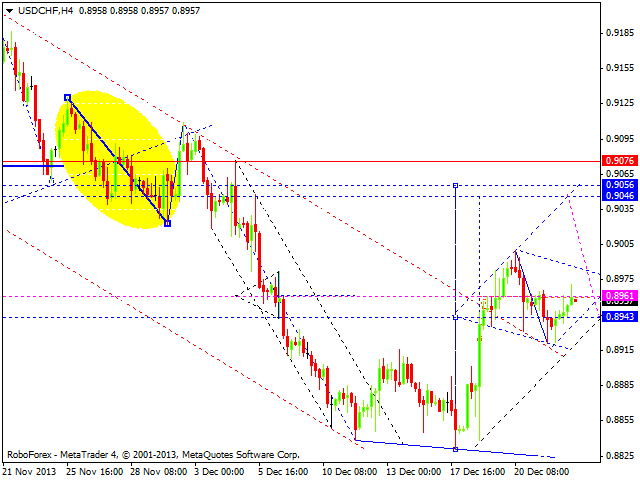

USD/CHF

Franc started forming another ascending structure; right now market is moving inside consolidation pattern. After the market opening, price may reach level of 0.9000 and then fall down towards 0.8960. Later, in our opinion, instrument may complete this correction by reaching level of 0.9060 (at least) and then continue falling down towards 0.8300.

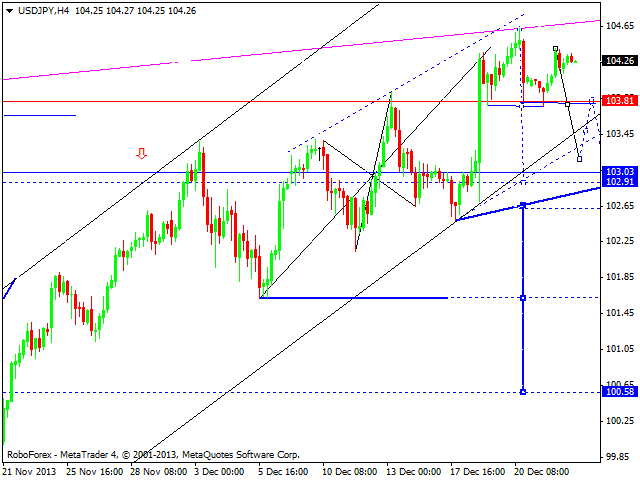

USD/JPY

Yet is still consolidating near its maximums. After the market opening, price may start descending structure towards level of 103.58, return to 104.00, and then continue falling down towards next target at 102.70. Alternative scenario implies that pair may continue growing up to reach new maximums.

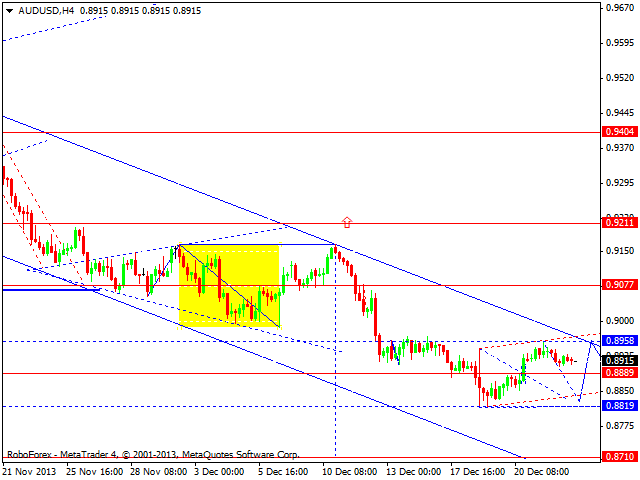

AUD/USD

Australian Dollar is still being corrected towards previous descending movement; structure of this correction implies that price may fall down to reach 0.8840. Later, in our opinion, instrument may complete this correction by forming ascending structure to reach level of 0.8958 and then start moving inside down trend towards 0.8720.

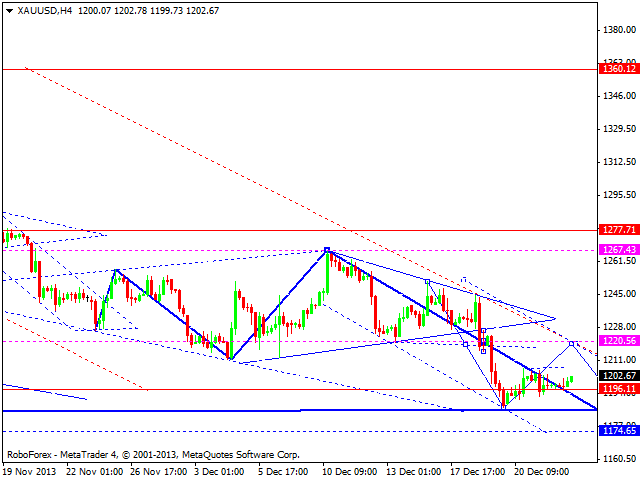

GOLD

Gold is still moving towards level of 1220; after the market opening, price may reach it. This movement may be considered as the fourth wave of another descending structure. Later, in our opinion, instrument may start the fifth wave inside this final structure with target at 1175 and then form reversal pattern for new ascending movement to return to 1360.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0800 after German sentiment data

EUR/USD stays in a consolidation phase at around 1.0800 on Tuesday after closing in positive territory on Monday. The upbeat ZEW sentiment data from Germany fails to provide a boost to the Euro as investors await producer inflation data from the US and Fed Chairman Powell's speech.

GBP/USD drops below 1.2550 after UK jobs data

GBP/USD struggles to build on Monday's gains and trades in the red below 1.2550 in the European session on Tuesday. The data from the UK showed that the Unemployment Rate edged higher to 4.3% in the three months to March as forecast, failing to help Pound Sterling find demand.

Gold price edges higher ahead of US PPI data, Fed’s Powell speech

The gold price (XAU/USD) rebounds despite the consolidation of the US Dollar (USD) on Tuesday. The upside of yellow metal might be limited as traders might wait on the sidelines ahead of key US inflation data this week.

Ethereum knocking at support’s door

Crypto market capitalisation rose 0.8% over the past 24 hours to 2.2 trillion, but growth exceeded 2% for most of the period. However, it dipped at the start of active European trading, temporarily returning to levels of a day ago.

Entering a crucial run of data for financial markets

We are entering a crucial period for financial markets and forecasters as Americans' near-term inflation expectations rise again. Upcoming reports on the CPI and PPI for April, along with new data on retail sales and industrial production, will provide valuable insights.