The Fed Chair Janet Yellen said yesterday that there is no need to hurry with the rate hike. For this reason the US dollar index is slipping but is still traded in a range. CPI will be released in Canada and the US tomorrow at 13:30 СЕТ. According to forecasts, it is expected to be cut in both countries. However, we deem the Canadian inflation indicator looks more preferable. We believe that the reduced US CPI may include deflation risks which can be regarded as a negative factor for the economy. Moreover, deflation could delay further the moment of raising the US base rate which now stands at 0.25%. The rate is higher in Canada and makes up 0.75%.

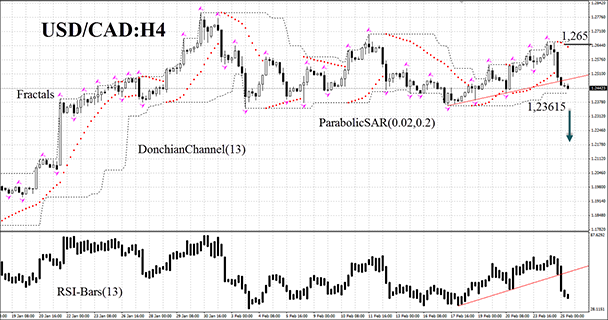

Let’s consider the USD/CAD on the H4 chart. It has been traded sideways for a month and has no definite direction so far. RSI-Bars shows signs of the downtrend approach, but in general it is also located in a range. It hasn’t reached the oversold zone yet – 30. We do not rule out the bearish momentum being developed in case of the fractal support level breakout at 1.23615: this level can be used for placing a pending sell order. However, the most careful traders should wait for the market reaction on the CPI release in the US and Canada. Stop loss is to be placed at the last Parabolic signal, which can currently act as the resistance line at 1.265. After pending order placing, Stop loss is to be moved every four hours near the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets stop loss level without reaching the order, we recommend cancelling the position: market sustains internal changes which were not considered.

- Position Sell

- Sell stop below 1.23615

- Stop loss above 1.265

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

AUD/USD drops below 0.6600 after RBA policy announcements

AUD/USD stays under bearish pressure and trades deep in negative territory slightly below 0.6600. The RBA left the policy settings unchanged as expected but Governor Bullock said that there was no necessity to further tighten the policy.

Gold price turns red amid the renewed US dollar demand

Gold price trades in negative territory on Tuesday amid the renewed USD demand. A downbeat US jobs data for April prompted speculation of potential rate cuts by the Fed in the coming months.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.