Analysis for November 7th, 2013

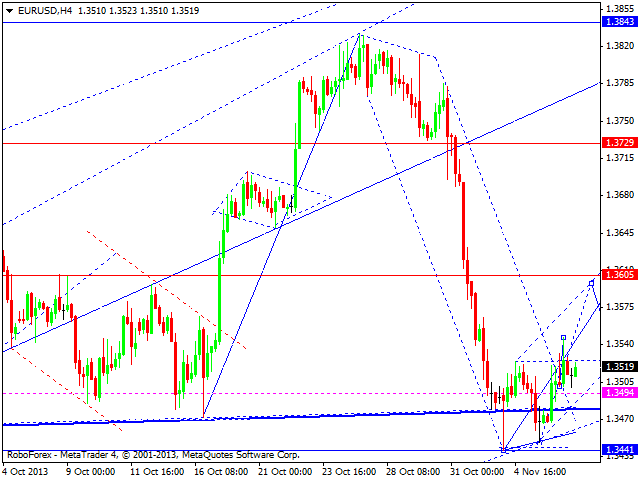

EUR/USD

Euro is forming the second ascending impulse. We think, today the price may continue growing up to reach 1.3605 and then form a correction towards 1.3525. This structure will help market to define whether price is going to continue rising and forming the fifth wave.

GBP/USD

Pound is still forming continuation pattern to continue moving upwards. We think, today the price may grow up and reach 1.6188 and then return to 1.6060. Later, in our opinion, the pair may move upwards again to reach 1.6228.

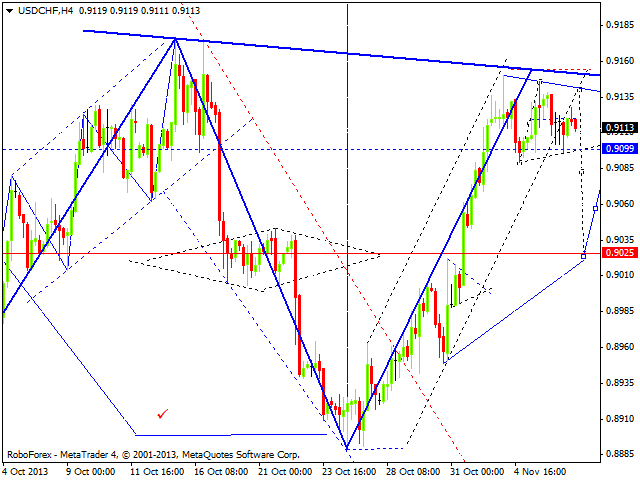

USD/CHF

Franc is consolidating; market has left ascending channel. We think, today the price may continue falling down and reach the first target at 0.9025. Later, in our opinion, the pair may rise to return to 0.9090.

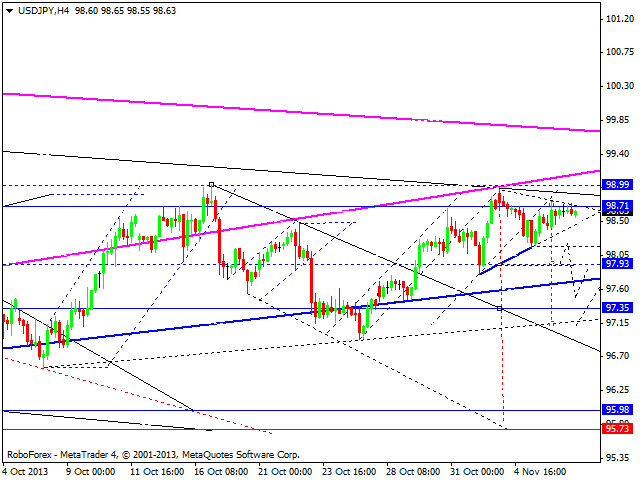

USD/JPY

USD/JPY is traded near 98.70. We think, today the price may break minimum of the first descending wave and move towards 97.35. Later, in our opinion, the pair may consolidate for a while and then continue falling down. Main target is at 96.00.

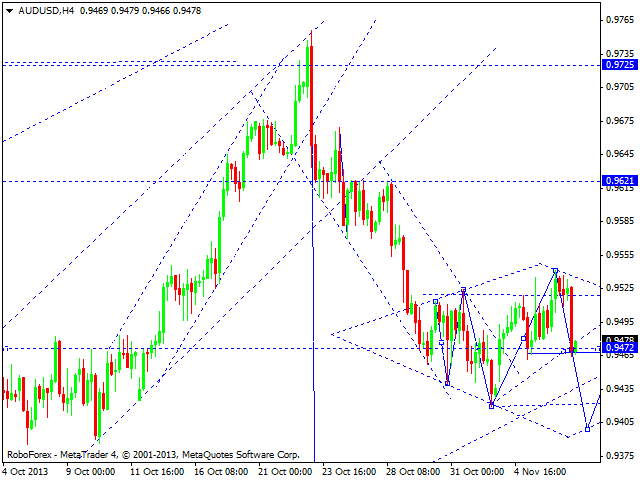

AUD/USD

Australian Dollar attempted to break upper border of consolidation channel and returned into the middle of its trading range. We think, today the price may try to expand lower border of the channel and then return into the middle again. Later, in our opinion, the pair may continue moving downwards to reach 0.9200. Alternative scenario implies correction towards 0.9620 and then falling down to reach above-mentioned target.

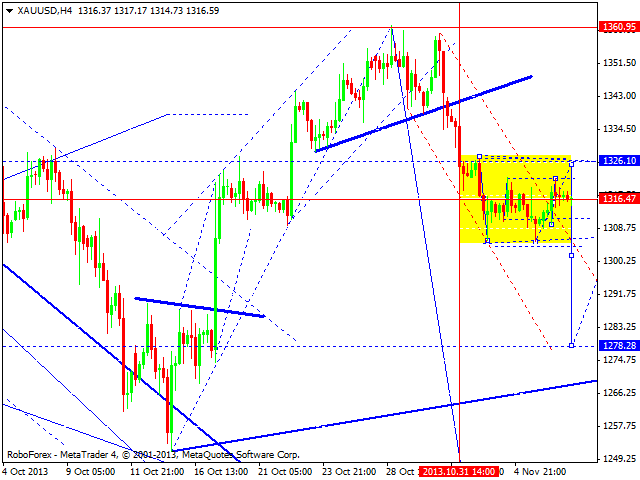

GOLD

Gold is still consolidating. We think, today the price may reach upper border, then form descending structure to break lower border of this consolidation channel and continue falling down. Target is at 1277.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.