Growing unemployment in February has been reported today in the EU. Deflation in March slipped but kept on track, driving the euro down. However, we believe that until the Friday Non-Farm Payrolls the common currency will be traded in a range. A number of important macroeconomic indices will be released in the US today: Chicago Purchasing Manager at 15:45 CET and Consumer Confidence at 16:00 CET. The tentative outlook is slightly positive for the American dollar.

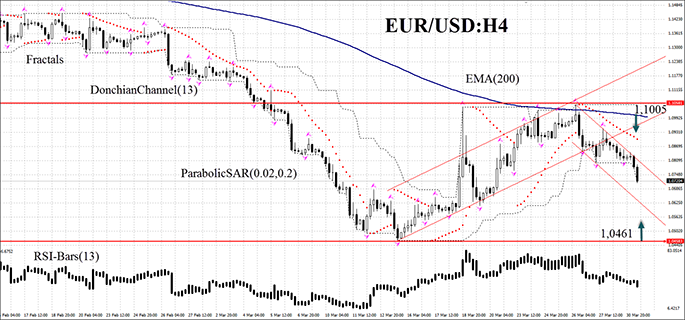

The EUR/USD currency pair escaped the down-trend on the H4 chart and is now traded in a range: 1.1052 – 1.0461. The curve is a little bit below the corridor center and is moving towards the lower boundary. Thus, we do not rule out that until Friday the pair will reach the top or the bottom and rebound back to the middle. If RSI-Bars touches the overbought or the oversold zone that may confirm our assumptions. A sell order may be placed at the moving average – 1.1005. Stop loss may be placed at the Donchian Channel upper boundary and at the local fractal high – 1.1052. A buy order may be located at the flat corridor's bottom – 1.0461 with a stop loss slightly below (at 1.0431 for example). After pending order activation stop loss is to be moved every 4 hours near the next fractal, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets stop loss level without reaching the order, we recommend cancelling the position: market sustains internal changes that were not considered.

- Position Sell

- Sell limit above 1,1005

- Stop loss above 1,1052

- Position Buy

- Buy limit below 1,0461

- Stop loss below 1,0431

Recommended Content

Editors’ Picks

AUD/USD remains firmer ahead of RBA interest rate decision

The Australian Dollar continued its winning streak for the fifth consecutive session on Tuesday, driven by a hawkish sentiment surrounding the Reserve Bank of Australia. This positive outlook reinforces the strength of the Aussie Dollar, offering support to the AUD/USD pair.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.