We would like to focus your attention to the AUD/USD currency pair. The Aussie is currently traded 29% below the historical high of 2011 and showed signs of the bullish influence over the last three weeks. Since September 2014 it has dipped 18% with the maintained base rate of 2.5%, kept since August 2013. In February 2015 the Reserve Bank of Australia (RBA) cut the rate only 0.25%, down to 2.25%. Some market participants deem that it is not enough for such a strong depreciation of the Australian dollar. The RBA meeting will take place next Tuesday. Most investors don’t expect additional rate cuts. In our opinion, these forecasts may buoy the Aussie.

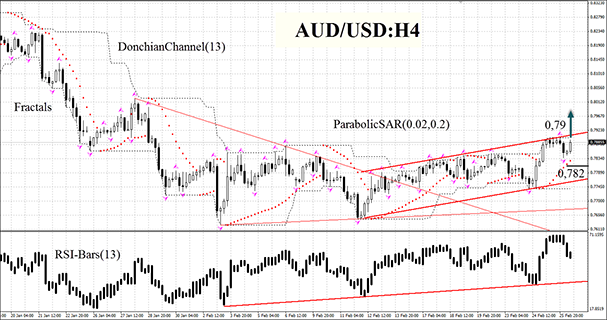

Having a look at the H4 chart, the AUD/USD broke the triangle top with confidence. Now it is moving inside the uptrend price channel, so that it can be considered as the trend confirmation. The RSI-Bars chart also indicates the uptrend. Please note that its readings reached the overbought border and performed a pullback: the oscillator has not been below 50. This is a good “bullish” signal which implies the Australian dollar strengthening. We do not rule out the bullish momentum being developed after the fractal resistance breakout at 0.79: this level can be used for placing a pending buy order. Stop loss is to be placed at the last Parabolic signal, which can currently act as the support line at 0.782. After pending order placing, Stop loss is to be moved every four hours near the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets stop loss level without reaching the order, we recommend cancelling the position: market sustains internal changes which were not considered.

- Position Buy

- Buy stop above 0.79

- Stop loss below 0.782

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold price turns red below $2,320 amid renewed US dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is Securities and Exchange Commission (SEC) filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.