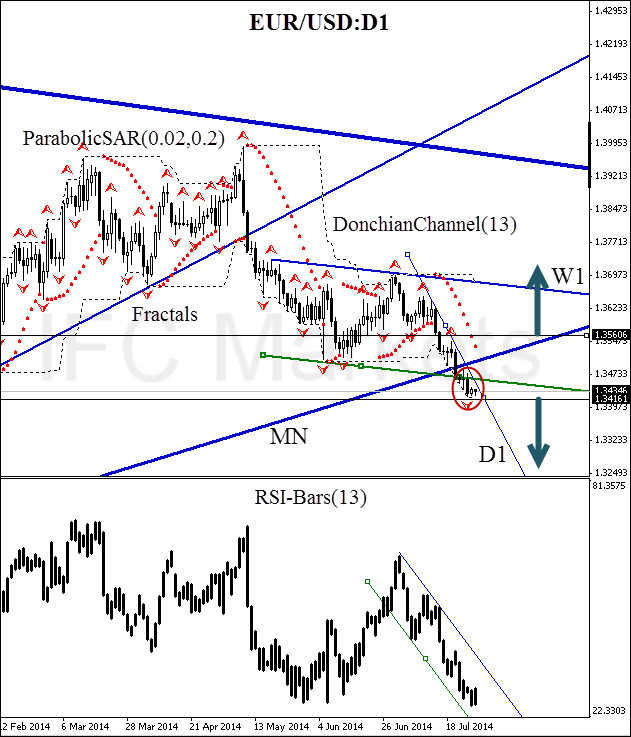

Good afternoon, dear traders. Here we consider the EUR/USD behavior on the daily chart. At the moment we can observe that the price broke the monthly trend line and is descending into the red zone. The weekly resistance was also broken, i.e. the movement is considerably accelerating. At the same time the DonchianChannel breach and the ParabolicSAR reversal occurred. Thus, there is a high probability of a new bearish momentum birth, especially that the RSI-Bars leading oscillator continues to slump in a narrow channel without significant corrections.

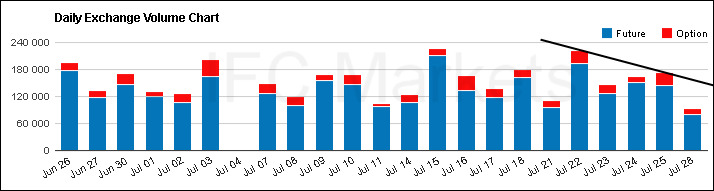

The only alarming factor is the low trading volumes. The daily volumes of the USD/CAD futures and options traded on the Chicago Mercantile Exchange are presented on the chart below. Both instruments are derivatives, and can be used to assess trends of the Forex spot market. We can see that the downtrend break is not observed yet. Thus, trading volumes do not confirm the bearish confidence, and it is possibly a disturbing signal of false breach. For conservative traders it is recommended to wait for a situation where the number of requests on futures and options exceeds 180,000. You can monitor trading volumes for this currency pair by clickinghere.

Right after that a pending sell order on euro can be opened starting from the key level at 1.34161. This support is confirmed by the 30-day DonchianChannel lower border and the fractal. It is reasonable to place the risk limitation at 1.35606, intensified by the parabolic and bearish trend line. Unlikely, but possible, that this breach might be false and the downward momentum will eventually be weakened, especially that there are low trading volumes observed. In this case, we expect a price rebound in the monthly trend channel area. Long position can be opened above the resistance at 1.35606. After position opening, Trailing Stop is to be moved after the ParabolicSAR values, near the next fractal trough (long position), or peak (short position). Thus, we are changing the probable profit/loss ratio to the breakeven point.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.