Good afternoon, dear traders.

Today at 14:30 CET we expect the release of two macroeconomic indicators: Building Permits, USA and Core CPI, Canada. The first index expresses the number of new housing building permits issued by the government last month. It allows assessing the real estate potential growth, and also secondary demand goods and technology sector. Positive data permits expecting a momentum for domestic consumption and production in the USA. The second indicator shows the change in prices of goods and services in Canada with the exception of the most volatile components: food and energy. The Core CPI defines inflation rate which affects the Bank of Canada monetary policy. The CPI release may lead to a significant boost of the Canadian dollar against its most liquid competitors, including the US dollar. Both indices are expressed on a monthly basis and influence considerably the investment expectations.

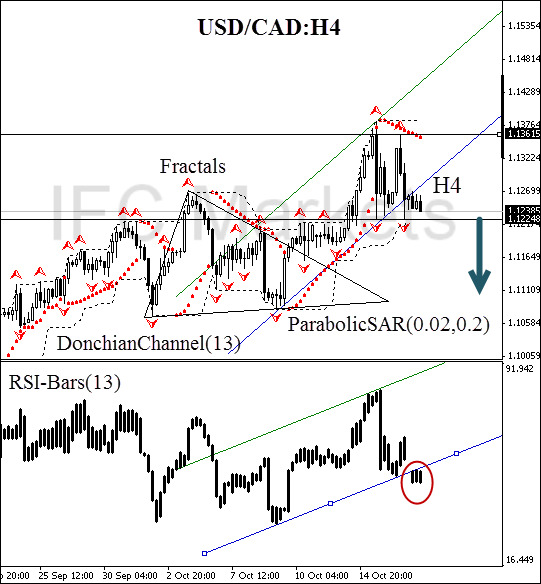

After position opening, Trailing Stop is to be moved after the Parabolic values, near the next fractal peak. Updating is enough to be done every day after the formation of 5 new H4 candlesticks, needed for the Bill Williams fractal formation. Thus, we are changing the probable profit/loss ratio to the breakeven point.

- Position Sell

- Sell stop below 1.12248

- Stop loss above 1.13615

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.