Money managers for Asia’s wealthy families are favoring the yen as it benefits from the turmoil in global financial markets.

Credit Suisse Group AG is advising its private-banking clients to buy the yen against the euro or South Korean won because the Japanese currency remains undervalued versus the dollar. Stamford Management Pte, which oversees $250 million for Asia’s rich, told clients the yen is set to strengthen to 110 against the greenback as soon as the end of this month. Singapore-based Stephen Diggle, who runs Vulpes Investment Management, plans to add to assets in Japan where the family office already owns hotels and part of a nightclub in a ski resort.

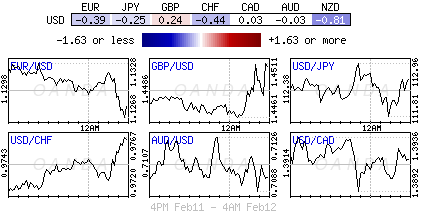

The yen has outperformed all 31 other major currencies this year as Japan’s current-account surplus makes it attractive for investors seeking a haven. Bank of Japan Governor Haruhiko Kuroda’s Jan. 29 decision to adopt negative interest rates has failed to rein in the currency’s advance.

“All existing drivers still point to more yen strength,” said Koon How Heng, senior foreign-exchange strategist at Credit Suisse’s private banking and wealth management unit in Singapore. “The BOJ will need to do more to convince the markets about the effectiveness of its negative interest-rate policy.”

15-Month High

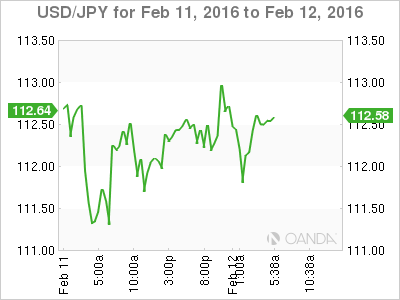

The yen has appreciated more than 7 percent against the dollar this year to 112.16 as of 6:31 a.m. in London Friday. It touched 110.99 Thursday, the strongest level since Oct. 31, 2014, the day the BOJ unexpectedly increased monetary stimulus for the second time during Kuroda’s tenure.

That’s a drawback for the central bank governor. He needs a weaker yen to help meet his target of boosting Japan’s inflation rate to 2 percent and keep exports competitive.

Stamford Management has briefed some of the families whose wealth it helps to manage about the firm’s “bullish stance” on the yen, said its chief executive officer, Jason Wang.

BOJ ‘Ineffective’

“The adoption of negative interest rates reeks of desperation to me,” Wang said. “It’s akin to an admission by the BOJ that conventional monetary policy is ineffective in hitting their 2 percent inflation target.”

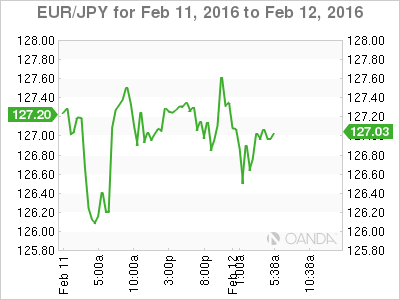

Credit Suisse predicts that the yen will strengthen to 115 against the euro in 12 months, from 126.91 Friday. Japan’s currency will gain to 11.10 won in 12 months, from 10.79, according to Heng.

In 2013, the yen tumbled 18 percent to 105.31 per dollar after Kuroda started quantitative and qualitative easing. It fell an additional 12 percent in 2014 to 119.78 helped by his surprise expansion of the program. The currency depreciated just 0.4 percent last year.

The yen’s weakness attracted tourists to Japan and boosted occupancy rates at the four hotels that Vulpes owns. The currency’s resilience now will be reassuring for investors whose money Diggle is putting into those assets along with his own, said the former hedge-fund manager. The family office owns boutique hotels, a cafe bar, part of a nightclub and a ski chalet in the resort town of Nozawa Onsen in Nagano prefecture, central Japan.

“We are positively disposed to selectively adding to our Japanese hotel portfolio,” said Diggle, who made money in 2014 from the dollar’s advance against the euro, yen and Australian dollar. “We see Japanese banks being somewhat keener to lend money to property and hospitality businesses and that’s a huge positive for an industry starved of credit for two decades.”

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.