Good afternoon, dear traders. Today at 14:30 CET we expect the release of the UK Current Account. This indicator includes the difference between imports and exports of goods, services, income flows, and unilateral transfers. The first two categories are included in the Balance of Trade; so therefore, the main suspense is the publication of the balance of net financial flows. Certainly, this event can have a significant impact on the British currency behavior.

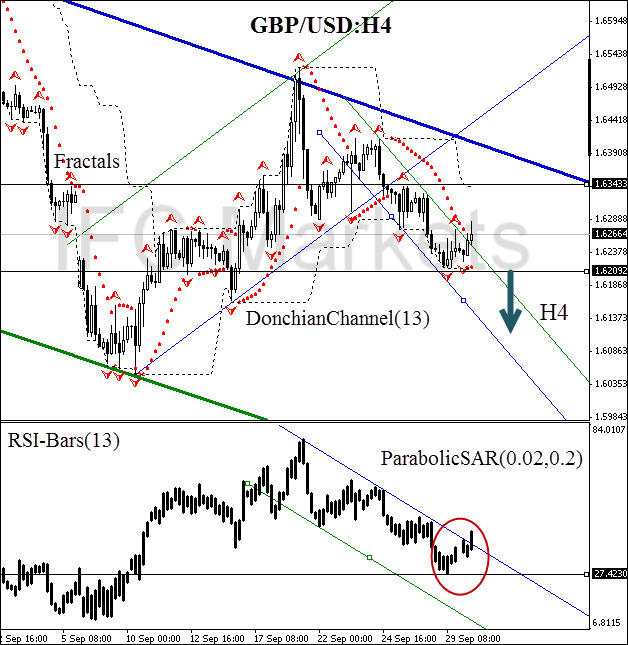

Here we consider the GBP/USD behavior on the H4 chart. Currently, the price broke the H4 trend line. However, we suggest the possible return to the downtrend corridor as the daily trend is influenced by bears. Donchian Channel confirms that investors are being pessimistic about the British currency. The key support breach at 1.62092 will lead to Parabolic SAR reversal in the direction towards the red zone, and we will get the necessary bearish confirmation. At this moment it is necessary to get an additional signal on the part of the RSI-Bars oscillator: the level at 27.4230%. For opening a conservative position we suggest limiting the risks by the last fractal resistance at 1.63433. This level is strengthened by ParabolicSAR historical values and the upper boundary of Donchian Channel.

After position opening, Trailing Stop is to be moved after the Parabolic values, near the next fractal peak. Updating is enough to be done every day. Thus, we are changing the probable profit/loss ratio to the breakeven point.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.